Contact center

Honorable business entities and citizens!

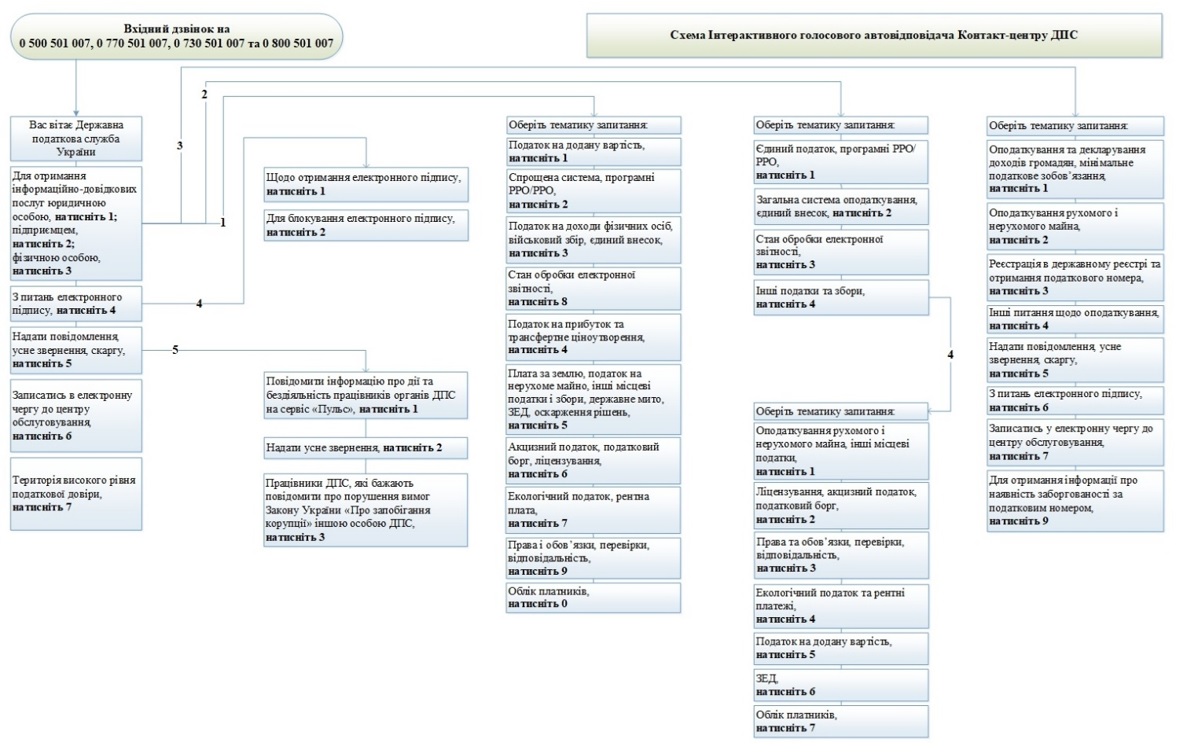

It is possible to receive information and reference services online daily from 8:00 to 19:00, on Friday from 8:00 to 18:00 (except for Saturday and Sunday) by calling the State Tax Service’s Contact Center at the following phone numbers:

(call cost according to the subscriber's tariff)

(free from the landlines, from mobile phones – at the mobile operators’ rates)

(citizens who are outside of Ukraine have opportunity to call the State Tax Service’s Contact Center from the landline or mobile phone at the following numbers:

+380 44 454 16 13, +380 50 050 10 07, +380 73 050 10 07 and +380 77 050 10 07)

|

|

| Viber, click here. QR-code: |

|

(it is also possible to join chat of Contact Center of the State Tax Service directly on the Public Information and Reference Resource (zir.tax.gov.ua) by clicking on the button ![]() )

)

or by sending question/message to the email address:

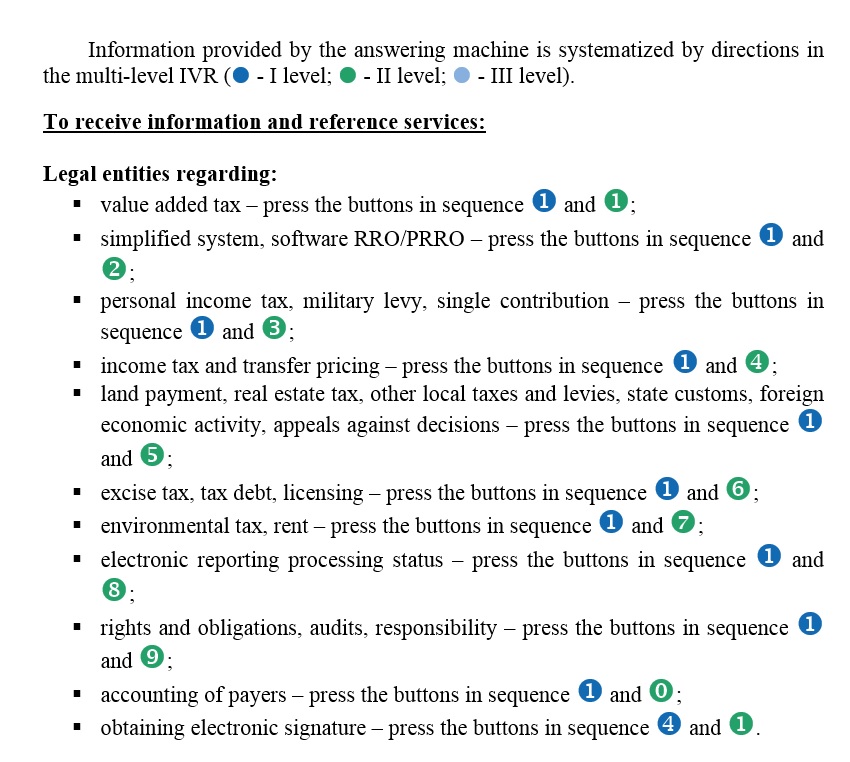

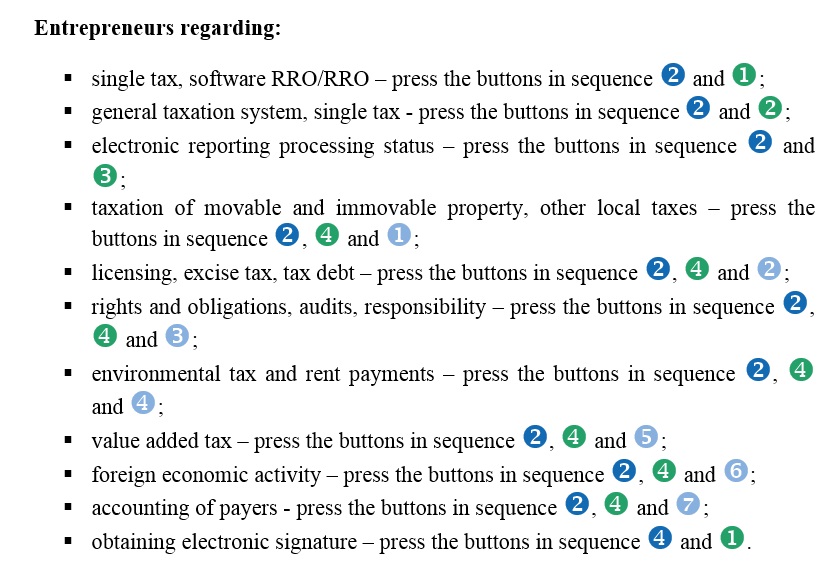

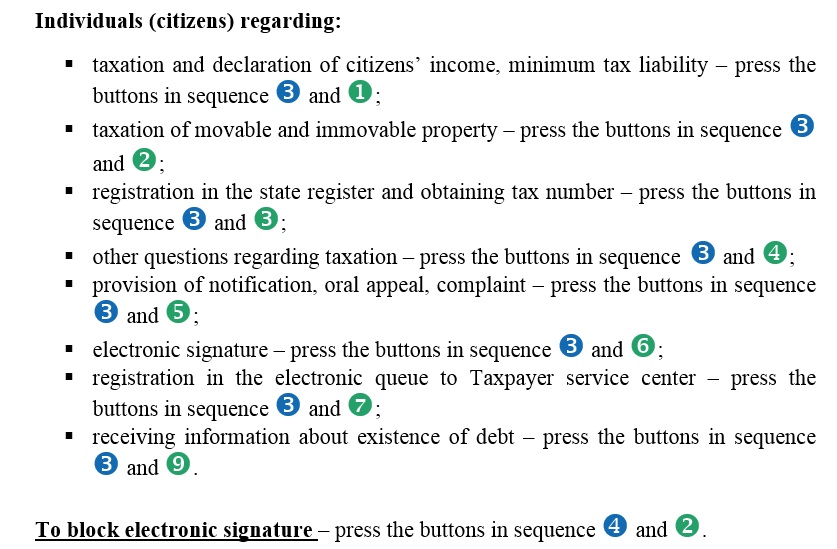

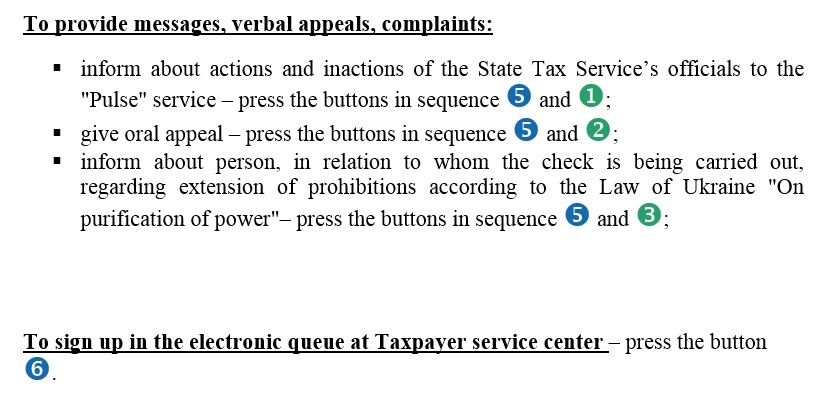

Information on obtaining information and reference services by the telephone communication means

Territory of high trust level - press button 7.

For independent search for answer to question, you need to go to the Public Information and Reference Resource on the Internet or web portal of the State Tax Service in section "Public Information and Reference Resource" or send question to the e-mail address:  .

.

Citizens who are outside Ukraine can call Contact Center of the State Tax Service from the landline or mobile phone at: +380 44 454 16 13.

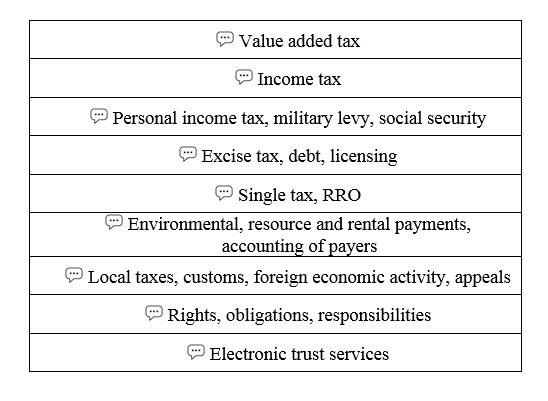

Information on contacting Contact Center of the State Tax Service via chat

After joining the chat, you must first choose information direction and reference services by clicking on the appropriate button:

After choosing direction, you need to ask question.

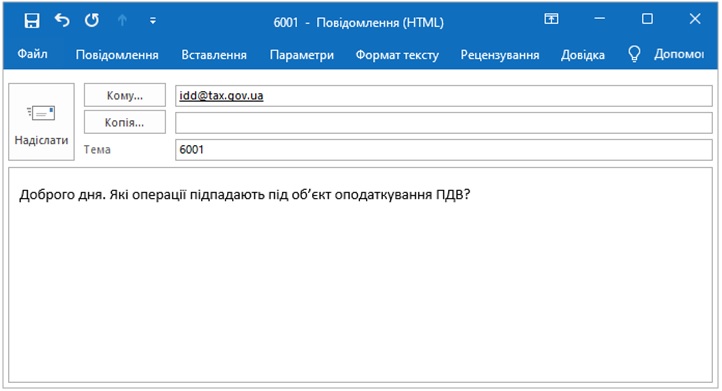

Information for individuals and legal entities on sending e-mails to the Information and Reference Department

If You are willing to send a question/message to e-mail address, you must clearly formulate question and OBLIGATORY indicate direction identifier of question in the "Topic" field.

If You have several questions for different field identifiers, please send questions in separate e-mails indicating relevant field identifiers of questions:

| Identifier of direction of the question | Direction for obtaining information and reference services on: |

| 7777 | Software RRO |

| 6001 | VAT |

| 6002 | Corporate income tax Transfer pricing |

| 6003 | Income tax Income tax of business entities Income tax of self-employed individuals involved in independent professional activity Single contribution Military levy |

| 6004 | Excise tax Licensing of production and turnover of alcohol, alcoholic beverages, tobacco products and fuel Repayment of taxpayers’ tax debt |

| 6005 | Single tax Procedure for using registrars of settlement operations |

| 6006 | Accounting of taxpayers Ecological tax Rent payment for special water use Rental payment for use of radio frequency resource of Ukraine Rent payment for special use of forest resources Rent payment for the transportation of oil and products by main pipelines and petroleum product pipelines, transit transportation of ammonia by pipelines across Ukraine Rent for the subsoil use Other levies (payments, contributions), not established by the Tax Code of Ukraine as national or local, but established by legislative acts of Ukraine as mandatory payments |

| 6007 | Land payment Real estate other than land tax Transport tax Levy for parking spaces for vehicles Tourist tax Foreign economic activity State duty Appealing decisions of regulatory bodies |

| 6008 | Rights and obligations of taxpayers Audits Responsibility |

| 6009 | Information about the "Pulse" service Notification of the presence of unreliable/outdated information, methodological or technical problems in the operation of electronic services or systems on the web portal/sub-sites of the State Tax Service, information on minimizing payment of taxes, levies, single contribution, suggestions for normative legal acts on taxation, etc. |

| 6010 | Other |

| 6011 | For information about legislative changes |

| 6012 | For refusal to receive information about legislative changes |