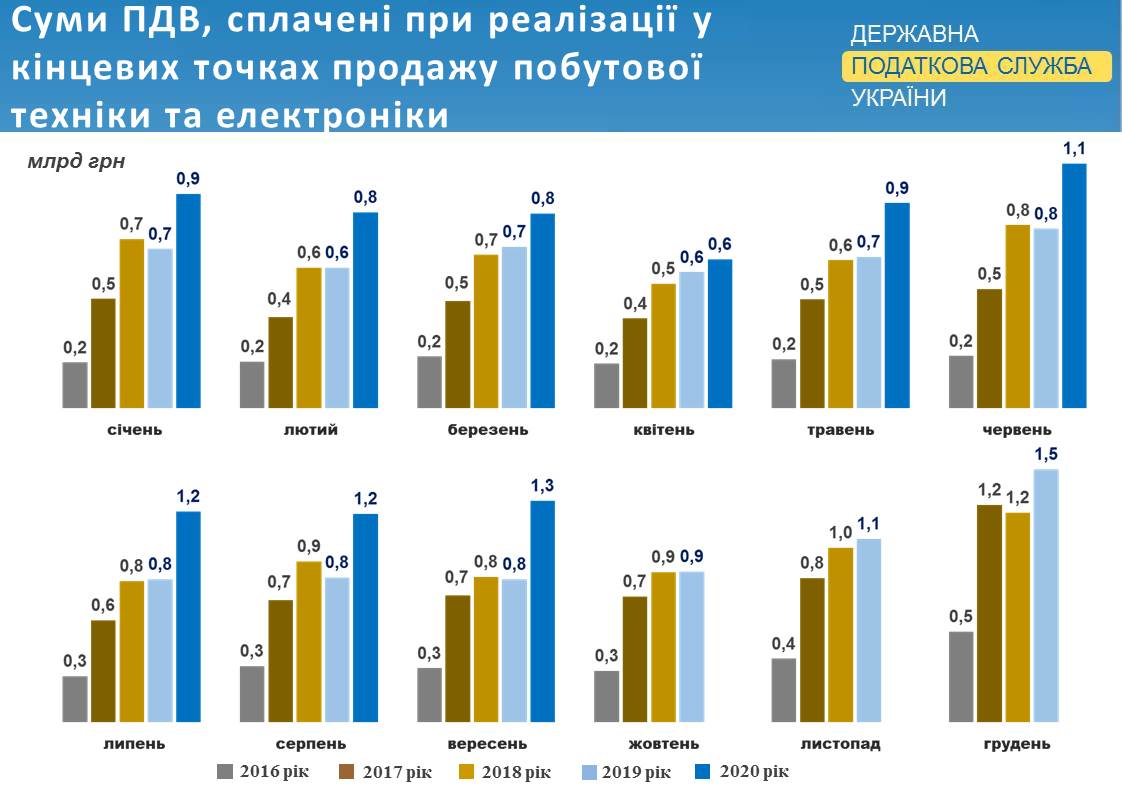

State Tax Service of Ukraine notes effectiveness of comprehensive measures to control the implementation of business operations on example of the retail market of household appliances and electronics. In 2016, after the start of systematic implementation of technical accounting of settlement operations with RCO only for a year there was a significant (2.3 times) increase in VAT paid on the sale of household appliances and electronics at end points – from 3.3 billion UAH in 2016 to 7.4 billion UAH in 2017. Sales volumes of household appliances and electronics to the final consumer by VAT payers for respective years were taken for comparison, as well as amounts of the VAT accrued on these volumes.

Further, the amount of tax paid to the budget increased to 9.6 billion UAH in 2018 and to 9.8 billion UAH in 2019. As follows, an increase in VAT paid on the sale of household appliances and electronics amounted to 297% during 2017-2019, while the increase in tax payments in all sectors was almost twice less – 162%.

According to results of 2020, the projected VAT payments from the retail market of household appliances and electronics will reach a record of 11.8 – 12.5 billion UAH. This is a direct demonstration of the un-shadowing effect, when the volume of shadow operations is reduced and the un-shadowed part of market is occupied by legal business entities that pay taxes.