Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portal

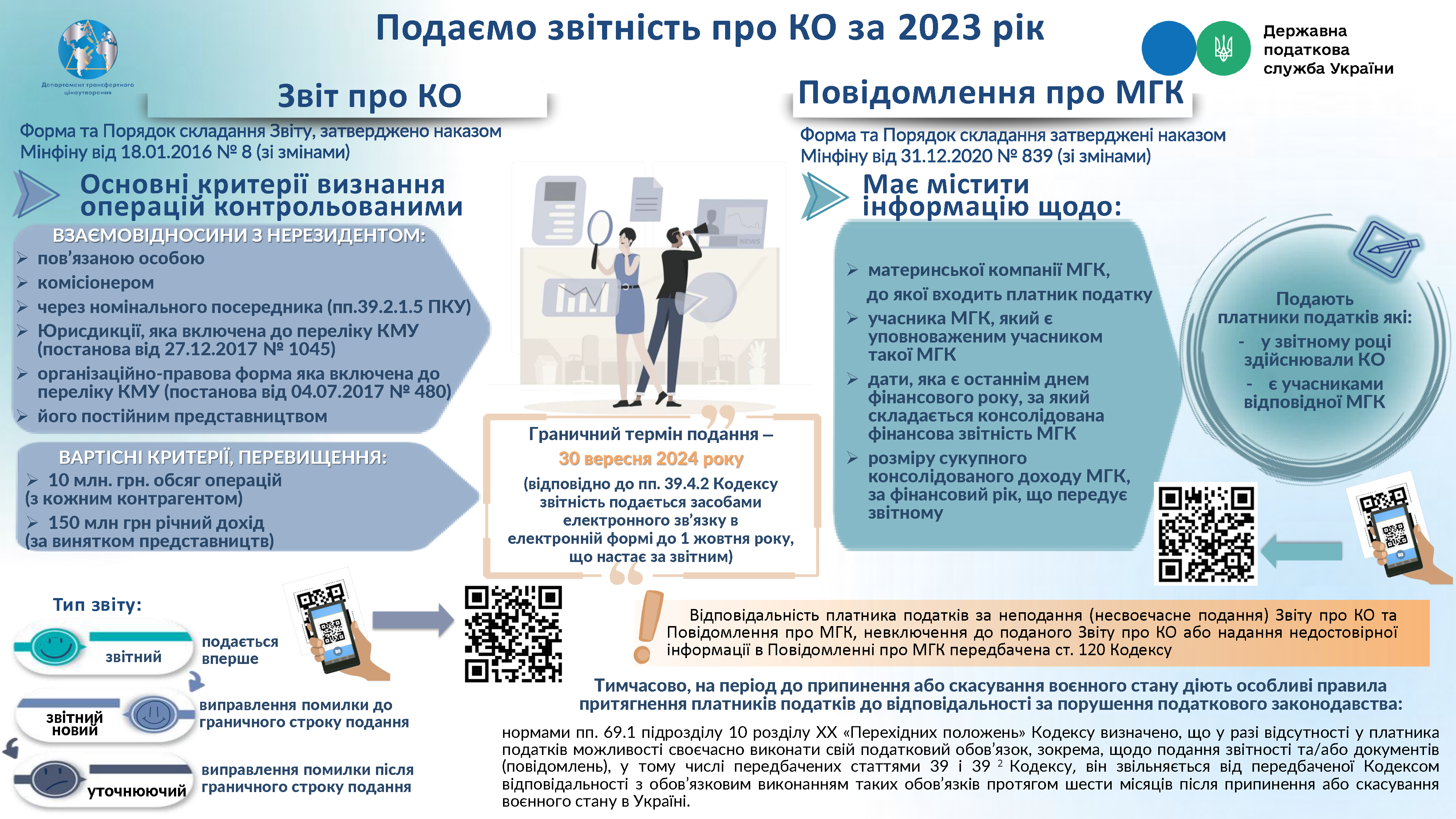

Deadline for submitting reports on controlled operations and notifications on participation in the international group of companies for the reporting year 2023 is approaching

State Tax Service of Ukraine reminds of the approach of deadline for taxpayers to submit reports on controlled operations and notifications on participation in the international group of companies, which are separate forms of reporting for tax control purposes over the transfer pricing.

Sub-paragraph 39.4.2 Paragraph 39.4 Article 39 of the Tax Code of Ukraine (hereinafter – Code) stipulates that the specified reporting is submitted by the electronic communication means in the electronic form in compliance with requirements of the Laws of Ukraine "On electronic documents and electronic document management" and "On electronic trust services" until October 1 of year following the reporting year.

In the current year, the last day for submitting Report on controlled operations and Notification on participation in the international group of companies for the reporting year 2023 is September 30, 2024.

Reminder! Starting from the reporting year2022, taxpayers who not only carried out controlled operations in the reporting period, but also as of December 31 of the reporting year, were members of the corresponding international group of companies submit Notification on participation in the international group of companies.

Along with this, attention should be paid to the fact that in connection with entry into force of Orders of the Ministry of Finance of Ukraine № 673 as of 07.12.2023 "On amendments to certain regulatory acts of the Ministry of Finance of Ukraine", registered in the Ministry of Justice of Ukraine on 21.12.2023 under № 2223/41279, with changes, made by Order of the Ministry of Finance of Ukraine № 725 as of 27.12.2023, registered in the Ministry of Justice of Ukraine on 29.12.2023 under № 2281/41337 (hereinafter – Order № 673) and № 58 as of 09.02.2024 "On amendments to Order of the Ministry of Finance of Ukraine № 839 as of 31.12.2020", registered in the Ministry of Justice of Ukraine on 26.02.2024 under № 282/41627, with changes and additions, made by Order of the Ministry of Finance of Ukraine № 101 as of 01.03.2024 "On amendments to Order № 58 of the Ministry of Finance of Ukraine as of 09.02.2024", registered in the Ministry of Justice of Ukraine on 03.04.2024 under № 316/41661 (hereinafter – Order № 839), there are made the corresponding changes to Procedure for compiling Report on controlled operations, approved by Order of the Ministry of Finance of Ukraine № 8 as of 18.01.2016, registered in the Ministry of Justice of Ukraine on 02.04.2016 under № 187/28317 (hereinafter – Order № 8) and to Procedure for compiling Notification on participation in the international group of companies, approved by Order of the Ministry of Finance of Ukraine № 764 as of 14.12.2020, registered in the Ministry of Justice of Ukraine on 04.02.2021 under № 155/35777.

In connection with the specified changes, specialists of the State Tax Service developed updated forms of Report on controlled operations and Notification on participation in the international group of companies. Relevant information messages are posted on web portal of the State Tax Service at the following links:

https://tax.gov.ua/media-tsentr/novini/797692.html (regarding submission of Notification on participation in the international group of companies starting from 07.01.2024);

https://tax.gov.ua/media-tsentr/novini/808294.html (regarding submission of Report on controlled operations starting from 01.08.2024).

Please note that it is possible to download new electronic forms of Report on controlled operations (form codes J0104707, J0147107, J0147207) and Notification on participation in the international group of companies (form code J1800103) on web portal of the State Tax Service in section Home/Electronic reporting/To taxpayers about electronic reporting/Informative and analytical provision/Register of electronic forms of tax documents.

State Tax Service also advises taxpayers, before submitting reports on transfer pricing, in order to comply with procedures for filling them out, to review presentation materials on the algorithms for filling out Report on controlled operations and Notification on participation in the international group of companies, which can be found at links provided in the attached infographic (in the form of QR codes).

Specialists of the State Tax Service conducted analysis of Reports on controlled operations submitted as of today (according to the new form) and requests received from taxpayers, according to results of which it was established that the biggest number of problematic issues that arise in the process of filling out Reports on controlled operations mainly concern:

determination of a unique number of registration countries of the non-resident counterparty;

use by the taxpayers of directories provided for by Order № 8;

reflection of requisites of contracts/agreements and changes to them in columns 7, 8 of annex to Report on controlled operations;

official exchange rate of UAH to foreign currency in column 19.1 of annex to Report on controlled operations.

Taking into account above specified, specialists of the State Tax Service draw the taxpayers’ attention to the fact that:

value of line "Total" of column 4 "Numeric code of the registration country" of Report on controlled operations is equal to the total number of registration countries of the non-residents – parties of controlled operations (number of unique values), i.e. digital code of one country is included in the final line only once (for example: in the current year, the taxpayer carried out operations with two related non-resident counterparties registered in the Republic of Cyprus, therefore, in line "Total" of column 4 "Digital code of the registration country" of Report on controlled operations, it is necessary to indicate - "1");

if the counterparty in controlled operations is the non-resident and type code of operation object specified in line n of column 3 is equal to "204" or "205" or "206" or "207", then in line n of column 6 "service code according to the Classification of foreign of economic services" of annex "Information regarding person carrying out controlled operations" to Report on the controlled operations, the service code must be indicated, which must correspond to the Classification of foreign economic services, approved by Order of the State Statistics Service of Ukraine № 69 as of 2702.2013 (with changes);

if the counterparty in controlled operations is a resident of Ukraine and subject type code of operation specified in line n of column 3 is equal to "204" or "205" or "206" or "207", then in line n of column 6 "service code according to Classification of foreign economic services" of annex "Information regarding person carrying out controlled operations" to Report on controlled operations, the service code must be indicated, which must correspond to the State Classifier of Products and Services DK 016:2010;

columns 7 and 8 of annex "Information regarding person carrying out controlled operations" to Report on controlled operations indicate requisites of the last document by date (contract (agreement), additions (amendments) to the contract (agreement)), which confirm agreement of parties on the essential terms of controlled operations (quality characteristics, prices of goods (works, services), volumes, conditions of supply, payment and responsibility of parties, etc.);

column 19.1 "Currency exchange rate on the date of reflecting controlled operations in accounting" of annex "Information Information person carrying out controlled operations" to Report on controlled operations is filled in according to the following algorithm:

if the first event is the product delivery, the supplier reflects income in the amount of cost of sold products at the official exchange rate of UAH of the National Bank of Ukraine to foreign currency on the date of determining income, then column 19.1 reflects official exchange rate of UAH to the foreign currency on the date of the product delivery in the accounting;

if preliminary payment for products (works, services) is made in several parts, then in column 19.1 it is recommended to indicate average (calculated) indicator of the currency exchange rate for the corresponding controlled operation;

if shipment of products (works, services) takes place on terms of partial subscription, then in column 19.1 it is recommended to indicate average (estimated) rate of the exchange rate for relevant controlled operation.

For example: advance payment of 100 USA dollars was received at the exchange rate of 40 UAH for 1 USA dollar. Completed works (signed act of acceptance – transfer of works) in the amount of 300 USA dollars at the exchange rate on the date of shipment is 41 UAH for 1 USA dollar. Accounting income is 12 200 UAH (4000 (100x40) + 8200 (200x41)). Average (estimated) rate of the exchange rate is 40.67 UAH for 1 USA dollar (12 200/300);

in case of grouping controlled operations in Report on controlled operations according to Paragraph 19 of Order № 8 of column 19.1 "Exchange rate on the date of reflecting controlled operations in accounting" may not be filled in, provided that column 24 is not equal to the number "1" (not filled in), and column 19 contains code equal to the code "980".

It should also be emphasized that Article 120 of the Code stipulates the taxpayers’ responsibility for non-submission (late submission) of Report on controlled operations and Notification on participation in the international group of companies, failure to include it in the submitted Report on controlled operations or providing inaccurate information in Notification on participation in the international group of companies.

As an example, fine for failure to submit Report on controlled operations in the reporting year 2023 is 805 200 UAH (300 x 2684 UAH), and for failure to submit Notification on participation in the international group of companies – 134 200 UAH (50 x 2684 UAH).

It is worth noting that temporarily, for a period until termination or abolition of the martial law, there are special rules for holding taxpayers accountable for violating tax legislation.

Norms of Sub-paragraph 69.1 Paragraph 69 Sub-section 10 Section XX of the "Transitional Provisions" of the Code determine that if the taxpayer does not have opportunity to timely fulfill tax obligation, in particular, with regard to submission of reports and/or documents (notifications), including those provided for by Articles 39 and 392 of the Code, such taxpayer is released from the responsibility provided for by the Code with obligatory fulfillment of such obligations within six months after termination or abolition of the martial law in Ukraine.

Procedure for confirming the taxpayer's possibility or impossibility of fulfilling obligations specified in Sub-paragraph 69.1 Paragraph 69 Sub-section 10 Section XX "Transitional provisions" of the Code and list of documents for confirmation was approved by Order of the Ministry of Finance of Ukraine № 225 as of 29.07.2022, registered in the Ministry of Justice of Ukraine on 25.08.2022 under № 967/38303.

Please note that if the taxpayer applies conditions that do not comply with the "arm's length" principle and/or does not correspond to a reasonable economic reason (business purpose), the taxpayer has a right to independently adjust price of controlled operation and amounts of tax liabilities provided that this does not lead to a reduction in the amount of corporate income tax payable to the budget (Sub-paragraph 39.5.4.1 of Sub-paragraph 39.5.4 Paragraph 39.5 Article 39 of the Code).

Along with this Sub-paragraph 69.38 Paragraph 69 Sub-section 10 Section XX "Transitional provisions" of the Code determines that temporarily for a period from August 1, 2023 until termination or abolition of the martial law, in case of independent correction by the taxpayer in compliance with procedure, requirements and restrictions specified according to Article 50 of the Code, errors that led to understatement of tax liability, such payer is exempted from accrual and payment of fines and penalty provided for in Paragraph 50.1 Article 50 of the Code.

Therefore, in order to determine the need for self-adjustment, the State Tax Service recommends that taxpayers review operations carried out both during 2023 and previous reporting periods regarding their compliance with the "arm's length" principle and take advantage of the opportunity to submit clarifying calculations without application of fines and penalties.