State Tax Service of Ukraine informs that, in accordance with the Law of Ukraine as of 15.03.2022 № 2139-IX “On amendments to the Tax Code of Ukraine and certain legislative acts of Ukraine on the introduction of differentiated rent for natural gas production” (hereinafter – Law), the procedure for rent taxation for the subsoil use for natural gas production has been changed.

Law introduces a mechanism for collecting rent for natural gas production using three rates depending on actual prices, which correspond to the monthly average market price calculated by the Ministry of Economy in the European market segment (hereinafter – Actual price).

Declaring rent tax liabilities before approving relevant changes, the rent payers should use current form of Annex 21 to the Rent tax declaration, approved by Order of the Ministry of Finance of Ukraine as of 17.08.2015 № 719, registered in the Ministry of Justice of Ukraine on 03.09.2015 under № 1051/27496 (hereinafter – Annex 21 to the Declaration), in order given in the conditional example.

Conditional example

Company extracted 4000cubic meters of natural gas, of which by means of wells from deposits that lie completely at depth:

up to 5000 meters – 1000 cubic meters,

more than 5000 meters – 1000 cubic meters,

from new wells from deposits that lie completely at depth:

up to 5000 meters – 1000 cubic meters,

more than 5000 meters – 1000 cubic meters.

Actual price in March was estimated at 29550.34 UAH or 1010.0988 USD per 1000 cubic meters.

Rent tax liabilities for extracted gas volumes are declared in separate Annexes 21 to the Declaration for each depth of gas deposits and type of wells, taking into account the maximum actual limit price (400 USD).

As follows, company’s tax liabilities on rent at the rate of 30.0 UAH for 1 US dollar, calculated at rental rates for the actual price for volume of natural gas extracted from wells from deposits that lie entirely at depth:

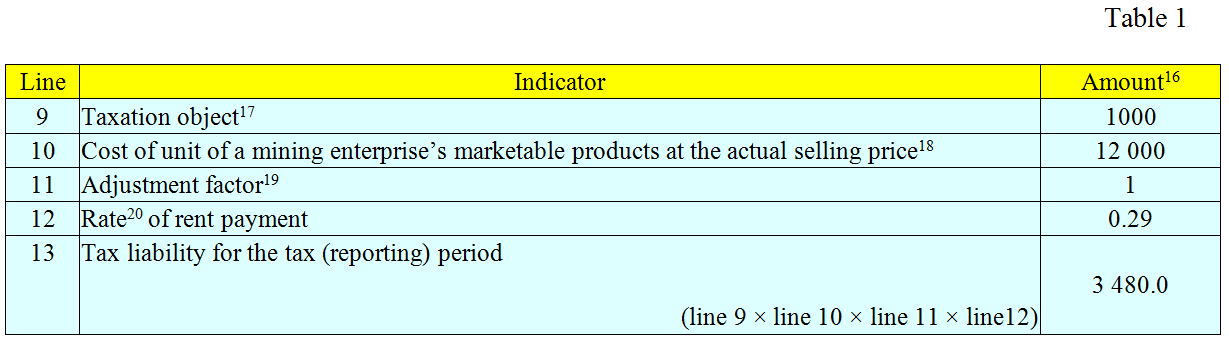

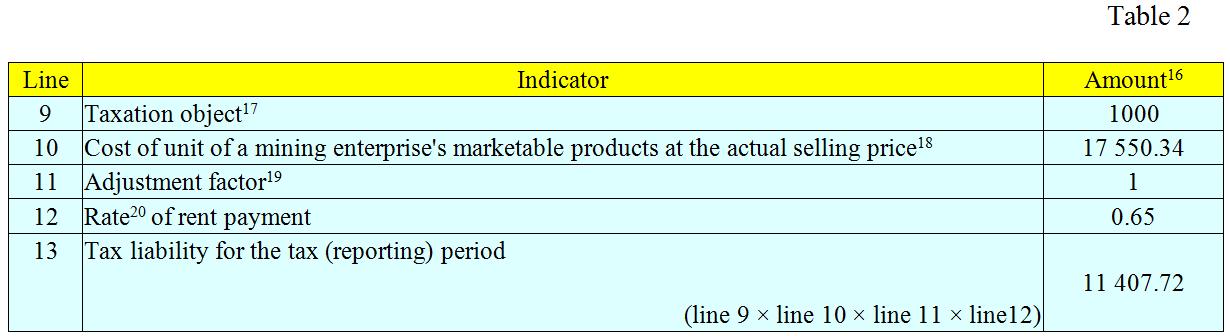

up to 5000 meters at 29% rental rates (from the maximum Actual price of 400 USD) and 65% (from difference between the Actual price of 1010 USD and the maximum Actual price of 400 USD) respectively

(1000 × 12000 × 0.29) + (1000 × (29550.34 - 12000) × 0.65) = 3480.0 + 11407.72 = 14887.72 UAH (see Table 1 and 2)

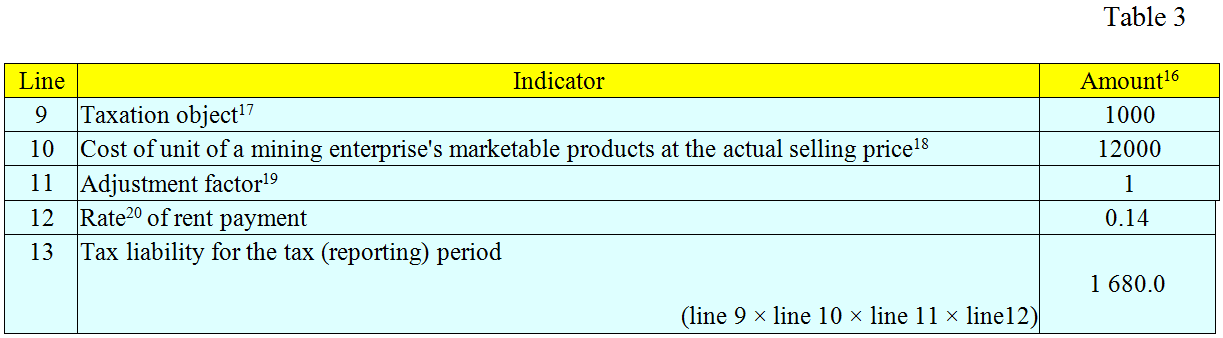

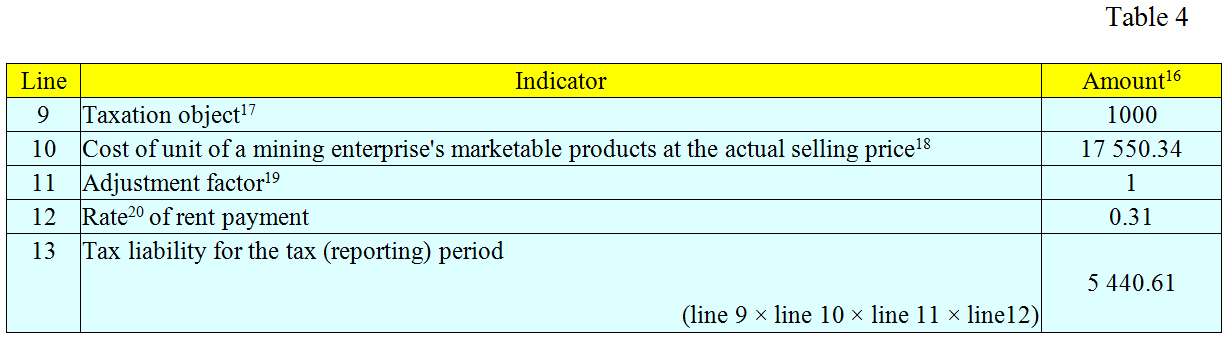

more than 5000 meters at 14% rental rates (from the maximum Actual price of 400 USD) and 31% (from difference between the Actual price of 1010 USD and the maximum Actual price (400 USD) respectively:

(1000 × 12000 × 0.14) + (1000 × (29550.34 - 12000) × 0.31) = 1680.0+ 5440.61 = 7120.61 UAH (see Table 3 and 4);

from new wells from deposits that lie completely at depth:

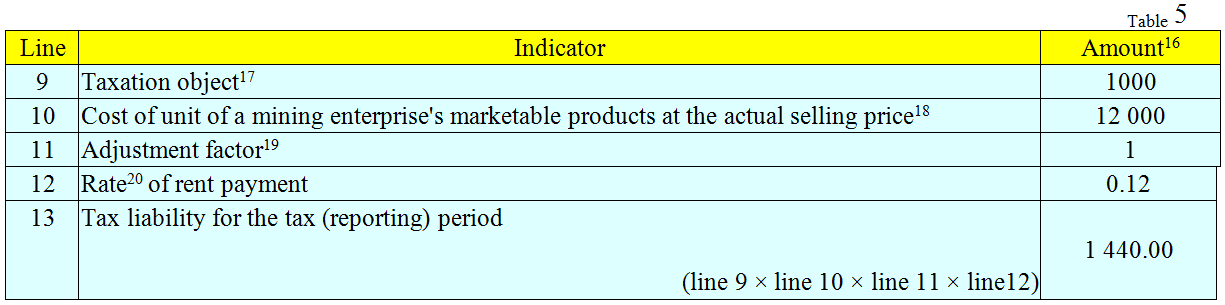

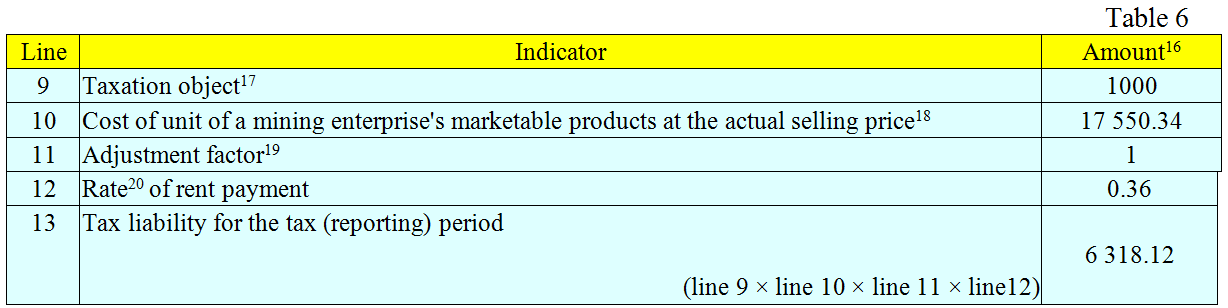

up to 5000 meters at 12% rental rates (from the maximum Actual price of 400 USD) and 36% (from difference between the Actual price of 1010 USD and the maximum Actual price of 400 USD), respectively:

(1000 × 12 000 × 0.12) + (1 000 × (29 550.34 – 12 000) × 0.36) = 1 440.00 + 6 318.12 = 7 758.12 UAH (see Table 5 and 6);

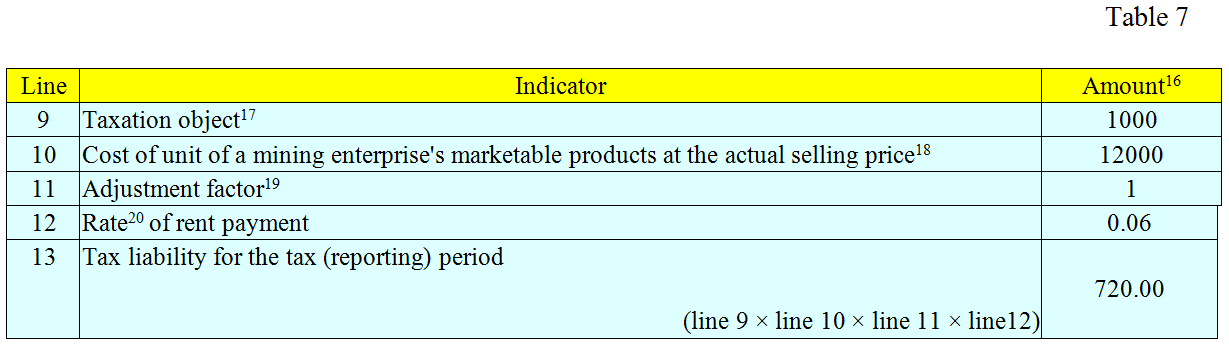

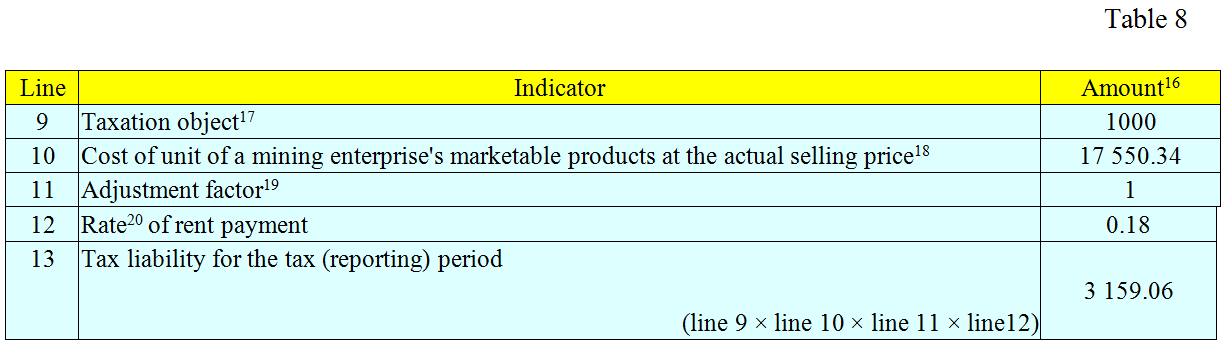

more than 5000 meters at 6% rental rates (from the maximum Actual price of 400 USD) and 18% (from difference between the Actual price of 1010 USD and the maximum Actual price of 400 USD), respectively:

(1000 × 12 000 × 0.06) + (1000 × (29 550.34 – 12 000) × 0.18) = 720.00 + 3 159.06 = 3 879.06 UAH (see Table 7 and 8);