State Tax Service of Ukraine takes measures on an ongoing basis to ensure proper fulfillment of requirements by financial institutions of Ukraine, established by the Agreement between the Government of Ukraine and the Government of the United States of America to improve implementation of tax rules and application of provisions of the US Law "On Foreign Account Tax Compliance Act" (FATCA) as of 07.02.2017, ratified by the Law of Ukraine № 229-IX as of 29.10.2019 (hereinafter – FATCA Agreement).

Based on results of the reporting campaign 2023, the State Tax Service analyzed the most common problematic issues faced by financial agents in the process of reporting on the accountable accounts FATCA.

The most common question that financial agents have is related to receiving feedback messages (FATCA Notifications), which are generated by results of the US Internal Revenue Service's review of FATCA reports submitted by financial agents and directly contain information about acceptance / rejection of report and coding of detected errors.

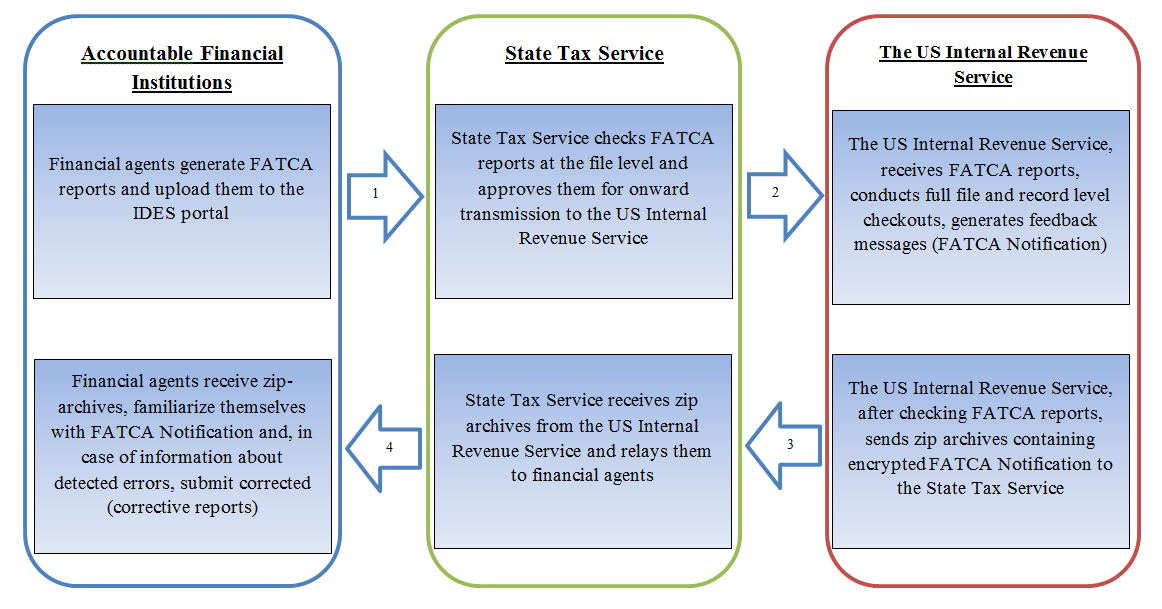

Schematically, process of submission of FATCA reports by Ukrainian financial agents to the US Internal Revenue Service and receipt of FATCA Notification looks like this:

Zip archive relayed by the State Tax Service to the financial agent’s address consists of three files:

- 000000.00000.TA.804_Key;

- 000000.00000.TA.804_Metadata.xml;

- XXXXXX.XXXXX.ME.804_Payload.

To get acquainted with feedback messages (FATCA Notification), which are formed based on the checkout results by the US Internal Revenue Service of FATCA reports submitted by financial agents, it is necessary to decipher existing in the zip archive file "XXXXXX.XXXXX.ME.804_Payload".

Software required for formation of FATCA reports, their encryption and decryption of FATCA Notification, financial agents decide independently, taking into account their own needs.

Therefore, the State Tax Service emphasizes that Paragraph 12 of "Procedure for filling out and submitting report on accountable accounts by financial agents according to the Agreement between the Government of Ukraine and the Government of the United States to improve implementation of tax rules and application of provisions of the US Law "On Foreign Account Tax Compliance Act" (FATCA), approved by Order № 496 of the Ministry of Finance of Ukraine as of 12.08.2020, registered in the Ministry of Justice of Ukraine on 20.08.2020 under № 810/35093 (hereinafter – Order) stipulates that FATCA Notification messages generated by the US Internal Revenue Service as a checkout result of FATCA reports submitted by financial agents are relayed to all financial agents automatically, in full and within time limits set by the law, to those e-mail addresses, that are reported by financial agents to the State Tax Service in compliance with Paragraph 5 of the specified Procedure.

The only state web portal

The only state web portal The only state web portal

The only state web portal