Tax map of Ukraine

Tax map of Ukraine

.png) Оnline education

Оnline education

.png) Service "Pulse"

Service "Pulse"

Contact center

Contact center

For volunteers

For volunteers

Property tax calculator

Property tax calculator

Mobile application «My Tax Service»

Mobile application «My Tax Service»

20 May 2024

Tax, levy, payment | Legislative and regulatory acts |

The last day for rent payment for the special use of forest resources for the I quarter of 2024 | Paragraph. 257.5 Article. 257 Section IX of the Tax Code of Ukraine |

The last day for payment of rent for the special water use for the I quarter of 2024 | Paragraph. 257.5 Article. 257 Section IX of the Tax Code of Ukraine |

The last day for payment of rent for the use of subsoil without rent for the use of subsoil in the extraction of hydrocarbons for the I quarter of 2024 | Paragraph. 257.5 Article. 257 Section IX of the Tax Code of Ukraine |

The last day for payment of the environmental tax for the I quarter of 2024 | Paragraph. 250.2 Article. 250 Section VIII of the Tax Code of Ukraine |

The last day for payment of the parking tax for the I quarter of 2024 | Sub-paragraph. 2681.5.3 Paragraph. 2681.5 Article. 2681 Section XII of the Tax Code of Ukraine |

The last day of submitting rent tax declaration for April 2024 with calculation of: - rent for the use of mineral resources in the production of hydrocarbon raw materials; - rent for the use of the radio-frequent resource of Ukraine; - rent for the transportation of oil and oil products by main pipelines and petroleum product pipelines; - rent for the transit transportation of ammonia by pipelines across Ukraine | Paragraph. 257.1 Article. 257 Section IX of the Tax Code of Ukraine |

The last day of submitting the land tax declaration (land tax and / or rent for land plots of state or communal property) (except for citizens) for April 2024 in case of failure to submit tax declaration for 2024 | Paragraph. 286.3 Article. 286 Section ХІІ of the Tax Code of Ukraine |

The last day for payment of the tourist tax for the I quarter of 2024 | Sub-paragraph. 268.7.1 Paragraph. 268.7 Article. 268 Section XII of the Tax Code of Ukraine |

The last day for payment of the single tax by legal entities – taxpayers of Group III for the I quarter of 2024 | Paragraph 295.3 Article 295 Chapter 1 Section XIV of the Tax Code of Ukraine |

The last day of submitting the value added tax declaration for April 2024 | Sub-paragraph. 49.18.1 Paragraph. 49.18 Article. 49 Section II and Paragraph. 203.1 Article. 203 Section V of the Tax Code of Ukraine |

The last day of submitting the excise tax declaration for April 2024 | Sub-paragraph. 49.18.1 Paragraph. 49.18 Article. 49 Section II and Paragraph. 223.2 Article. 223 Section VI of the Tax Code of Ukraine |

The last day for payment of the corporate income tax for the I quarter of 2024 | Paragraph 57.1 Article 57 Section II of the Tax Code of Ukraine |

The last day for payment of the net profit part (income) by state unitary enterprises and their associations based on results of financial and economic activity for the I quarter of 2024 | Paragraph 57.1 Article 57 Section II of the Tax Code of Ukraine Paragraph 2 of Procedure for deducting the net profit part (income) from state unitary enterprises and their associations to the state budget, approved by Resolution № 138 of the Cabinet of Ministers of Ukraine as of 23.02.2011 |

The last day for the corporate income tax payment under the production sharing agreement for the I quarter of 2024 | Paragraph. 57.1 Article. 57 Section II and Sub-paragraph. “e” Paragraph. 336.1 Article. 336 Section XVIII of the Tax Code of Ukraine |

The last day for payment of advance payments from the single tax by individuals-entrepreneurs who chose simplified taxation system of Groups I and II for May 2024 | Paragraph 295.1 Article 295 of the Tax Code of Ukraine |

The last day for payment of the single tax by taxpayers of Group III, according to results of submitted declarations for the I quarter of 2024 | Paragraph 295.3 Article 295 of the Tax Code of Ukraine |

The last day of submitting the land tax declaration (land tax and / or rent for land plots of state or communal property) (except for citizens) for April 2024 in case of failure to submit tax declaration for 2024 | Paragraph. 286.3 Article. 286 Section ХІІ of the Tax Code of Ukraine

|

The last day for payment of single contribution calculated for April 2024 by employers for hired employees (except for mining enterprises) | Clause 1 of Part 8 Article 9 of the Law of Ukraine № 2464 |

Department of the DPS for work with large taxpayers:

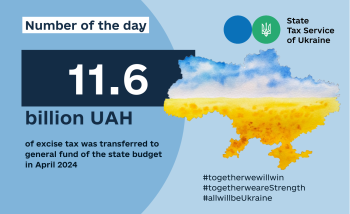

.png)

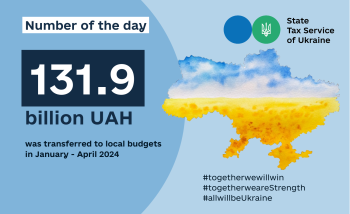

.png)

.png)

.png)