Specialists of the Tax Consultant Offices provided almost 16.5 thousand consultations: satisfaction level with the service is almost 98%

Press service of the State Tax Service of Ukraine , published 11 November 2025 at 16:56 Chapter: News

Tax Consultant Offices have already provided 16 479 consultations to citizens, entrepreneurs and legal entities throughout Ukraine in almost two months of work.

The most active respondents for consultations were payers in Vinnytsia, Khmelnytskyi regions and Kyiv city.

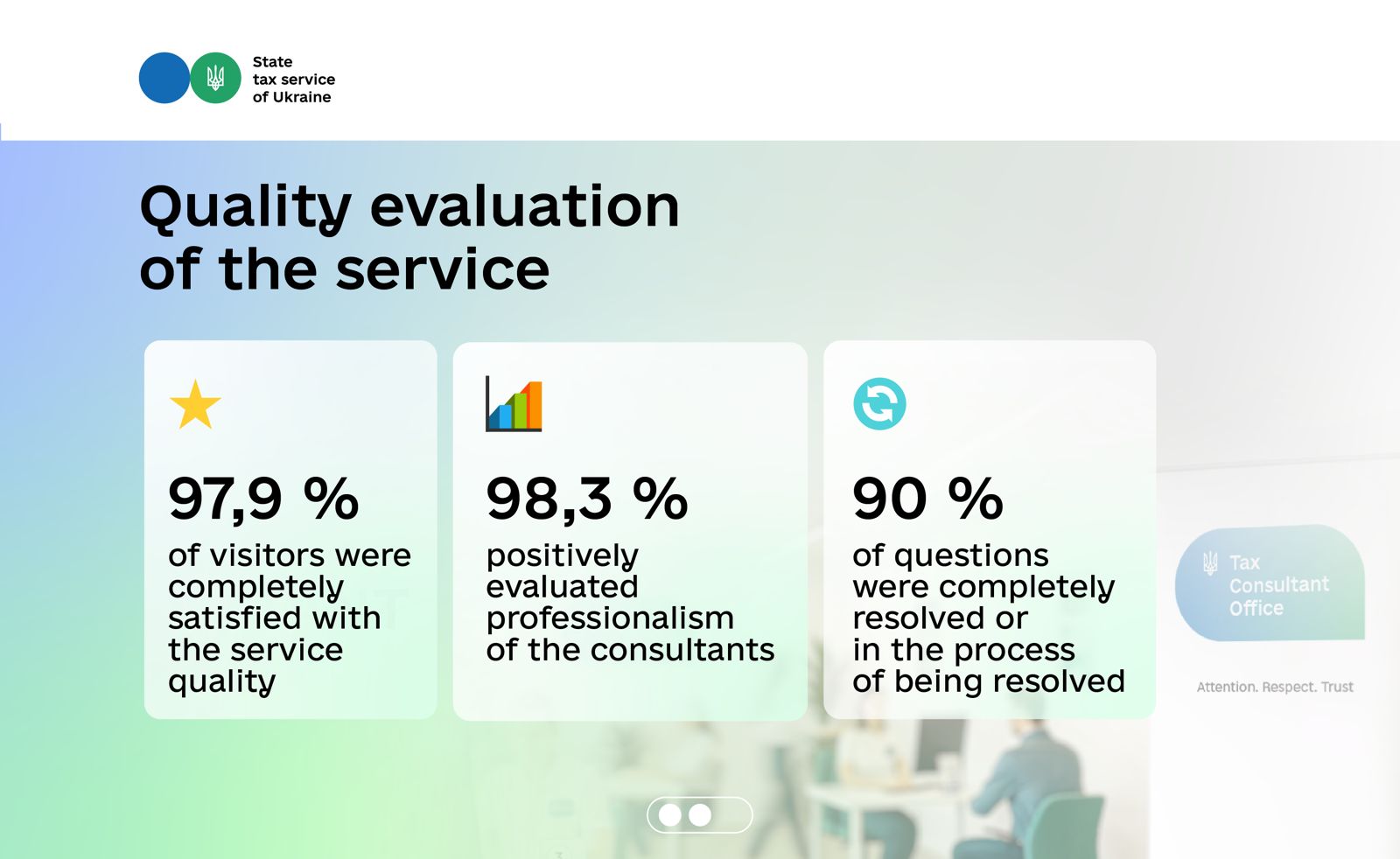

Quality evaluation of the service left by clients after their visit:

- 97.9% of visitors were completely satisfied with the quality of provided services;

- 98.3% positively evaluated professionalism of the consultants;

- more than 90% of clients indicated that their question was completely resolved or was in the process of being resolved.

The most often, consultations were requested by:

- individuals – 63.4%;

- self-employed individuals (individuals-entrepreneurs) – 20%;

- legal entities – 17%.

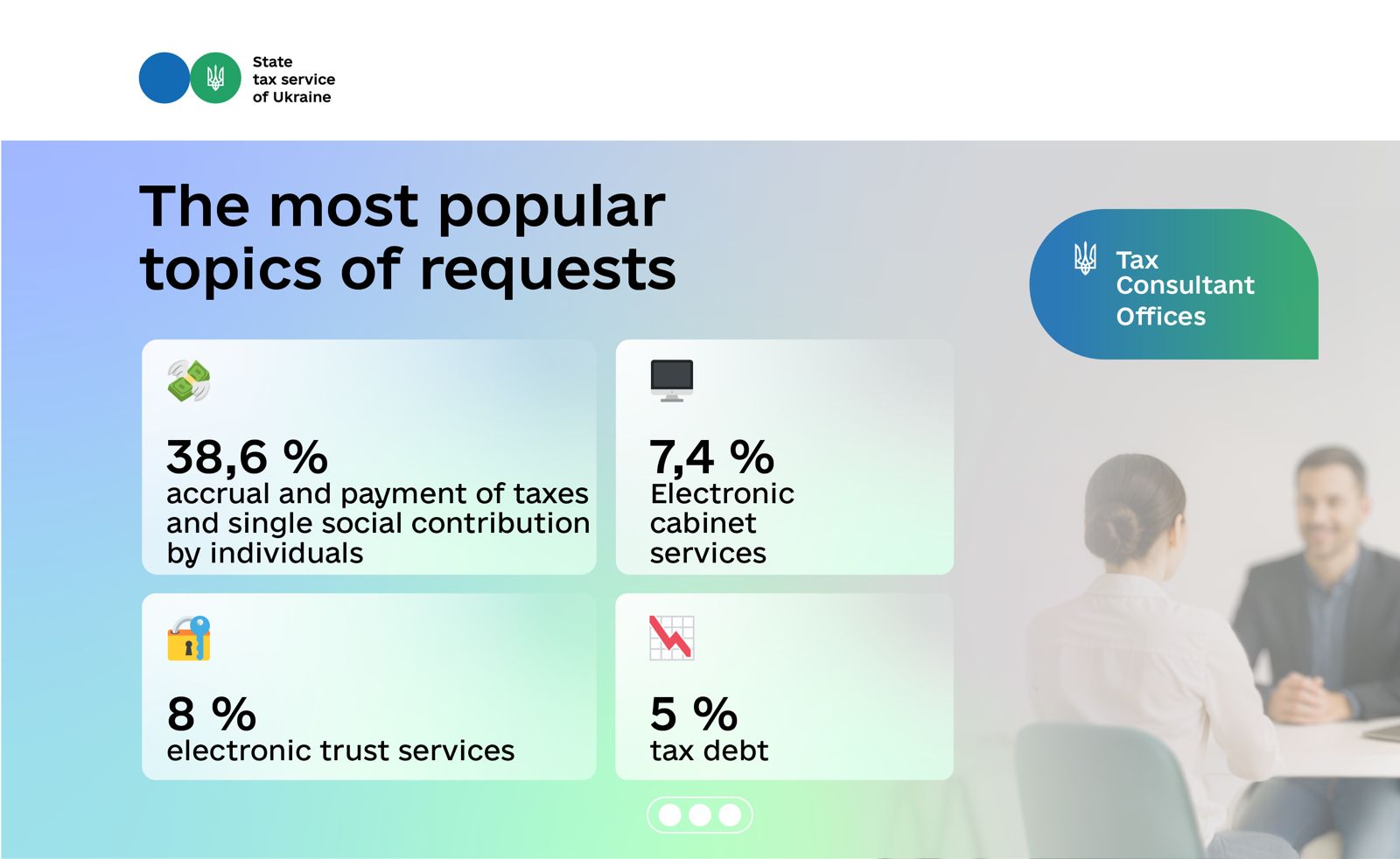

The most popular topics of requests:

- accrual and payment of taxes and single social contribution by individuals – 38.6% of all consultations,

- electronic trust services – about 8%

- Electronic cabinet services – 7.4%,

- tax debt questions – 5 %.

Such indicators specify high demand among the taxpayers for tax consulting services and effectiveness of such mechanism.

Tax Consultant Offices have been operational since September, 8 in 20 regions of Ukraine. This is a network where business, individual-entrepreneur or citizen can receive professional advice and assistance in tax matters, which will save them time.

Offices addresses: https://tax.gov.ua/en/about-sfs/contacts/tax-consultant-offices.

Offices’ provide consultations in the following areas:

- taxation of individuals and legal entities,

- electronic services and reporting,

- tax disputes,

- tax audit,

- actual audits and legislation regarding the RRO/PRRO,

- control over circulation of excisable products,

- registration suspension of tax invoices/adjustment calculations,

- tax debt repayment and debts from the single social contribution,

- provision of the qualified electronic trust services.

- transfer pricing.