Top 10 of the most viewed open data

Press service of the State Tax Service of Ukraine , published 02 October 2020 at 12:08 Chapter: News

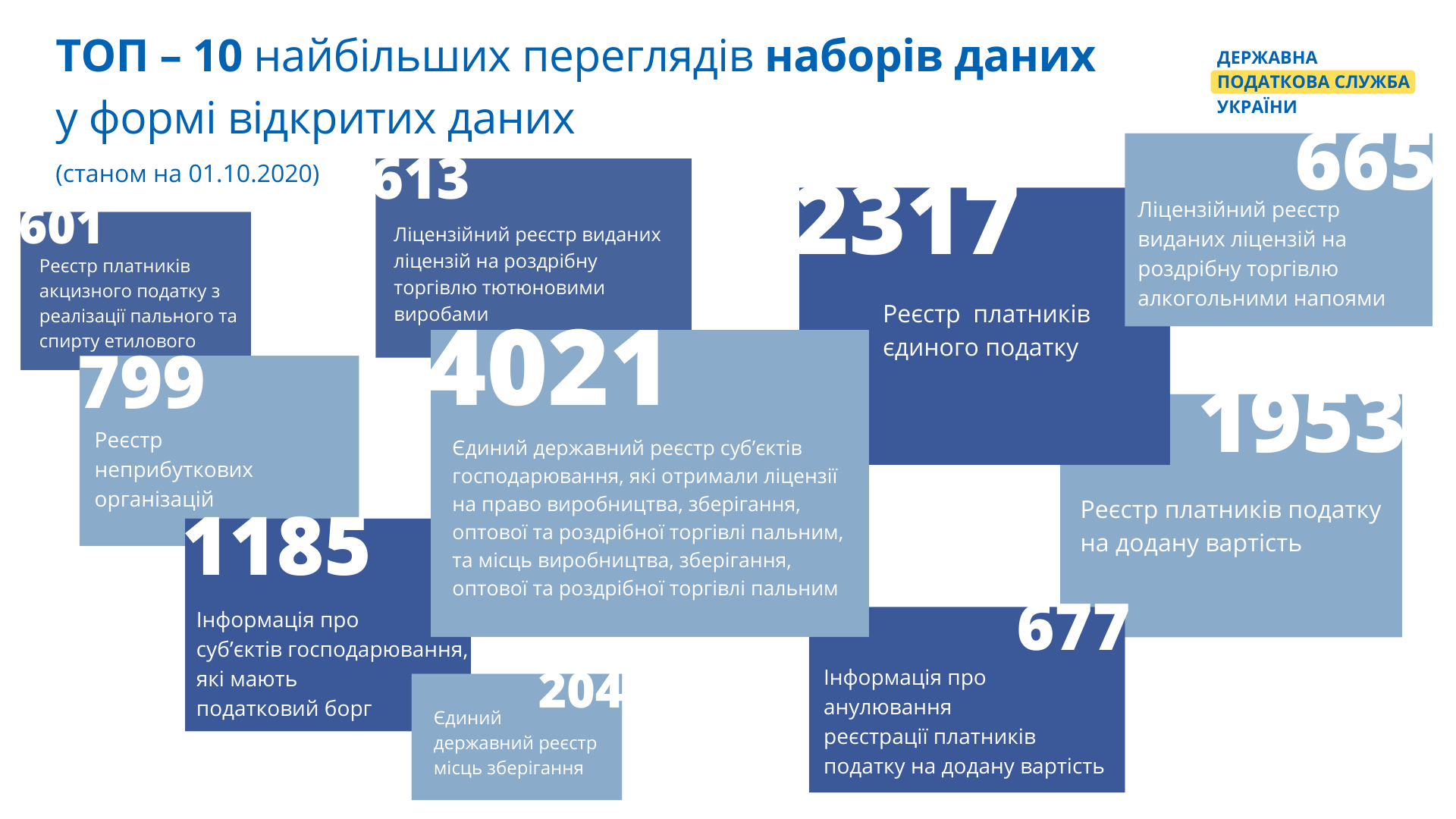

State Tax Service of Ukraine analyzed the review of data sets in the form of open data published and updated on the Open Data Portal of the Unified State Web Portal of Open Data as of 01.10.2020.

Currently, the State Tax Service updates 50 data sets in the form of open data at different intervals: daily, monthly, quarterly, within three working days after the changes.

Of the specified number of data sets, the TOP 10 of the most viewed included the following data sets:

- Unified State Register of Business Entities that received licenses for production, storage, wholesale and retail sale of fuel, as well as places of production, storage, wholesale and retail sale of fuel – 4021 views;

- Register of single tax payers – 2317 views;

- Register of value added tax payers – 1953 views;

- Information about business entities that have a tax debt – 1185 views;

- Register of non-profit organizations – 799 views;

- Information about registration cancellation of value added tax payers – 677 views;

- License register of issued licenses for the retail sale of alcohol beverages – 665 views;

- License register of issued licenses for the retail sale of tobacco products – 613 views;

- Register of excise tax payers for the sale of fuel and ethyl alcohol – 601 views;

- Unified state register of storage places – 204 views.

As follows, obtaining information from data sets is a convenient and fast way and does not require additional time to write appeals and wait for a response.

We ask all interested parties to use data sets in the form of open data which are updated on the Open Data Portal and on the official web portal of the State Tax Service.

Reference:

Analysis of data sets was done on the basis of data from the Open Data Portal of the Unified State Open Data Web Portal from Section “Statistics of views” which is posted for each data set.