Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portal

Transfer pricing rules have been in force in Ukraine for 10 years, which were introduced on September 1, 2013 and have become important tool for combating tax evasion and ensuring stability of revenue part of the budget.

Process of establishing legislative rules on transfer pricing is accompanied by implementation into Tax Code of Ukraine (hereinafter – Code) of the OECD guidelines, steps of the BEPS Action Plan, GAAR rules, joining the CRS/CbC exchange and general active movement towards European integration.

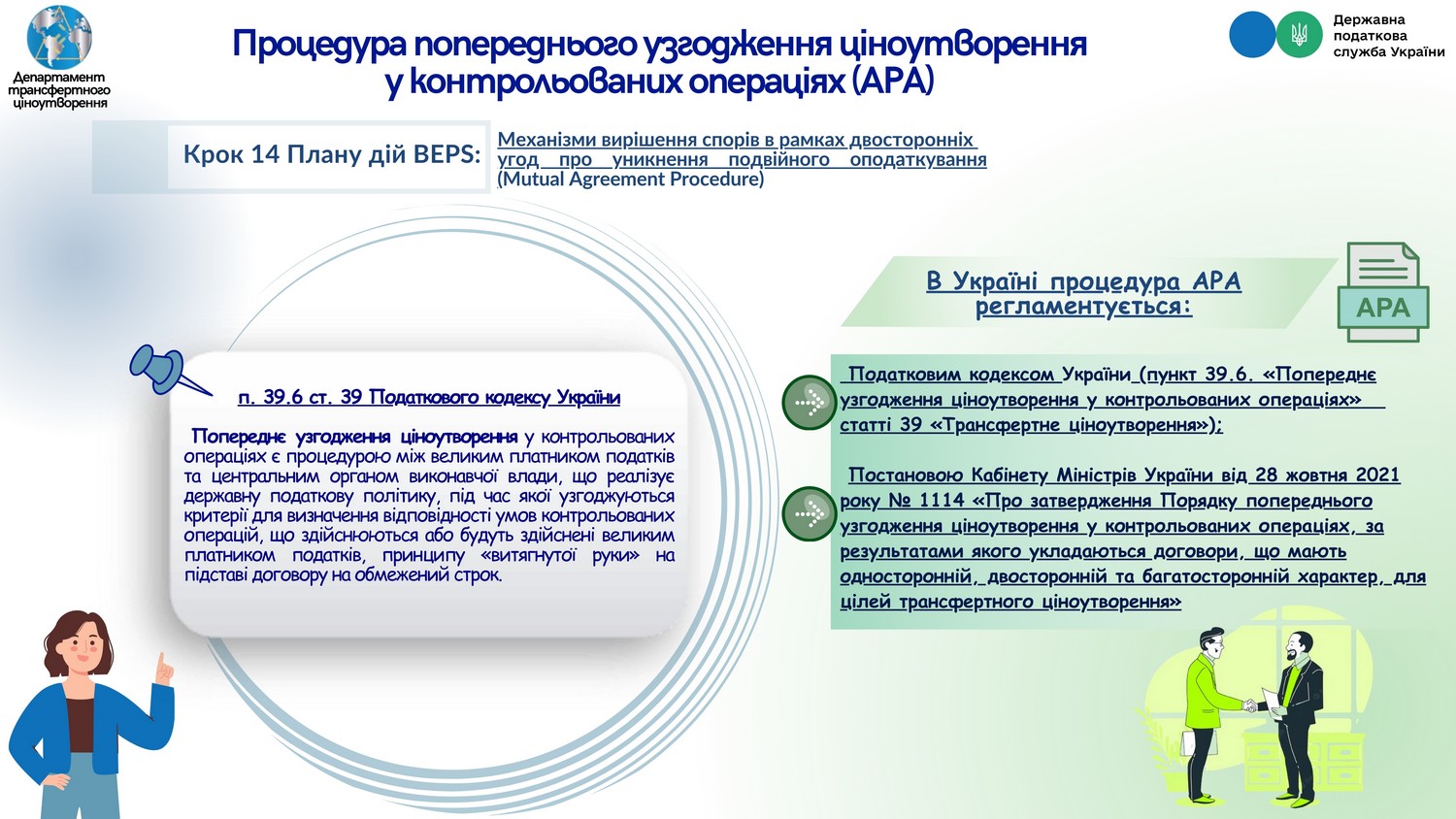

In particular, step 14 of the BEPS Action Plan introduces dispute resolution mechanisms within the framework of bilateral agreements on avoidance of double taxation (Mutual Agreement Procedure), which provide for the taxpayer’s right to apply to the competent authorities of countries that are convention parties in order to resolve disputes between the taxpayer and tax authority.

Advance pricing arrangement procedure in controlled operations was absent in domestic tax legislation before the introduction of transfer pricing rules.

Regulatory and legal acts that regulate advance pricing arrangement in controlled operations in Ukraine are:

Tax Code of Ukraine (Paragraph 39.6 "Advance pricing arrangement in controlled operations" of Article 39 "Transfer pricing" Section I);

Resolution of the Cabinet of Ministers of Ukraine № 1114 as of 28.10.2021 "On approval of Advance pricing arrangement procedure in controlled operations, as a result of which contracts of unilateral, bilateral and multilateral essence are concluded for the transfer pricing purposes".

Sub-paragraph 39.6.1 Paragraph 39.6 Article 39 Section I of the Code stipulates that: "Advance pricing arrangement in controlled operations is a procedure between major taxpayer and central executive body that implements state tax policy, during which criteria for determining compliance of conditions of controlled operations carried out or to be carried out by major taxpayer with the "arm's length" principle on the basis of contract for a limited period are agreed.

Only major taxpayer can use Advance pricing arrangement procedure in controlled operations.

Sub-paragraph 39.6.1.1 of Sub-paragraph 39.6.1 Paragraph 39.6 Article 39 Section I of the Code stipulates that subject of advance pricing arrangement in controlled operations may be, in particular, but not exclusively:

- types and/or list of products (works, services) that are the subject of controlled operations;

- methods or combination of methods for establishing compliance with conditions of controlled operation with the "arm's length" principle;

- list of information sources that are expected to be used to establish compliance of conditions of controlled operations with the "arm's length" principle;

- period for which prices are agreed in controlled operations;

- acceptable deviation from established level of economic conditions for implementation of controlled operations;

- procedure, deadlines for submission and list of documents confirming compliance with agreed prices in controlled operations.

Other conditions for advance pricing arrangement in controlled operations are determined by the agreement of parties.

Contract is concluded basing on results of advance pricing arrangement in controlled operations, which is signed by the head of major taxpayer or authorized person and the head (deputy head) of central executive body that implements state tax policy (hereinafter – State Tax Service) (Sub-paragraph 39.6.2 Paragraph 39.6 Article 39 Section I of the Code).

Such contract is unilateral in essence.

If a foreign state body authorized to administer taxes and levies in the state of which party of controlled operations is resident and involved in advance pricing arrangement procedure in controlled operations (provided there is international agreement (convention) on the avoidance of double taxation between Ukraine and such state), contract concluded as a result of such agreement between major taxpayer and central executive body that implements state tax policy, has a bilateral essence.

If two or more state bodies authorized to administer taxes and levies in the state of which party (parties) of controlled operations is resident and involved in advance pricing arrangement procedure (provided there are international treaties (conventions) on the avoidance of double taxation between Ukraine and such states), contract concluded as a result of such agreement between major taxpayer and central executive body that implements state tax policy has a multilateral essence.

To date, in international practice, there is a tendency towards increase in share of contracts that have a bilateral or multilateral essence with advance pricing arrangement procedure in controlled operations, which compared to contract that is of unilateral essence, significantly reduces potential risks of further challenges to contracts of advance pricing arrangement procedure in controlled operations, including by foreign competent authorities.

Sub-paragraph 39.6.2.4 of Sub-paragraph 39.6.2 Paragraph 39.6 Article 39 Section I of the Code stipulates that Resolution of the Cabinet of Ministers of Ukraine № 1114 as of 28.10.2021 approved Advance pricing arrangement procedure in controlled operations, as a result of which contracts of unilateral, bilateral and multilateral essence are concluded for the transfer pricing purposes (hereinafter – Procedure), which defines:

- procedure for submitting and considering application for advance pricing arrangement procedure in controlled operations;

- list of documents, submission of which is necessary for advance pricing arrangement procedure in controlled operations;

- grounds for making changes to the current contract, concluded as a result of advance pricing arrangement in controlled operations, extending its validity term or early termination;

- grounds for terminating advance pricing arrangement procedure in controlled operations;

- grounds for termination or extension of the contract.

Based on results of conducted advance pricing arrangement procedure in controlled operations, in case of reaching agreement regarding the subject of such procedure, criteria for determining compliance of conditions of controlled operations with the "arm's length" principle, other conditions, circumstances and peculiarities of controlled operations, contract is concluded, which enters into force on the date agreed by the State Tax Service and the taxpayer.

Contract term is determined by parties and cannot exceed five calendar years (Paragraph 27 of Procedure).

With agreement of the State Tax Service and the taxpayer, validity of contract can be extended to the entire reporting period in which it was concluded and/or to the reporting periods that precede its entry into force, if in relation to such reporting periods, audit on compliance by the taxpayer has not been conducted and there is no verification of the taxpayer's compliance with the "arm's length" principle.

In case of compliance with the contract terms on advance pricing arrangement in controlled operations, the controlling bodies do not have the right to make decisions on additional tax liabilities, fines and penalties for controlled operations that are the subject of such contact.

In case of non-compliance with the contract terms on advance pricing arrangement in controlled operations by the taxpayer, such contract becomes invalid from the date of its entry into force. Controlling bodies have the right to make decisions on additional accrual of tax liabilities, fines, penalties in relation to controlled operations, which are the subject of such contract, terms of which do not correspond to the "arm's length" principle (Sub-paragraph 39.6.2.5 of Sub-paragraph 39.6.2 Paragraph 39.6 Article 39 Section I of the Code).

In case that the payer complies with the contract terms and provided that agreed criteria for determining compliance with conditions of controlled operations remain unchanged, validity of contract may be extended for a period agreed upon by the parties.

Important legal basis for major taxpayers is stability of the contract terms concluded as a result of advance pricing arrangement in controlled operations (Sub-paragraph 39.6.3 Paragraph 39.6 Article 39 Section I of the Code):

- contract conditions remain unchanged in case of a change in tax legislation in terms of regulation of relations that arise in the process of concluding such contract, making changes to it, terminating its validity, or if the taxpayer loses status of major taxpayer;

- in case of changes to tax legislation that affect activities of major taxpayer and/or criteria for determining compliance of conditions of controlled operations with the "arm's length" principle, parties of contract have the right to make appropriate changes to its text.

If one of the parties does not agree with suggested changes, the contract is terminated.