Results of the Income Declaration Campaign 2019 show an increase in the voluntary tax payments.

“Strategic direction of the Tax Service is voluntary declaration of income and voluntary payment of the tax liabilities. Revenue from the individual income tax declared by citizens is one of the supplies for filling the local budgets. Therefore, citizens should understand that submission of declaration and paying this tax – is a support to the local budget that shapes the social policy of the region.” – stated Chairman of the STS Serhii Verlanov.

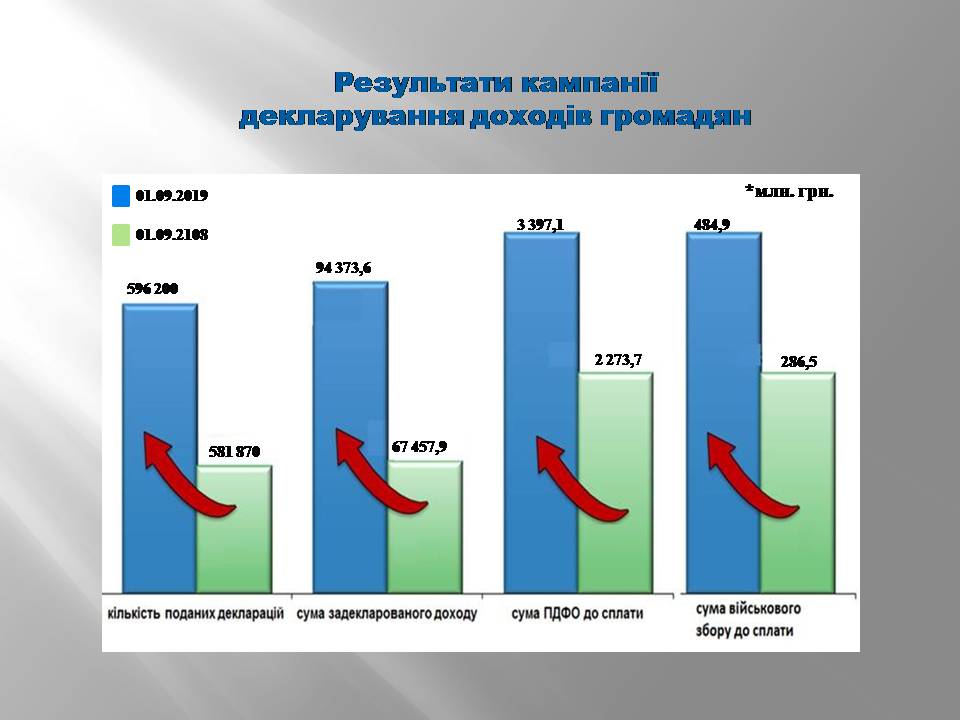

In total, over 596.000 citizens in Ukraine have submitted the property and income tax declarations since the beginning of 2019, declaring the income from 2018 for total amount UAH 94.4 billion UAH. Citizens independently determined to pay nearly 3.4 billion UAH of personal income tax and nearly 485 million UAH of military fees.

Figures have improved significantly in comparison with 2018.

The biggest share belongs to the declared foreign income – 18.8 billion UAH. Compared to the same period last year, this figure has more than doubled or by 11.2 billion UAH. In general, there is an increase in all types of income compared to the previous year. In spite of the foreign income, there are significant figures of the taxable income – 15.6 billion UAH, inheritance and gifts – 7.5 billion UAH, income from the sale of movable and immovable property – 6.1 billion UAH, rental income – 2.3 billion UAH and investment income - 2.0 billion UAH.

Even though the Income Declaration Campaign has ended, the STS is not completing its work in attracting the declarations of those citizens who were obliged to submit property and income declarations and did not do so. The taxpayer will be liable according to legislation for the failure to submit the tax declaration within the prescribed period of time.

Also it should be reminded that according to the provisions of the Tax Code of Ukraine failure to submit tax declaration by the taxpayer is the basis for documentary verification.