Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portal

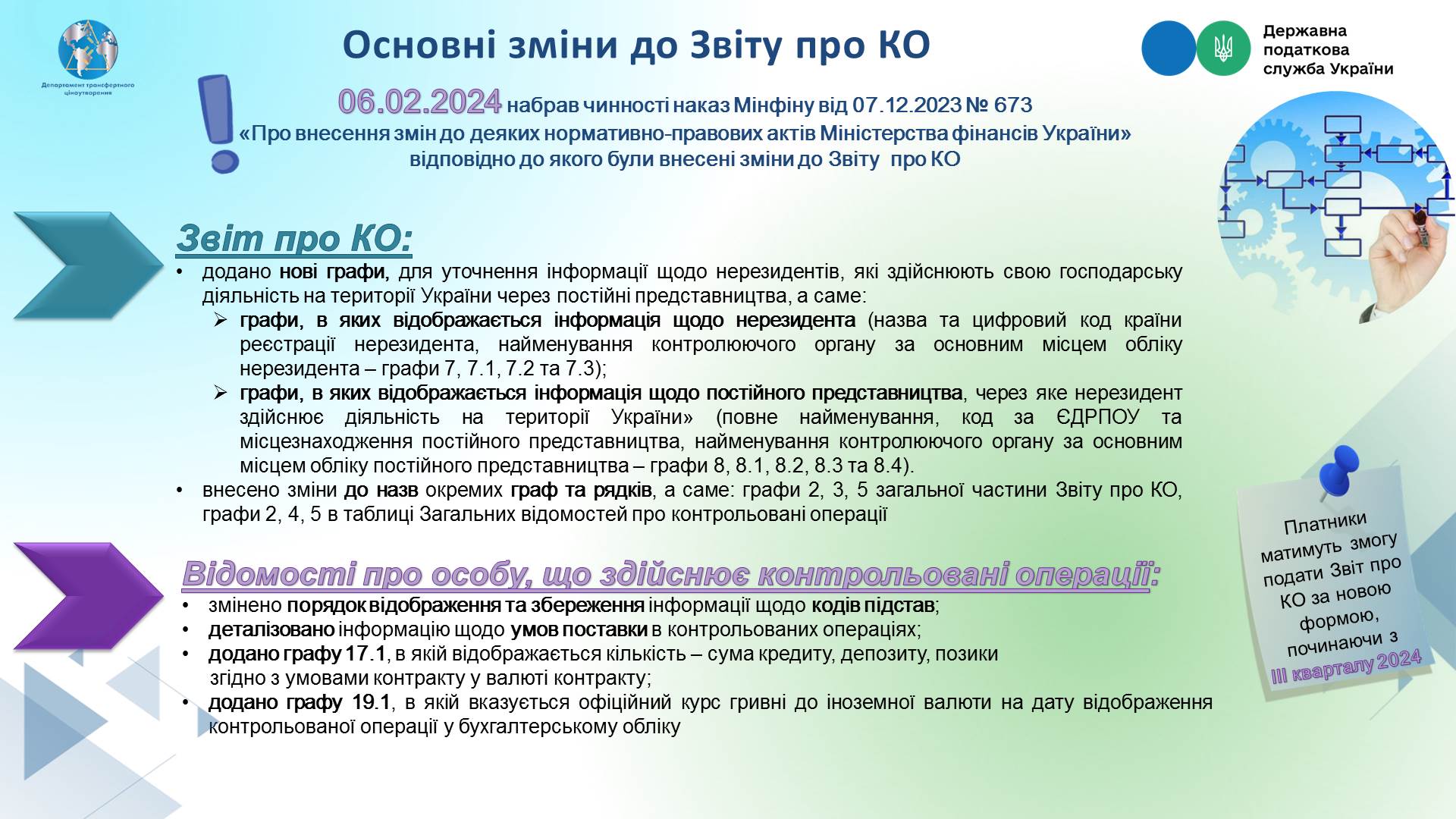

State Tax Service of Ukraine informs that Order of the Ministry of Finance of Ukraine № 673 as of 07.12.2023 "On amendments to certain regulatory acts of the Ministry of Finance of Ukraine", registered in the Ministry of Justice of Ukraine on 12.21.2023 under № 2223/41279 (hereinafter – Order № 673) entered into force on 06.02.2024, with changes introduced by Order of the Ministry of Finance of Ukraine № 725 as of 12.27.2023, registered in the Ministry of Justice of Ukraine on 12.29.2023 under № 2281/41337.

Order № 673, with aim of improving control over compliance with conditions of controlled operations of the "arm's length" principle, made changes to the form and Procedure for compiling Report on controlled operations, approved by Order № 8 of the Ministry of Finance of Ukraine as of 18.01.2016, registered in the Ministry of Justice of Ukraine on 04.02.2016 under № 187/28317 (hereinafter – Order № 8).

The following was reported on web portal of the State Tax Service in the section: Home/Press Center/News (https://tax.gov.ua/en/mass-media/news/760878.html).

The specified changes will enable taxpayers to reflect in more detail conditions of controlled operations to substantiate their compliance with the "arm's length" principle.

Among the main changes to form and procedure for compiling Report on controlled operations (hereinafter – Report), the following should be noted:

- new columns have been added to Report in order to clarify information regarding non-residents who carry out their economic activities on the territory of Ukraine through permanent representative offices, namely:

columns 7, 7.1, 7.2 and 7.3, which reflect information about non-resident (name and numerical code of the non-resident’s registration country, title of the controlling authority at the non-resident’s main registration place);

columns 8, 8.1, 8.2, 8.3 and 8.4, which reflect information about permanent representative office through which non-resident carries out activities on the territory of Ukraine" (full name, code from the Unified State Register of Enterprises and Organizations of Ukraine and location of permanent representative office, title of the controlling authority the main permanent representative office’s registration place);

- in annex "Data about person carrying out controlled operations" in particular:

procedure for reflecting and saving information regarding codes of reasons for classifying operations as controlled has been changed, namely: each reason code is filled in a separate cell - with a "+" sign; one of the cells "no" or "yes" of the base code "010" must be filled in, and if the cell "no" is filled in, then one or more cells with the base code "015" must be filled in, "020", "030", "040", "050");

there is added information on the need to indicate not only contracts (agreements), but also the latest changes to them, which confirm agreement by the parties of essential conditions of controlled operations, in particular, characteristics of product price, volume, terms of supply, payment and responsibility of the parties of operation;

there is detailed information on delivery conditions in controlled operations; in column 11 delivery condition code according to Incoterms is reflected, and place of delivery in column 11.1;

there is added column 17.1, which reflects amount, namely amount of credit, deposit, loan according to the contract terms in the contract currency, if code type of operation object, specified in the corresponding line of column 3, is equal to 205 or 206;

there is added column 19.1, which indicates official exchange rate of UAH to foreign currency on the date of reflecting controlled operation in accounting. Official rate of the NBU on the date of controlled operation (numerical value with six decimal places) is used for calculation. This column is not filled in if the contract currency is UAH and/or the taxpayer has grouped controlled operations (number 1 is inserted in column 24).

Titles of individual columns and rows were also specified in Report form, namely:

- columns 2, 3, 5 of general part of Report, columns 2, 4, 5 in the table of General information on controlled operations;

- columns 1, 5, 6 in Information on controlled operations table of appendix to the Report.

In connection with made changes, specialists of the State Tax Service have developed updated control algorithm for purpose of accepting Report.

In case of non-compliance with requirements of Order № 8 regarding filling out Report (with attachments), taxpayers will receive receipts with a description of made and discovered violations.

Taxpayer's report will not be accepted if annexes provided for by Order № 8 are not attached to Report (number of annexes "Data about person carrying out controlled operations" (hereinafter – "Data") must correspond to number of counterparties, and number of annexes "Information to annex to Report on controlled operations " (hereinafter – information to Data) should be equal to the number of counterparties indicated by the taxpayer related to him/her).

Taxpayer's Report is accepted, but if it is incorrectly filled out (with attachments), receipt № 2 is sent, if it is particularly established:

- inconsistency of the amounts of controlled operations indicated in the Report and in the Data for this counterparty (value of column 5 "Total amount of controlled operations with the counterparty (total) (UAH)" of the Report table should be equal to the value of row(s) "Total" of column 20 of the table of annex № n (taking into account availability of portions) Data on this non-resident counterparty);

- columns (digital code of the non-resident’s registration country, product code according to Ukrainian classification of the foreign economic activity product, service code, delivery terms, measurement units) are not filled in according to classifiers of countries of the world DK 007-96, products of foreign economic activity, products and services DK 016:2010, international commercial terms (Incoterms), designations systems of measurement units and accounting DK 011-96, foreign currencies;

- columns are not filled in according to codes provided for by Order № 8 (grounds for classifying economic operations as controlled; signs of person's relation; title of operation; type of operation; parties of the operation; method of establishing compliance with conditions of controlled operation with the "arm's length" principle; profitability indicators; information sources);

- there are no marks in field of the line "Code(s) of relationship characteristics(s)".

In order to eliminate identified errors, taxpayers must submit to the controlling authority report of the types "reporting", "reporting new" or "clarifying" in manner prescribed by Sub-paragraph 39.4.2 Paragraph 39.4 Article 39 of the Code and Paragraph 2 Section I of Order № 8.

It should be emphasized that the Code does not provide for application of fines in case that the taxpayer independently corrects methodological errors made during preparation of Report, which did not lead to non-declaration or late declaration of controlled operations in previously submitted Report.

Presentation materials on the algorithm for filling out Report taking into account changes.

Additionally, it should be informed that the updated XML scheme of Report and its description (J0104707, J0147107, J0147207 with a note "for developers)" has been published on web portal of the State Tax Service in section: Home/Electronic reporting/To taxpayers on electronic reporting/Information and analytical support/Register electronic forms of tax documents.

In addition, please note that Report on controlled operations carried out by taxpayers during reporting year 2023 must be compiled and submitted to the controlling authority in the updated form and in Procedure approved by Order № 673.

Taking into account above specified, Reports on controlled operations carried out by taxpayers during the reporting year2023, submitted by taxpayers before entry into force of Order № 673 and development of appropriate electronic formats for submitting Report in the updated form, are considered valid.