(general fund of the state budget, operational data)

Strategic goals of the State Tax Service are unchanged and clear.

State Tax Service remains a reliable partner for honest taxpayers. Actual implementation of reforms and expert recommendations of the Public Financial Management Support Programme of Ukraine (EU4PFM project) has already proved its effectiveness and allows to achieve high practical results in filling budgets of all levels.

Result:

August 2021:

Indicative figure – 77.0 billion UAH;

In fact – 79.4 billion UAH.

Comparing to last year: +23.1 billion UAH or 41.0%.

Over-fulfillment is + 2.4 billion UAH

Including the VAT:

Indicative figure (balance) – 12.4 billion UAH;

In fact – 15.3 billion UAH.

Comparing to last year: + 0.5 billion UAH or 3.6%.

Over-fulfillment is + 2.9 billion UAH or 23.2%.

January – August 2021:

Indicative figure – 388.8 billion UAH;

In fact – 409.9 billion UAH.

Comparing to last year: + 54.2 billion UAH or +15.2%.

(excluding the profit part and dividends + 92.8 billion UAH or +31.9%)

Over-fulfillment is + 21.0 billion UAH

Including the VAT (January – August 2021):

Indicative figure (balance) – 91.8 billion UAH

In fact – 101.2 billion UAH

Comparing to last year: + 27.3 billion UAH or by 37.0% more!

Over-fulfillment is + 9.4 billion UAH or + 10.2%

Growth rate of the VAT revenues exceeds the growth rate of supply by 9.5 percentage points.

The VAT reimbursement to taxpayers amounted to 96.8 billion UAH during January – August 2021. Reimbursement is made according to the claimed amounts.

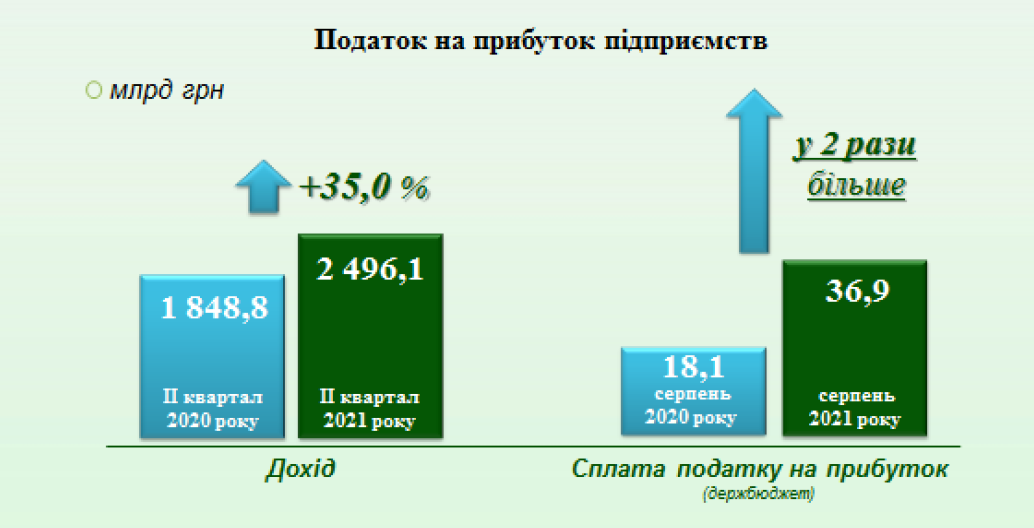

Regarding results of the income tax declaration

Income tax payment amounted to 36.9 billion UAH according to the declaration results in August 2021.

Comparing to last year: 2 times more!

Growth rate of income tax payments exceeds the growth rate of taxpayers’ income by 2.7 times.

This testifies to the effective STS’s counteraction against formation and use of fictitious tax credit and, accordingly, unreasonable overestimation of the expenditure part.

Communicate with the State Tax Service remotely using the “InfoTAX” service

The only state web portal

The only state web portal The only state web portal

The only state web portal