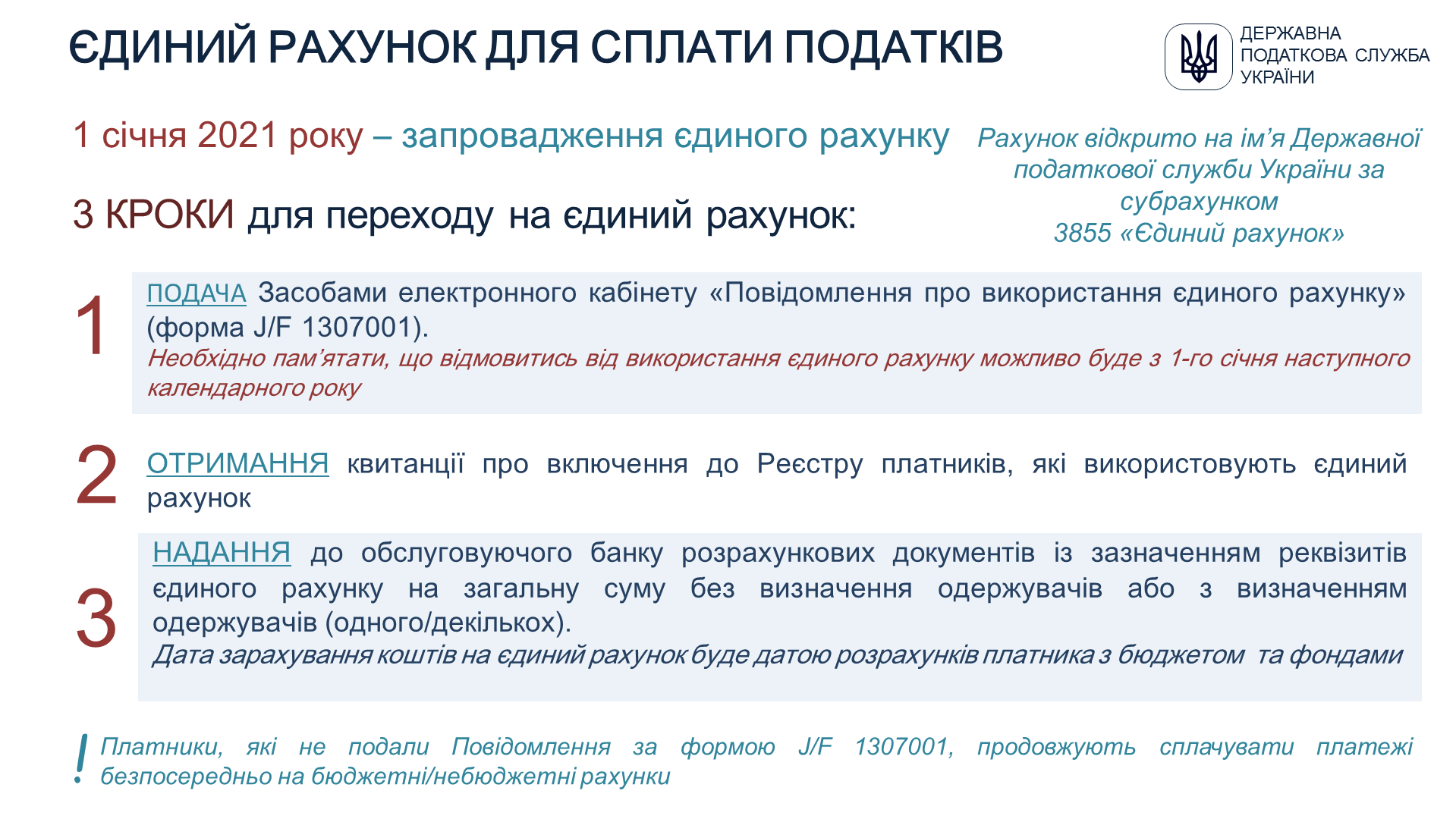

From the 1st of January 2021, a single account for payment of taxes will be introduced. To switch to a single account, it is needed to take three simple steps.

The first is to submit a “Notification on the use of a single account” in the form J / F 1307001 through the Electronic Cabinet.

The second is to receive a receipt for inclusion in the Register of taxpayers who use a single account.

The third is to provide a servicing bank with settlement documents indicating requisites of a single account for the total amount without / or with determining the recipients.

Taxpayers who have not submitted a Notification form J / F 1307001 continue to pay payments directly to the budget / non-budget accounts.

Please note that it is possible to refuse to use a single account from the 1st of January 2021.

Communicate with the State Tax Service remotely using the “InfoTAX” service

The only state web portal

The only state web portal The only state web portal

The only state web portal