Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portal

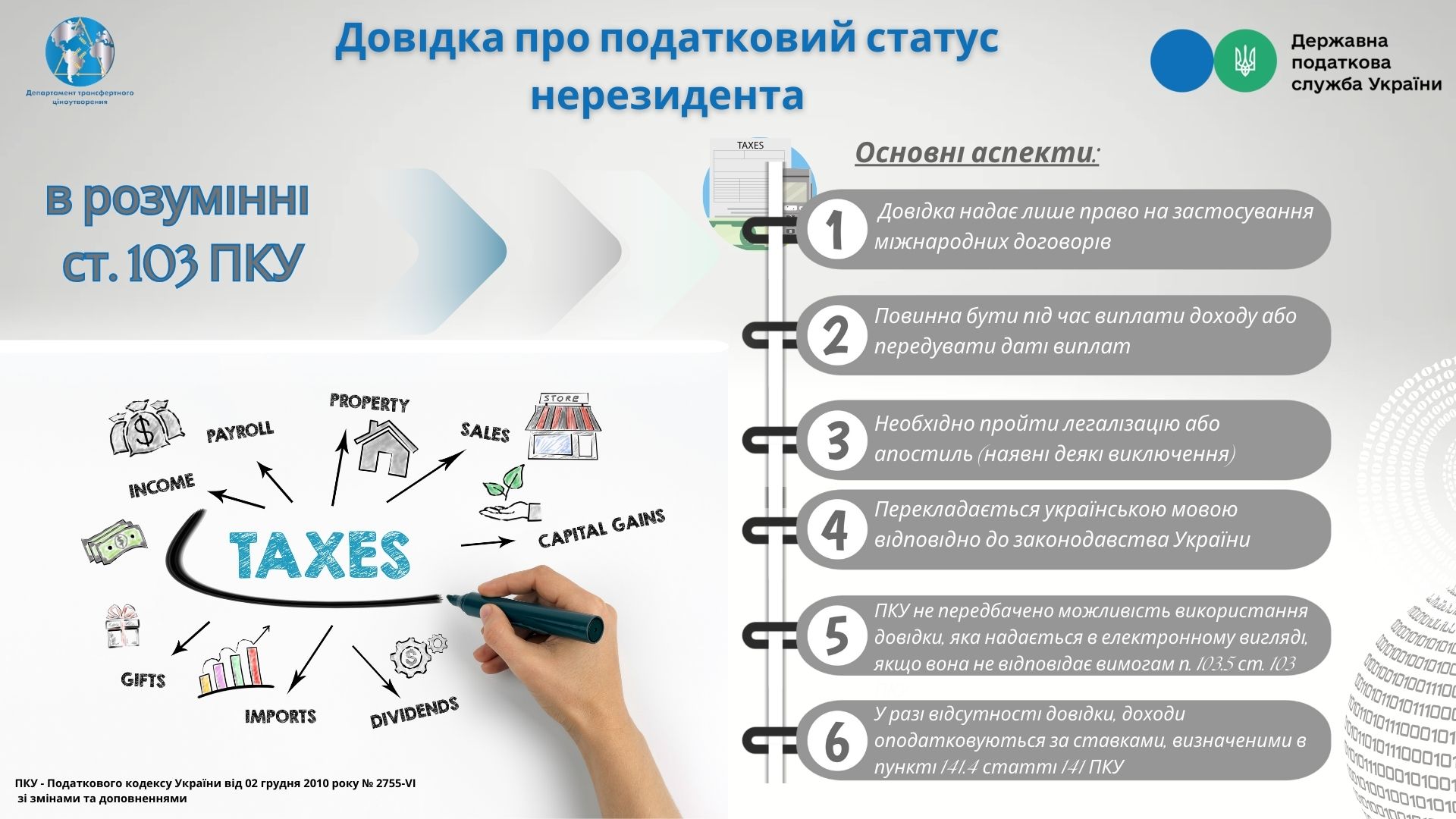

State Tax Service of Ukraine informs that in case of income payment to non-resident, if such non-resident is beneficial (actual) recipient (owner) of income (if relevant condition is stipulated by international agreement) and is resident of country with which Ukraine has concluded international agreement, the non-resident may submit a corresponding certificate to confirm resident status for exemption from taxation or application of reduced tax rate.

Paragraph 103.2 Article 103 of the Tax Code of Ukraine (hereinafter – Code) stipulates that person (tax agent) has a right to independently apply exemption from taxation or reduced tax rate provided for by relevant international agreement of Ukraine at the time of income payment to non-resident, if such non-resident is beneficial (actual) recipient (owner) of income (if relevant condition is stipulated by international agreement) and is resident of country with which Ukraine has concluded international agreement. In case of obtaining a syndicated financial loan, person (tax agent) applies tax rate stipulated by relevant international agreement of Ukraine on the payment date of interest or other income received from sources in Ukraine to participants of creditors syndicate, taking into account jurisdiction in which each participant of the syndicated loan is resident, and in proportion to his share within the credit agreement, provided that such resident is beneficial (actual) recipient (owner) of income, regardless of whether payment is made through agent or directly.

Procedure for application of international agreement of Ukraine on the avoidance of double taxation regarding full or partial exemption from taxation of non-residents’ income with a source of origin from Ukraine is provided for in Article 103 of the Code.

Paragraph 103.4 Article 103 of the Code stipulates that basis for exemption (reduction) from taxation of income with a source of origin in Ukraine is submission by non-resident, taking into account peculiarities provided for in Paragraphs 103.5 and 103.6 of this Article, to person (tax agent) who pays income, certificates (or its notarized copy), which confirms that non-resident is resident of country with which Ukraine has concluded international agreement, as well as other documents, if this is stipulated by the international agreement of Ukraine.

Paragraph 103.5 of Article 103 of the Code stipulates that certificate is issued by the competent (authorized) body of relevant country, defined by the international agreement of Ukraine, in the form approved according to legislation of relevant country, and must be properly legalized, translated according to legislation of Ukraine.

Certificate of non-resident’s tax status is issued by the competent (authorized) body of non-resident's country. In the context of Article 103 of the Code, the competent authority is determined according to provisions of international agreements concluded by Ukraine with other countries. That is, such competent (authorized) bodies are the Ministry of Finance/Tax Service of relevant contracting country or authorized representative of these state bodies.

It is important to note that the form of certificate of non-resident’s tax status does not have unified form, in each case this form is approved by the authority of relevant foreign country according to its legislation. That is, there is no standardized form for issuing certificate of non-resident’s tax status, however, each such certificate (certification, etc.) usually contains the following elements:

- Taxpayer’s name.

- Tax year for which certificate (certification, etc.) was issued.

- Issuance date of document.

- Signature of authorized person who is authorized to issue certificate (certification, etc.).

- Notification that the specified taxpayers are residents within the meaning of relevant agreement on avoidance of double taxation.

Please note that the Code does not provide for the possibility of using certificate confirming non-resident’s tax status provided electronically for applying benefits of international agreement in terms of exemption from taxation or application of reduced tax rate.

In order for certificate to be recognized as valid on the territory of Ukraine, it must undergo legalization procedure.

Legalization of foreign documents is procedure that ensures recognition of legality and authenticity of official documents issued in another country, on the territory of country where they are to be used. This procedure is regulated by international and domestic legal norms of countries. Legalization method of certificate depends on the country where person that receives income is resident, namely: consular legalization, affixing apostille, or without any confirmation (that is, without consular legalization and without apostille).

Procedure for consular legalization of official documents is established by the Vienna Convention "On consular relations" of 1963, international agreements and current legislation of Ukraine, as well as Instruction on the procedure for consular legalization of official documents in Ukraine and abroad, approved by Order of the Ministry of Foreign Affairs of Ukraine № 113 as of 04.06.2002 (hereinafter – Instruction).

Consular legalization of official documents, according to Instruction, is procedure for confirming authenticity of originals of official documents or certifying authenticity of signatures of officials authorized to certify signatures on documents, as well as authenticity of impressions of stamps and seals used to seal the document.

Consular legalization consists in confirming compliance of documents with legislation of country of their origin and is certification of authenticity of official's signature, his/her status and seal of authorized state authority on documents and acts for their further use on the territory of another country. Consular legalization of documents can be carried out either on the territory of country that issues this document, or on the territory of country where this document is used.

The 1961 Convention Abolishing the Requirement of Legalisation for Foreign Public Documents (HCCH 1961 Apostille Convention) (hereinafter – Hague Convention) entered into force for Ukraine on December 22, 2003.

Official documents that will be used on the territory of countries that are parties to the Hague Convention must be certified with a special "Apostille" stamp (hereinafter – apostille) affixed by the competent authority of country in which document was compiled and do not require any further certification (legalization).

Countries – participating in the Hague Convention are most of countries of the world, including countries of the European Union, United States of America, Australia, Japan, India and many others, which recognize apostille procedure for legalization of documents among themselves.

The Hague Convention establishes single sample apostille, which has standardized format and contains necessary requisites to confirm authenticity of official documents issued in countries participating in the Hague Convention.

Official documents bearing apostille do not require any further certification (legalization).

Part 2 of Article 3 of the Hague Convention stipulates that compliance with procedure for affixing apostille cannot be required by countries that are parties to the Convention, if there are agreements between two or more countries that cancel or simplify this procedure, or exempt document itself from legalization.

Ukraine was a party to the Convention on Legal Assistance and Legal Relations in Civil, Family and Criminal Matters as of 22.01.1993 until December 29, 2023 (hereinafter – the 1993 Convention). According to conclusion of the Ministry of Justice of Ukraine, documents of tax institutions of foreign countries, which are parties to agreements on legal assistance and legal relations in civil, family and criminal cases, had to be accepted in territories of the Contracting Parties without any additional certification.

According to information of the Ministry of Foreign Affairs of Ukraine, validity of the 1993 Convention and Protocol thereto for Ukraine has been suspended since 29.12.2023 (Letter of the Ministry of Foreign Affairs of Ukraine № 72/14-612-2008 as of 06.01.2023).

From the termination date of the 1993 Convention in relations with the russian federation and republic of belarus, documents issued on the territory of these countries will be subject to requirement of apostille certification according to the Convention, which cancels legislative requirement of foreign official documents, when they are presented on the territory of Ukraine, the 1961, which remains valid in Ukraine's relations with the russian federation and republic of belarus.

In relations with the Republic of Azerbaijan, Republic of Armenia, Republic of Kazakhstan, Kyrgyz Republic, Republic of Tajikistan and Turkmenistan, the 1993 Convention was in effect until the date of Ukraine's withdrawal, that is, until 29.12.2023.

In relations with the Republic of Moldova, Republic of Uzbekistan and Republic of Georgia, there are bilateral international agreements, on the basis of which foreign official documents can be accepted in Ukraine without additional certification.

According to clarification on the application of international agreements of Ukraine on legal aid in the part that concerns cancellation of requirement for legalization of foreign official documents (Letter of the Ministry of Justice № 1326/12.1.1/26-21 as of 12.02.2021), presence of relevant provisions cannot be interpreted as automatically providing for acceptance by the competent authorities of Ukraine without any additional certification of all official documents compiled by authorities of foreign countries that are parties to such agreements.

Exemption of official documents from legislative requirement or other additional certification (apostille) based on relevant provisions of international agreements of Ukraine does not cancel requirement to provide a certified translation of document into the official language of country in whose territory te document is presented or will be used.

Therefore, certificates of tax resident status submitted to tax authorities must meet requirements of official documents and be translated into the official language. Translation must be certified by a notary. If notary does not know relevant language, translation can be done by a translator, and the translator's signature is confirmed by a notary (Article 79 of the Law of Ukraine "On notaries").

However, translation of a notarized copy of certificate, which confirms that non-resident is resident of the country with which Ukraine has concluded an international agreement, does not have the same legal force as the original. Authenticity of certificate’s copy (authenticity, correspondence to its original) must be certified.

According to the validity period of certificate, legislation of Ukraine stipulates that person who pays income to non-resident in the reporting (tax) year, in case that non-resident submits certificate with information for the previous reporting tax period (year), may apply rules of international agreement of Ukraine, in particular regarding exemption (reduction) from taxation, in the reporting (tax) year with receipt of certificate after end of the reporting (tax) year (Paragraph 103.8 Article 103 of the Code).

Certificate must be available to tax agent at the time of income payment, as it is one of the grounds for exemption from taxation of non-resident’s income at the time of their payment.

Person who pays income to non-resident in the reporting (tax) year, if non-resident provides certificate with information for the previous reporting tax period (year), may apply rules of international agreement of Ukraine, in particular regarding exemption (reduction) from taxation, in the reporting (tax) year upon receipt of certificate after end of the reporting (tax) year. As follows, certificate is valid within the calendar year in which it is issued.

If non-resident does not submit certificate, income of non-resident with the source of their origin in Ukraine is subject to taxation according to legislation of Ukraine on taxation (Paragraph 103.10 Article 103 of the Code).