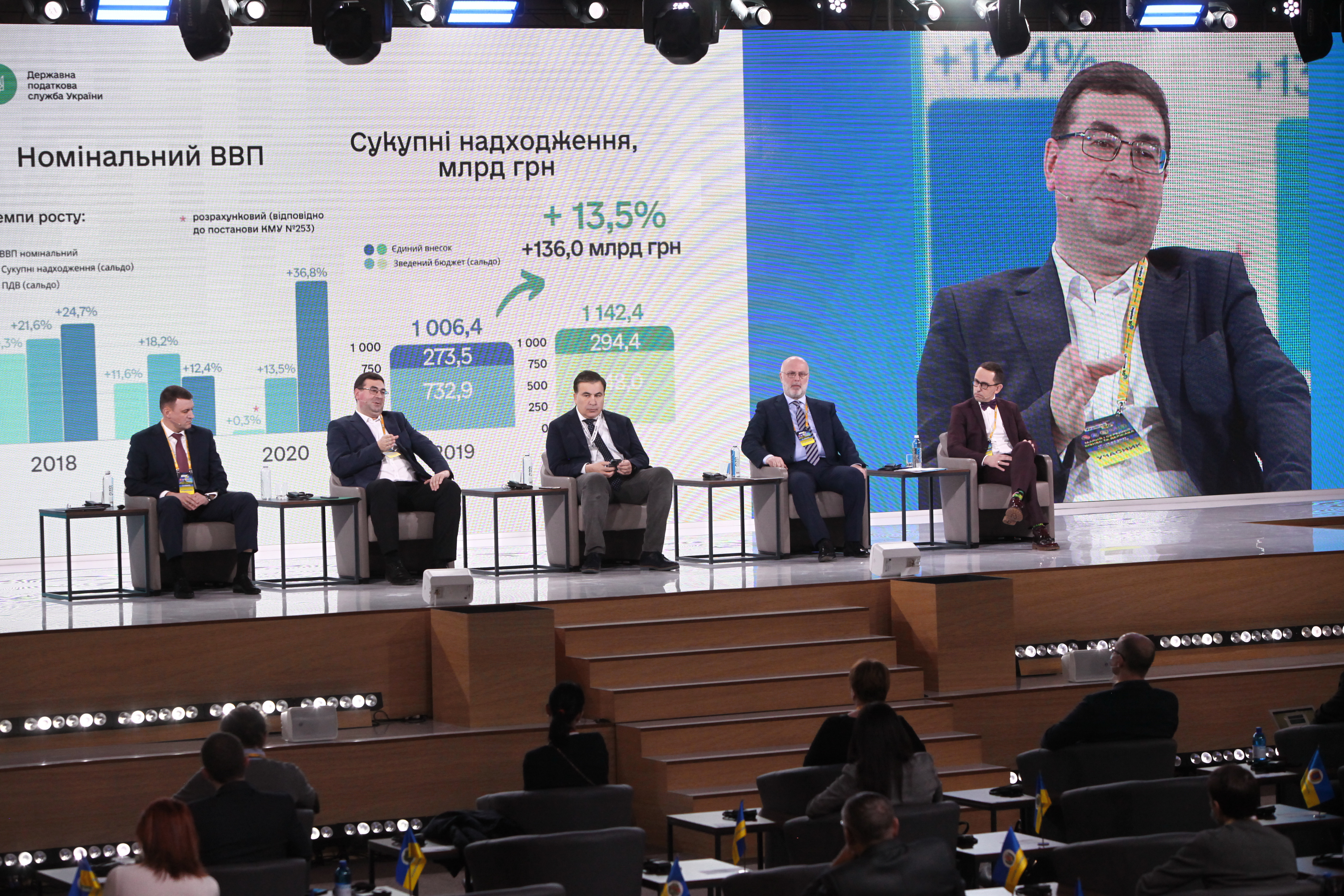

Transparency is one of the key priorities in reformation of the State Tax Service of Ukraine. This was stated by Deputy Chairman of the STS Yevhen Oleinikov during a speech at the All-Ukrainian Forum “Ukraine 30. Small, Medium Business and State”.

“Business pays taxes. Task of the Tax service is to create conditions under which business will pay these taxes. And this is how we formulated a new goal, mission of the Tax service, which is constantly being implemented. We are a transparent, modern, technological Tax service that provides quality and convenient services to the taxpayers, effectively administers taxes, fees, payments and shows intolerance towards corruption.” – stated Yevhen Oleinikov.

According to him, functioning of the Tax service as a single legal entity is among elements of reformation to which Ukraine’s international partners have paid serious attention. This is a major institutional reform that has been implemented in a timely and successful manner. Today the Tax service has a single policy and requirements for all territorial bodies. It is a system that is headed by a person who has all necessary powers and is responsible for its work.

“Transparency is also a key position for us. Tax service should be clear to everyone – both to society and to business. They need to understand what and how it does, why the Tax service exists, how it acts in the public interest. We maintain open dialogue in which each party can express its position. For us, cooperation with business associations, every company and each taxpayer is important” – stated Yevhen Oleinikov.

“We thank the business for trust. Result of our constant cooperation was creation of conditions under which volume of shadow operations was reduced. Accordingly, legal business has opportunity to expand their operations and pay taxes from them” – emphasized Yevhen Oleinikov.

According to results of 2020, with the growth of nominal GDP by 0.3%, the total growth of tax revenues was 13.5% and growth of the value added tax – by 36.8%.

“And most importantly, growth of revenues occurred along with growth of sales. That is, in the quarantine year, when the whole world plunged into economic crisis, Ukrainian taxpayers were able to increase legal sales” – emphasized Yevhen Oleinikov.

Read more.

Communicate with the State Tax Service remotely using the “InfoTAX” service

The only state web portal

The only state web portal The only state web portal

The only state web portal