Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portal

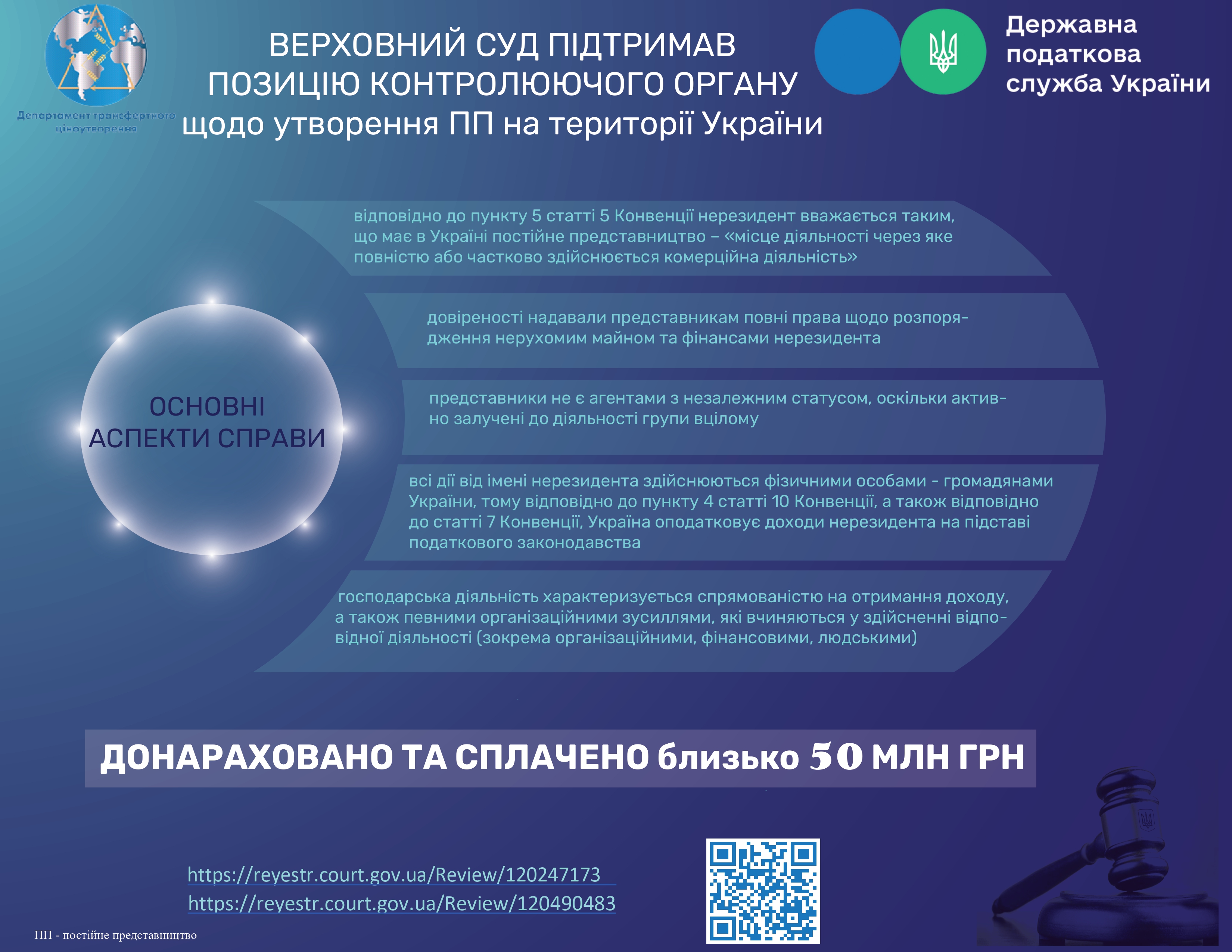

The Supreme Court, as a part of panel of judges of the Administrative cassation court, while sending the case for a new review, noted that in order to confirm conclusion regarding classification of enterprise as a permanent establishment within the meaning of provisions of Paragraph 5 Article 5 of Convention between the Government of Ukraine and Government of the Republic of Cyprus on the avoidance of double taxation and prevention of tax evasion in relation to the income taxes (hereinafter – Convention), which was ratified by the Verkhovna Rada of Ukraine on 04.07.2013 by the Law № 412-VI, the research of evidence regarding conduction of commercial activity is of decisive importance, therefore courts of the first and appellate instances did not comply with principle of official clarification of all important circumstances that are important for resolution of dispute making a decision.

The court found that the non-resident’s interests were represented by authorized persons – citizens of Ukraine, who acted on the basis of powers of attorney. According to the content of these powers of attorney, the non-resident’s representatives had full rights to dispose real estate and finances of the non-resident, had a right to purchase shares in Ukrainian companies and alienate them. In addition to above specified, the latter used authority to conclude operations on behalf of non-resident, in particular, contracts for the purchase and sale of corporate rights, contracts for provision of services. Also, on the non-resident’s behalf, the same persons participated in general meetings of enterprises whose corporate rights belong to the non-resident, made decisions on payment of dividends, and approved the enterprise’s status. These persons are not agents with independent status, because they are actively involved in the activities of a group of related persons, which includes, in particular, the non-resident, receive wages from Ukrainian enterprises that are members of a group of companies, which also includes the non-resident, are beneficial owners of the non-resident and of Ukrainian enterprises, did not receive any income from abroad for representing the non-resident’s interests, which is a direct sign of permanent representation according to provisions of Paragraph 5 Article 5 of the Convention.

Taking into account above specified, as well as the fact that all investments of the non-resident company are located in Ukraine, and managed from Ukraine by persons – citizens of Ukraine, according to Paragraph 4 Article 10 of the Convention, as well as according to Article 7 of the Convention, Ukraine taxes the non-resident’s income based on tax legislation.

Paragraphs 23 and 24 of the official commentary to the OECD Model Convention, stipulate that activity of a representative office cannot be considered to be of auxiliary nature, if it mainly performs the same functions as a parent company. That is, if the main type of activity of the representative office is the same as a type of activity of the non-resident (parent company), defined in the non-resident’s statutory documents, representative office is considered as a permanent representative office for tax purposes.

To distinguish "permanent" representation from "non-permanent" (non-commercial), key characteristics should be identified that serve as a basis for their distinction. First of all, activity of a non-permanent representative office has exclusively preparatory or auxiliary nature in relation to activities of the non-resident company and must be different from statutory functions of the parent company. Similar legal position was expressed by the Supreme Court in Resolutions as of 21.12.2022 (in case № 200/7051/20-а) and 15.03.2016 (in case № 826/14127/14).

Panel of courts also noted that "in order to recognize the non-resident’s representation as having status of the permanent representation, a necessary condition is its commercial activity.

By its essence, this term is equivalent to the term "economic activity", which is used in the Tax Code of Ukraine, as well as in a significant number of other international treaties.

Therefore, clarifying nature of the non-resident's economic activity is important in view of definition of the permanent establishment.

Term "economic activity" is defined in Sub-paragraph 14.1.36 Paragraph 14.1 Article 14 of the Tax Code of Ukraine as activity of person related to production (manufacturing) and/or sale of products, performance of works, provision of services, aimed at obtaining income and carried out by such person independently and/or through its separate divisions, as well as through any other person acting for benefit of the first person, in particular under commission treaties, mandates and agency agreements.

Therefore, economic activity is characterized, first of all, by the focus on obtaining income, as well as certain organizational efforts that are made in implementation of the corresponding activity (in particular, organizational, financial, human, etc.).

In case of carrying out economic activities on the territory of Ukraine by the representative office, in particular, but not exclusively, activities aimed at providing services to the third parties (consultations, advertising promotions, etc.), and carrying out other actions that may indicate the "business" or "commercial" nature of activity of the representative office, the representative office acquires characteristics of the permanent establishment and is obliged to pay income tax on income received with a source of origin in Ukraine.

Considering types of activities of the non-resident (...), and taking into account activities of the plaintiff (...), such actions of the plaintiff indicate economic nature of performed functions. Letters signed by the head of Representation, contained in the case file, which state the fact of conducting economic activities and concluding agreements with various state institutions, additionally confirm such qualifications.

Defining peculiarity of the permanent establishment is also presence of a specific place of activity. In order for the place of activity to have character of the permanent representative office, it is not necessary that such place has a certain design in the form of a separate subdivision. In particular, (...) the permanent establishment can be considered not only a branch, but also another place of management, office, factory, workshop, mine, oil or gas well, quarry or any other place of exploration".

Summarizing above mentioned, the Supreme Court considers conclusions of the courts of previous instances to be erroneous, premature and made without examining all evidence in the case.

In addition to above mentioned, the panel of judges of the Cassation administrative court believes that "conclusion of the courts that documentary unscheduled audit on grounds provided for by Sub-paragraph 78.1.1 Paragraph 78.1 Article 78 of the Code of Ukraine, could not be started and the started should have been stopped, is unfounded, since it is Article 78 of the Tax Code of Ukraine that is a basic norm, which, in the presence of appropriate grounds, gives the controlling authority right to conduct audit, in this case, on the grounds provided for in Sub-paragraph "b" of Sub-paragraph 69.2 Paragraph 69 Sub-section 10 Section XX "Transitional provisions" of the Tax Code of Ukraine on taxation by legal entities or other non-residents who carry out economic activity through the permanent representation on the territory of Ukraine, income received by non-residents with a source of origin from Ukraine, and provisions of Sub-paragraph 69.2 Paragraph 69 Sub-section 10 Section XX "Transitional provisions" of the Tax Code of Ukraine, in turn, do not limit the grounds for their conduction, which are specified in Article 78 of the Tax Code of Ukraine".

Position of the controlling authority was also strengthened by materials received from foreign competent authorities, which once again proves that the exchange of tax information with foreign countries is important tool for proving established violations, including in the court proceedings.

As a result, taxpayers paid a pre-calculated amount of about 50 million UAH.

References to the court rulings: https://reyestr.court.gov.ua/Review/120247173 and https://reyestr.court.gov.ua/Review/120490483.