Law of Ukraine № 2970-IX as of 20.03.2023 "On amendments to the Tax Code of Ukraine and other legislative acts of Ukraine regarding implementation of the international standard for automatic exchange of information on financial accounts" (hereinafter – Law 2970-IX) entered into force on 28.04.2023.

Starting from 01.07.2023 Law № 2970-IX requires accountable financial institutions of Ukraine to apply due diligence measures to financial accounts to determine whether accounts are accountable. If account is accountable (subject to exchange), financial institution is obliged to include information about account in report on accountable accounts and submit this report to the State Tax Service of Ukraine.

New requirements for verification of financial accounts and their reporting to the State Tax Service apply to four categories of organizations defined by Section VIII of the General CRS Reporting Standard: depository institution (banks, credit unions, etc.); custodial institution (depository institutions performing depository activities, nominal holders); investment company (investment firms, joint investment institutes, asset management companies, etc.); designated insurance company (insurers, non-state pension funds).

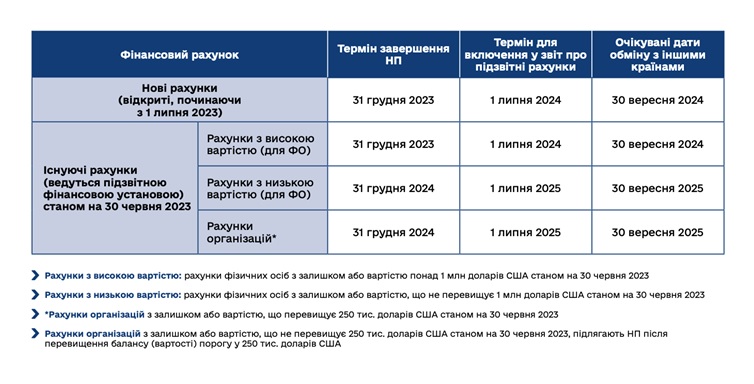

The CRS standard contains separate due diligence rules for accounts opened before and after 01.07.2023. Depending on this, separate rules for due verification of accounts and deadlines for completing this verification are established.

Deadlines for completion of due diligence (DDI) of financial accounts:

It is worth noting that implementation of the CRS Standard is coordinated by the OECD Secretariat in order to ensure unified approach of jurisdictions to its interpretation and application, and implementation of this international standard into Ukrainian legislation; practice is carried out with support of the Global Forum on Transparency and Exchange of Information for Tax Purposes and the European Union Program in support of public finance management in Ukraine (EU4PFM).

Reminder! Text of the CRS Standard in Ukrainian and English, Commentary to it, as well as presentation materials and explanations are posted on the website of the Ministry of Finance and the State Tax Service.

The only state web portal

The only state web portal The only state web portal

The only state web portal