Operational indicators

(general fund of the state budget)

State Tax Service continues counteracting the shadow economy and building modern model of interaction with taxpayers on the principles of fairness, equality, transparency and convenience of taxation processes.

Budget revenues exceed certain indicators and maintain a positive growth tendency comparing to the same period last year.

March 2021

Indicative figure – 54.7 billion UAH

In fact – 57.7 billion UAH .

Over-fulfillment is + 3 billion UAH

Comparing to last year: + 6.3 billion UAH or 12.3%.

Including the VAT:

Indicative figure (balance) – 10.6 billion UAH

In fact – 13.0billion UAH .

Over-fulfillment is + 2.3 billion UAH or 22.2%.

Comparing to last year: + 4.8 billion UAH or 1.6 times more!

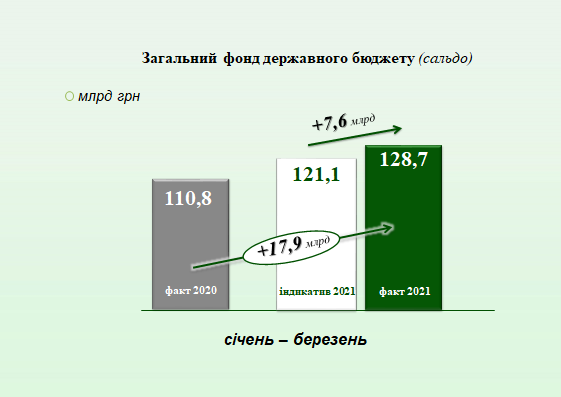

January – March 2021:

Indicative figure – 121.1 billion UAH

In fact – 128.7 billion UAH

Over-fulfillment is + 7.6 billion UAH

Comparing to last year: + 17.9 billion UAH or + or 16.1%.

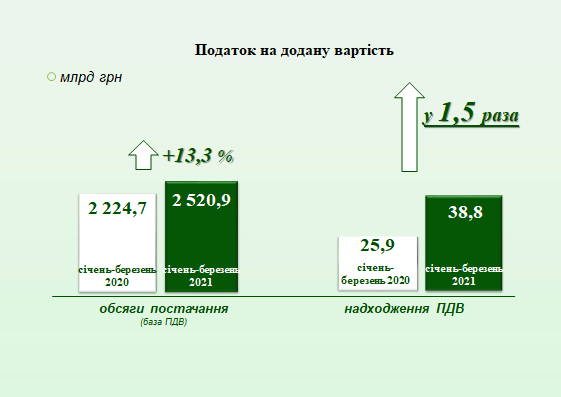

Including the VAT (January – March 2021):

Indicative figure (balance) – 34.5 billion UAH

In fact – 38.8 billion UAH

Over-fulfillment: + 4.2 billion UAH or + 12.3%.

Comparing to last year: + 12.9 billion UAH or 1.5 times more!

Amount of reimbursed VAT is 37.5 billion UAH in January – March 2021.

Communicate with the State Tax Service remotely using the “InfoTAX” service

The only state web portal

The only state web portal The only state web portal

The only state web portal