Main Directorate of the STS in Kyiv region jointly with colleagues from other regions prevented the use of a tax credit by the real sector of economy with signs of fictitiousness in the amount of more than 20 million UAH of the VAT.

On July 14, 2020 the tax specialists of the Main Directorate of the STS in Kyiv region revealed a number of operations of one business entity which contained signs of substituting the product range (so-called “scroll”) during the implementation of measures to analyze potentially risky operations.

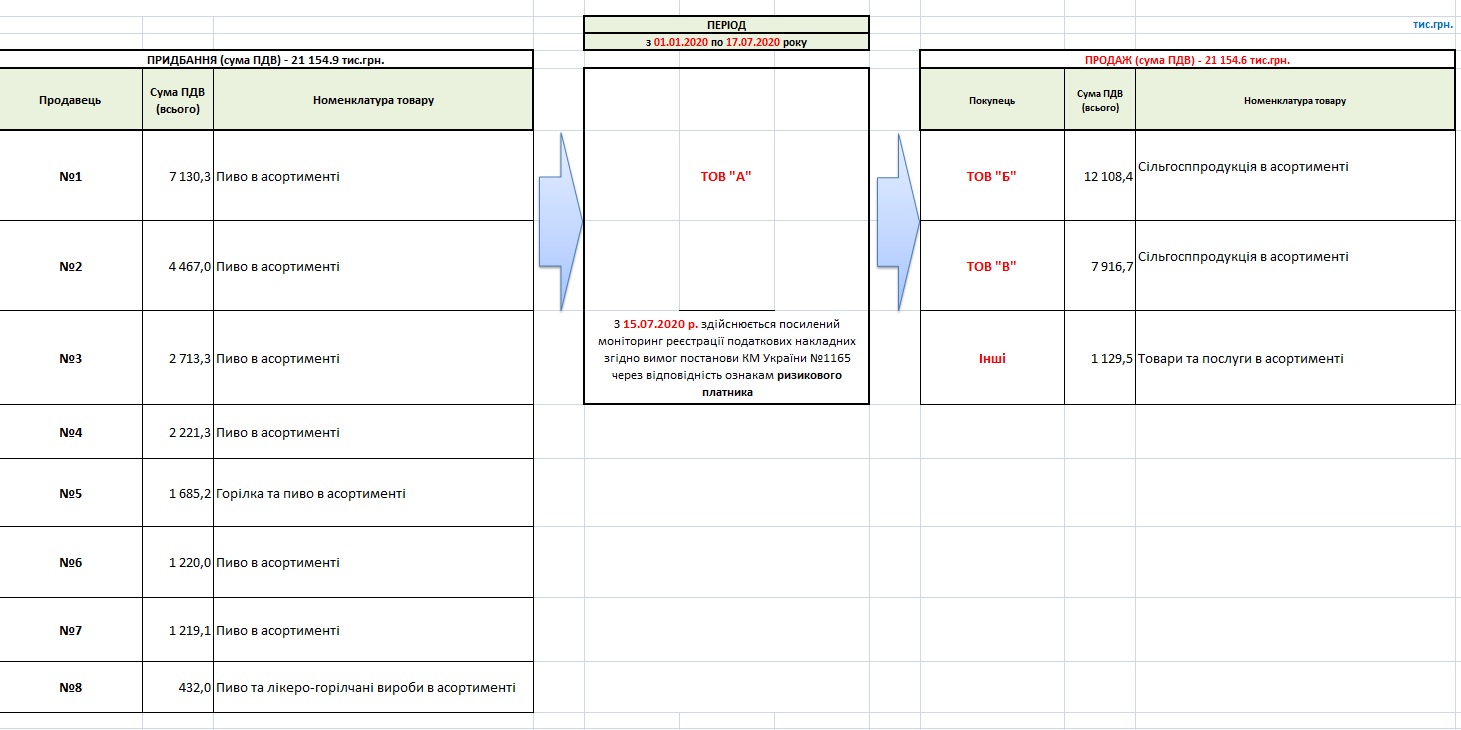

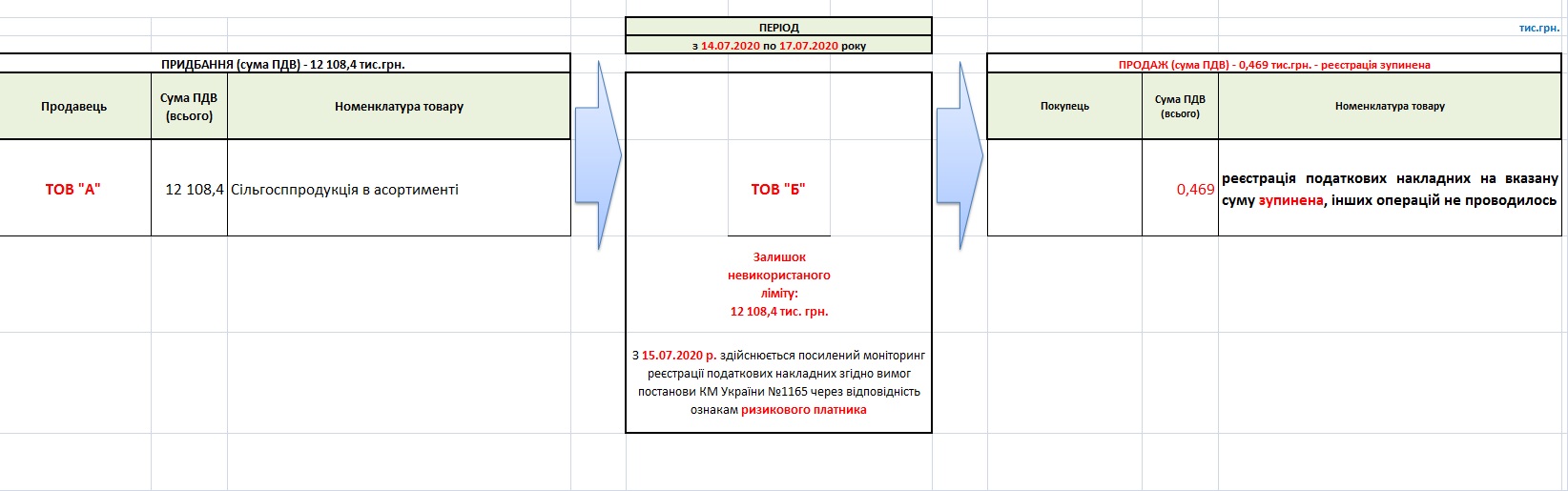

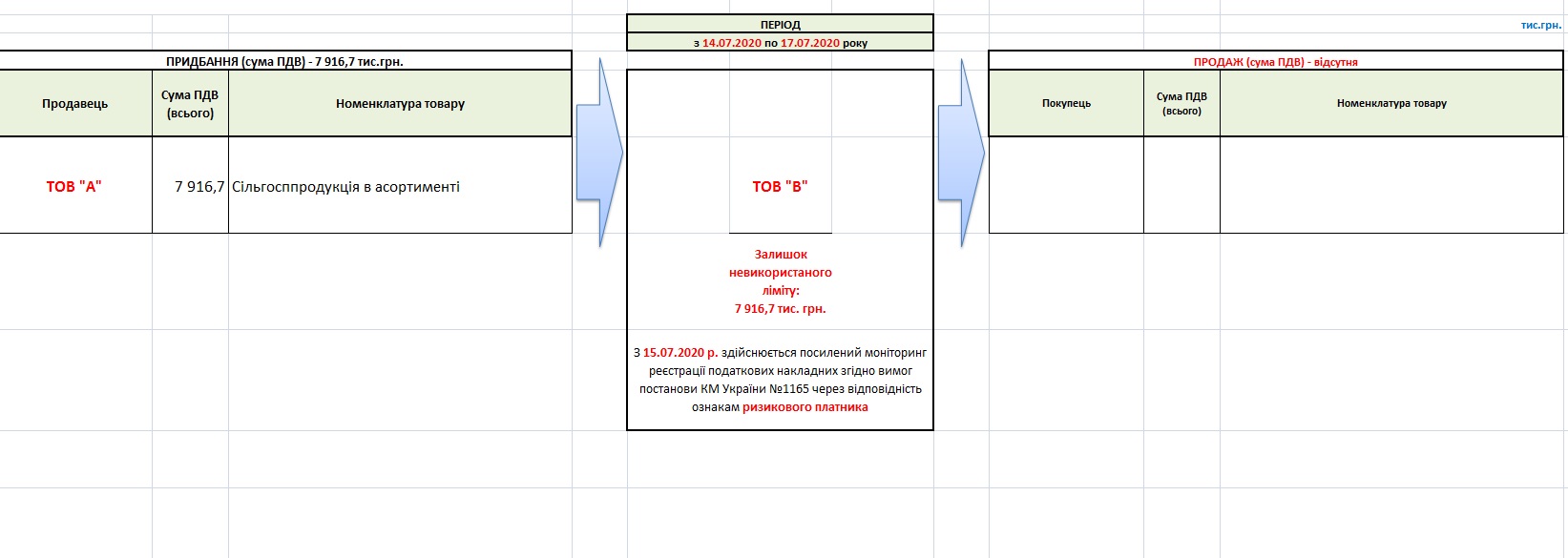

Having formed a limit in the VAT system of electronic administration (SEA) due to the registration of tax invoices for the receipt of alcohol beverages and beer in a range, the business entity attempted further registration due to the thus formed limit of tax invoices for shipment of agricultural products (sunflower and rapeseed, wheat, barley, spare parts for diesel locomotives, etc.). That is, tax invoices were registered for shipment of products, the origin of which was not traced in the SEA.

Conducted operational analysis of activity of the specified business entity and its counterparties showed that there was a common feature in their activity. So, for the last month they have had a change of owners and managers, subsequently payment of taxes is minimal or non-existent.

Through the system of operative exchange of information about risky operations created for the last two months by the STS, notifications of detected risky operations were immediately sent to the Main Directorates of the STS in regions where the business entity’s counterparties were registered.

As a result, on July 15, 2020 the regional commissions of controlling bodies decided to determine business entities with signs of risk that participated in these operations. Registration of tax invoices submitted by them was suspended with a suggestion to provide an explanation about operations and copies of documents confirming their actual conduct. However, as of July 17, 2020 the State Tax Service did not receive such confirmations, as well as complaints about the suspension of tax invoices’ registration.

Given above, the STS appealed to the law enforcement agencies with a statement about the presence in actions of officials of these entities signs of a crime under Article 366 of the Criminal Code of Ukraine “Official forgery”.

At present, the possibility of registration of tax invoices by the above-mentioned subjects for the purpose of forming tax credit with signs of fictitiousness for enterprises of the real sector of economy is biased.

“I would like to address to those who continue to use services of developers of schemes for fictitious tax credit formation, - the Deputy Chairman of the STS Evhen Oleinikov commented on this situation. - The best thing you can do when you hear a suggestion to reduce tax liabilities through a “reliable company” which has “everything decided with the State Tax Service” is to pass relevant information to the law enforcement agencies. In this way you will save your time and money, because the only thing you can finally agree with the State Tax Service is the procedure for compensation of damage caused to the state budget.”