National Forum under patronage of the President of Ukraine Volodymyr Zelenskyy “Safe and prosperous communities of the future” was held with participation of the State Tax Service of Ukraine.

State Tax Service supports course of fiscal decentralization in order to ensure financial independence of local budgets that will strengthen capacity of local communities. This is one of working priority areas and important components of improving public financial management system.

Decentralization and expansion of powers of local governments, transparency in formation of local budgets are important components of ensuring development of territorial communities.

Building effective communication with local communities and providing up-to-date and complete information on the state of tax base, as well as formation of balanced base of taxation objects is one of main activities of the State Tax Service.

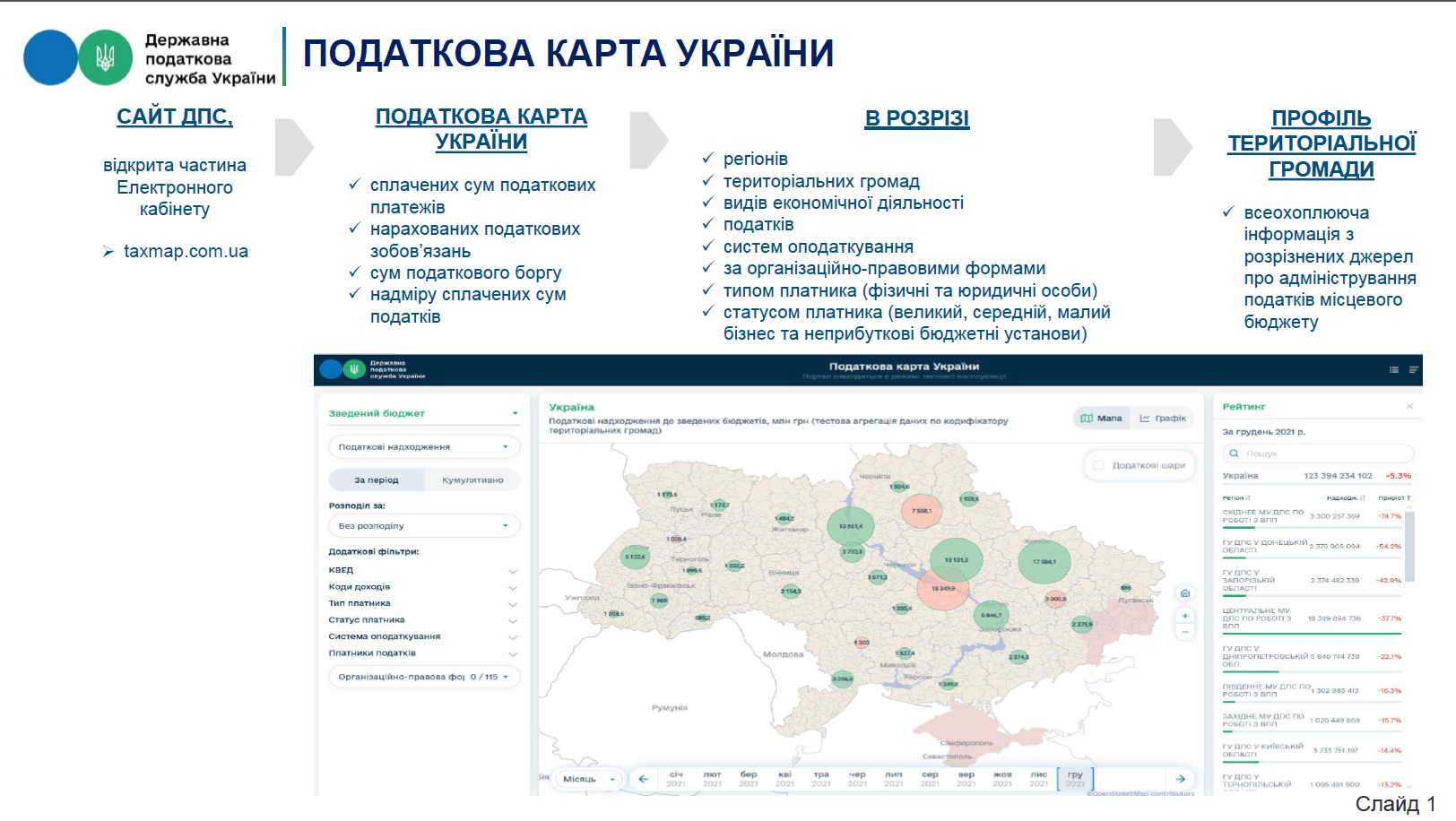

State Tax Service with support of the Ministry of Finance of Ukraine, Ministry of Digital Transformation with assistance of Office of the National Security and Defense Council of Ukraine introduced the Interactive Tax Map of Ukraine on 24.08.2021.

Information about payment of taxes to the state and local budgets, about accrued tax liabilities, amount of tax debt, overpaid taxes is gaining popularity among citizens and business community.

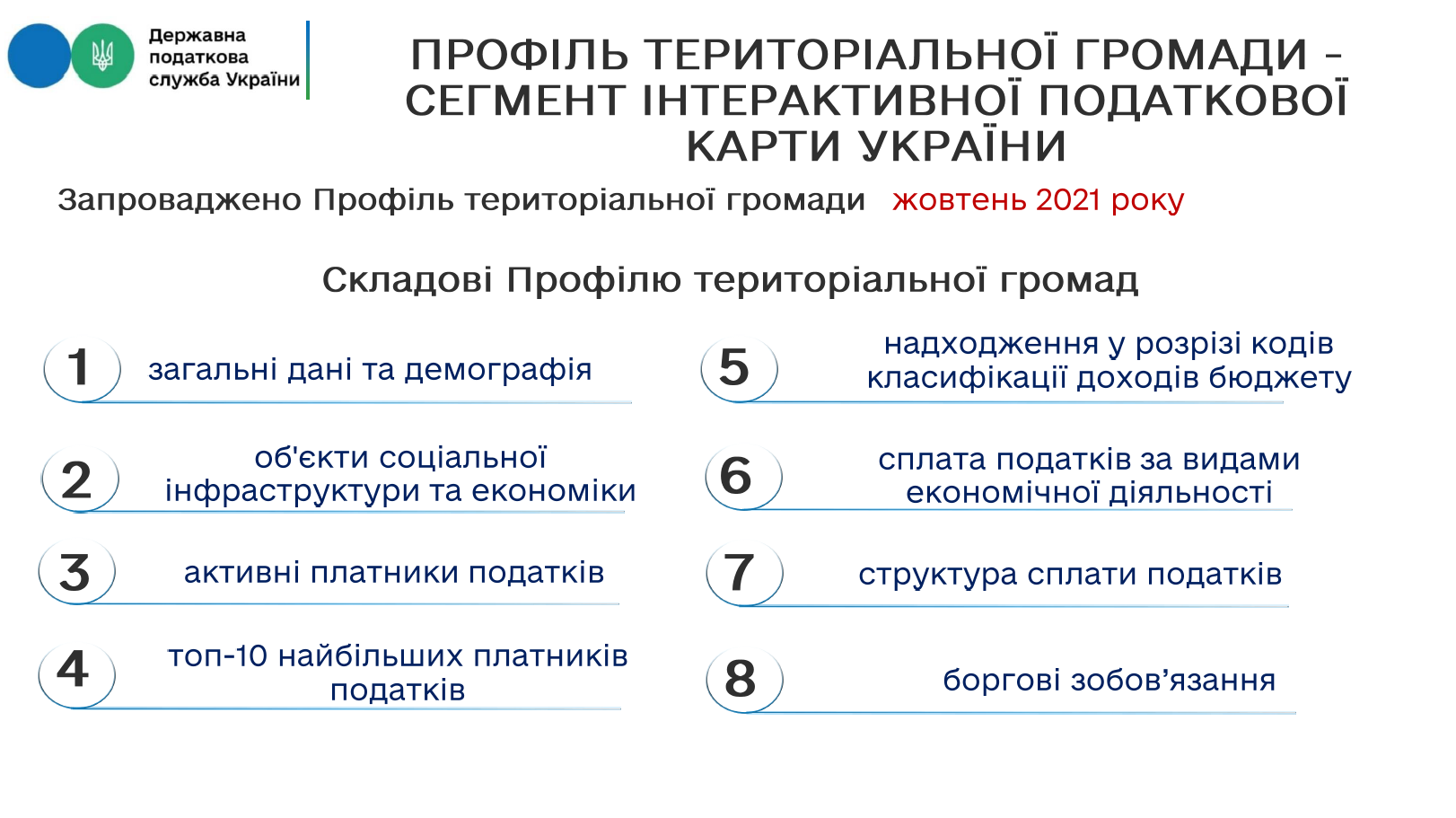

State Tax Service has created tax profiles of territorial communities (segment of the Interactive Tax Map), graphical reflection of indicators as of the reporting date compared to the previous period. Users have opportunity to get acquainted with components of profiles of local communities about:

general data and demographics;

objects of social infrastructure and economy;

active taxpayers;

top 10 of major taxpayers;

receipts in terms of classification codes of budget revenues;

payment of taxes by type of economic activity;

tax payment structure;

debt obligations.

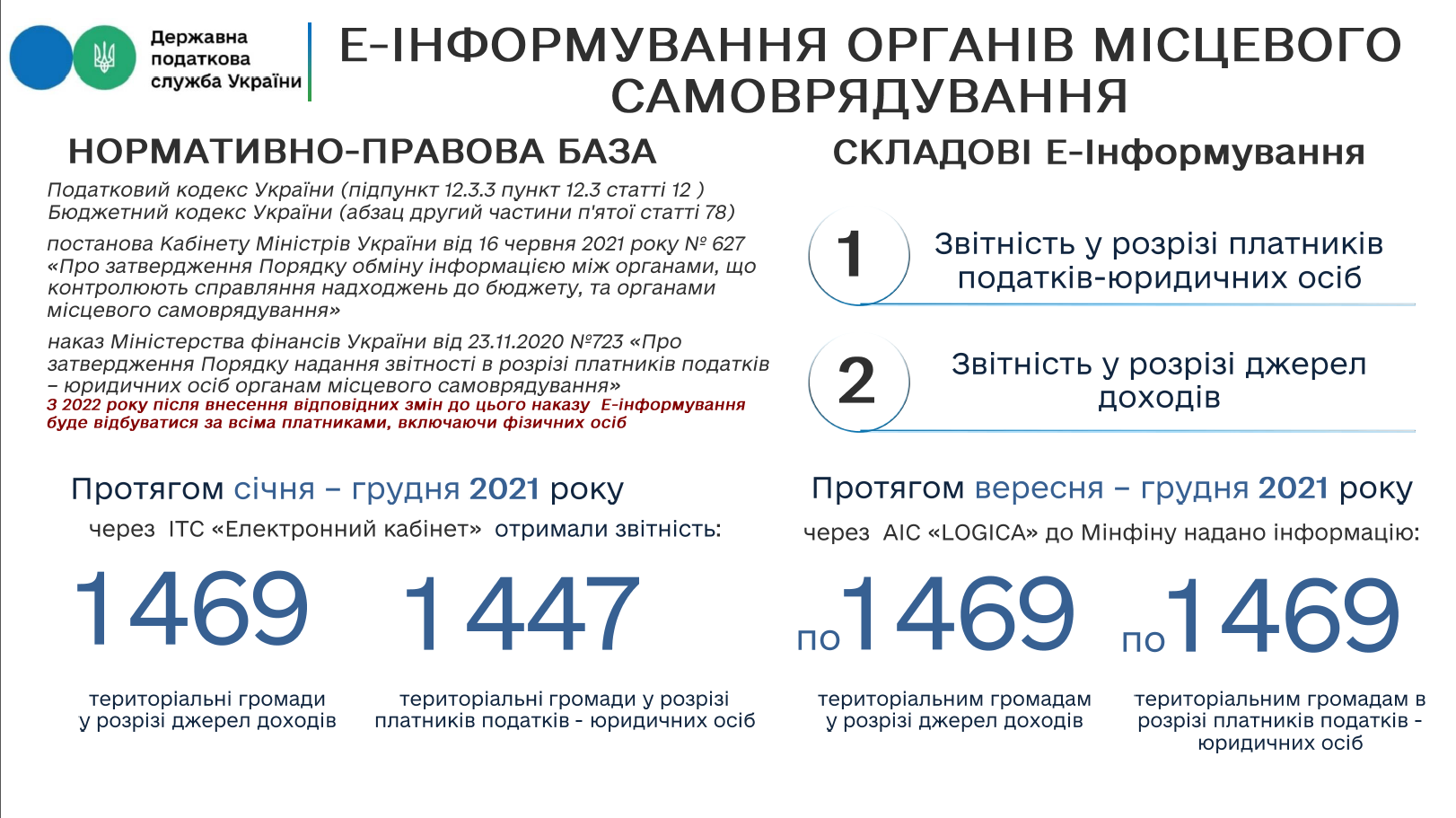

State Tax Service in 2021 according to norms of tax legislation implemented electronic information service for local communities through the Electronic Cabinet or through the information-analytical management system for planning and execution of local budgets “LOGICA” of the Ministry of Finance of Ukraine.

To date, all 1469 local communities use the Electronic Cabinet and receive tax information.

State Tax Service continues vector of transparency, openness and digital transformations in its activities.

Communicate with the State Tax Service remotely using the “InfoTAX” service