State Tax Service of Ukraine informs that campaign is being started for submission of CRS reports by Accountable Financial Institutions in order to implement the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (MCAA CRS).

Reports are generated and submitted in compliance with requirements of "Procedure for filling out and submitting report on accountable accounts by financial agents according to the multilateral agreement of competent authorities on the automatic exchange of information on financial accounts", approved by Order of the Ministry of Finance of Ukraine № 516 as of 25.09.2023 and registered in the Ministry of Justice of Ukraine on 10.10.2023 under № 1774/40830 (hereinafter – Procedure).

Paragraph 14 of Procedure stipulates that report is submitted by the Accountable Financial Institutions every year, by July 1 of year following the reporting year.

Part 1 of Sub- paragraph 531.1 Paragraph 531 Sub-section 10 Section XX "Transitional provisions" of the Tax Code of Ukraine stipulates that the first reporting period for purposes of the CRS Multilateral Agreement and CRS Common Reporting Standard is period beginning on July 1, 2023 and ending on December 31, 2023.

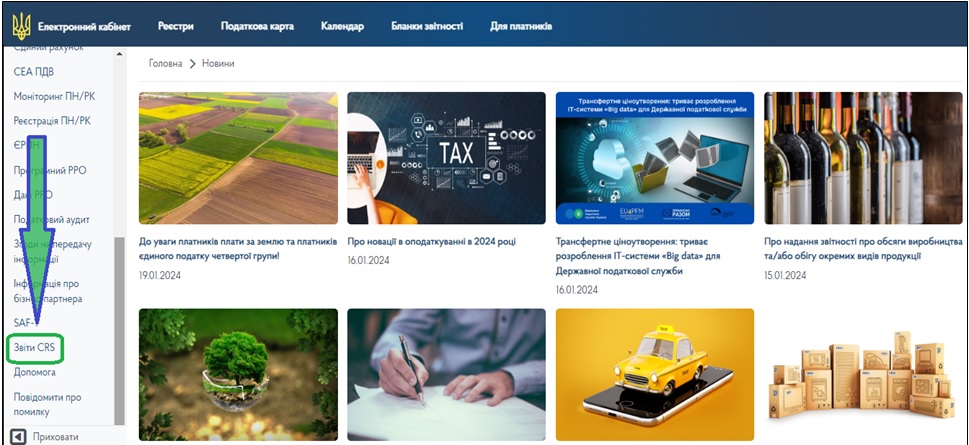

In order to organize process of submitting reports to the State Tax Service, the ICS "Electronic Cabinet" functionality was updated and new "CRS Reports" section was added.

Procedure for submitting report on accountable accounts to the State Tax Service involves step-by-step implementation of the following actions by the Accountable Financial Institutions:

1) downloading the CRS Report in XML format, formed according to requirements of Procedure;

2) signing the downloaded report with a qualified electronic signature of Head of the Accountable Financial Institution or authorized person;

3) sending report to the State Tax Service.

According to the processing results of received report, appropriate messages (receipts) will be sent to address of the Accountable Financial Institution, containing information about acceptance of report or, in case of errors, about its rejection.

If there are any questions related to the process of submitting report, please call: 272-26-71 or send questions to the e-mail box: crs.info@tax.gov.ua.

The only state web portal

The only state web portal The only state web portal

The only state web portal