Ministry of Finance of Ukraine issued Order № 39 as of 24.01.2025, which entered into force on 06.02.2025. This Order introduces changes to the Tax calculation form and rules for its completion and submission. Particularly, changes concern reporting on the income of individuals, taxes withheld from them, as well as single contribution. The updated procedure for completing and submitting the Calculation was approved back in 2015 by Order № 4, which has now been adjusted.

Calculation according to the updated form (according to Order № 39) must be submitted for the first time for January 2025.

Report for the IV quarter of 2024 was submitted using the old form approved by Order № 4 (revised on 02.03.2023 under № 113) until 10.02.2025.

If the taxpayer independently finds errors in the submitted Calculation, such taxpayer is obliged to submit the clarifying calculation using form valid at the submission time.

Correction of the submitted Calculation is possible:

- if error was discovered by the payer;

- if the controlling authority informed about error.

For the purposes of correcting errors identified by the payer for 2021 - 2024, the following periods shall be considered appropriate:

I quarter:

1 month - January (1);

2 month - February (2);

3 month - March (3);

II quarter:

1 month - April (4);

2 month - May (5);

3 month - June (6);

III quarter:

1 month - July (7);

2 month - August (8);

3 month - September (9);

IV quarter:

1 month - October (10);

2 month - November (11);

3 month - December (12).

For correcting errors identified by the payer for periods prior to 2021, the following periods are considered relevant:

for tax agents:

I quarter: March (3);

II quarter: June (6);

III quarter: September (9);

IV quarter: December (12).

In this case, adjustment is carried out in manner specified in Paragraph 10 of this Section with the "Clarifying" type;

for single contribution payers – relevant month for which adjustment is made.

Calculation is considered submitted and accepted if it is checked and entered into relevant registers. It remains valid until the next calculation is submitted for the same reporting period.

Adjustments to indicators and requisites in the Calculation can be made both within the same reporting period and for previous periods.

Calculation submitted for correction of errors should contain only those additions that are directly corrected.

Procedure for filling out the "New reporting" and "Clarifying" Calculations is the same. They are formed on the basis of previous Calculations and contain only changed requisites or amounts of the personal income tax and military levy.

Also, data from reports from controlling authorities on detected errors are used for correction.

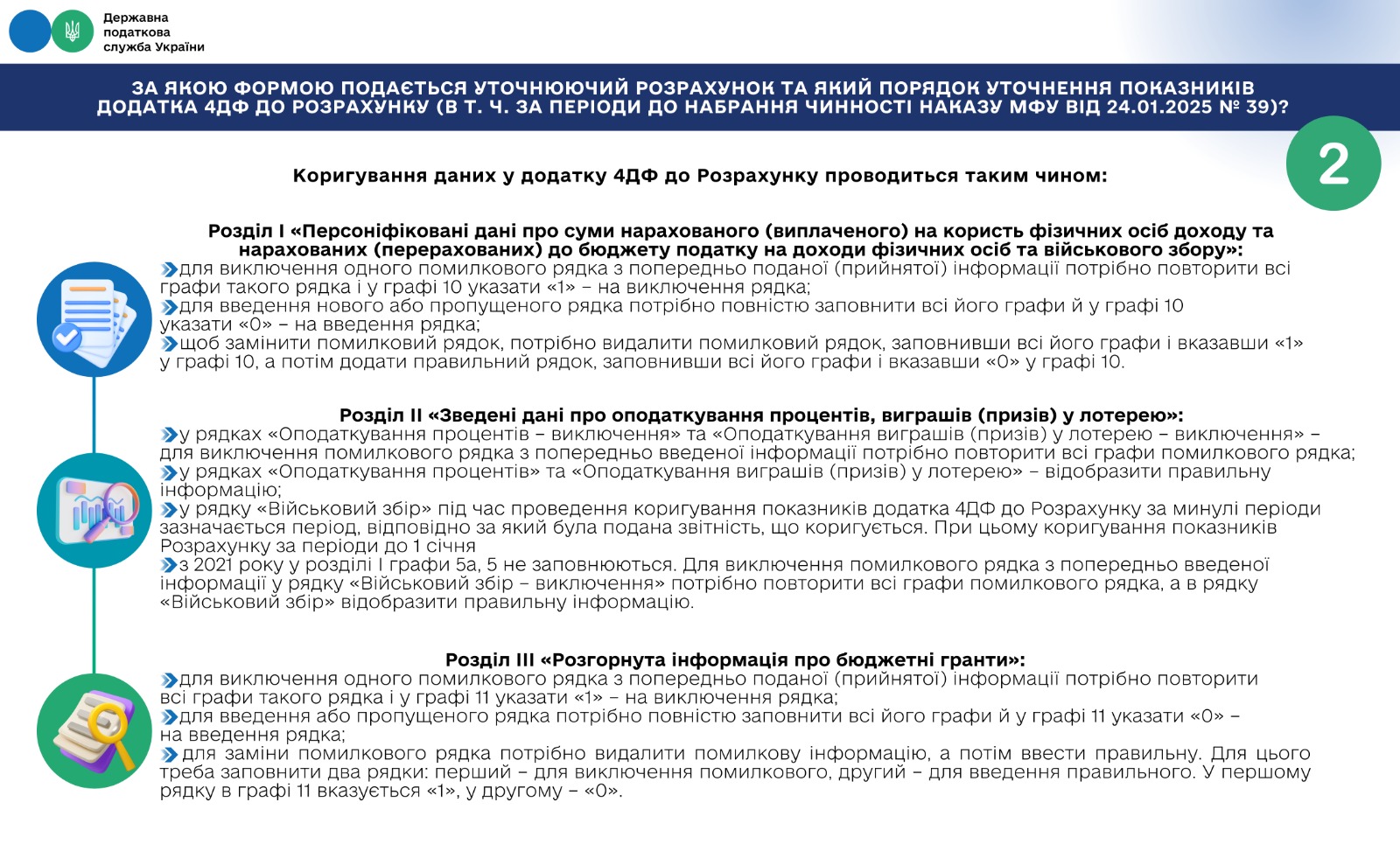

Correction of data in Annex 4DF to the Calculation is carried out as follows:

Section I "Personalized data on the amounts of income accrued (paid) to individuals and the personal income tax and military levy accrued (transferred) to the budget":

- to exclude one erroneous line from the previously submitted (accepted) information, the one must repeat all the columns of such line and in column 10 indicate "1" – to exclude the line; to enter new or omitted line, the one must completely fill in all its columns and in column 10 indicate "0" – to enter the line;

- to replace incorrect row, the one needs to delete incorrect row by filling in all its columns and entering "1" in column 10, and then add the correct row by filling in all its columns and entering a "0" in column 10.

Section II "Summary data on taxation of interest, lottery winnings (prizes)":

- in the lines "Taxation of interest – exclusion" and "Taxation of lottery winnings (prizes) – exclusion" – to exclude erroneous line from the previously entered information, the one must repeat all columns of the erroneous line;

- in the lines "Taxation of interest" and "Taxation of lottery winnings (prizes)" – reflect correct information;

- in the line "Military levy" adjusting indicators of Annex 4DF to the Calculation for past periods, period for which the adjusted reporting was submitted is indicated. In this case, adjustment of the Calculation indicators for periods before 01.01.2021 in Section I, columns 5a, 5 are not filled in. To exclude the erroneous line from the previously entered information in the line "Military levy – exclusion", the one needs to repeat all the columns of the erroneous line, and reflect correct information in the line "Military levy".

Section ІІІ "Detailed information about the budget grants":

- to exclude one erroneous line from the previously submitted (accepted) information, the one needs to repeat all the columns of such line and in column 11 indicate "1" – to exclude the line;

- to insert or skip the line, the one must completely fill in all its columns and indicate "0" in column 11 – to insert the line;

- to replace the incorrect line, the one needs to delete incorrect information and then enter the correct one.

To do this, the one needs to fill in two lines: the first one is to exclude incorrect one, the second one is to enter the correct one. In the first line, in column 11, enter “1”, in the second one, enter “0”.

Correction of requisites of line 032 “Code of administrative-territorial unit” is carried out by submitting separate Calculations: one to exclude erroneous data from Annex 4DF, and the other to enter the correct requisites of line 032. This is done according to with Sub-paragraphs 1–3 Paragraph 11 Section V of the Procedure.

* Contact Center of the State Tax Service of Ukraine provides consultations to the taxpayers, clarifications regarding tax legislation and assistance in resolving tax-related questions. Total number of applications received last year reached 1 062 448.

How to contact? Hotline: 0 800 501 007 (free calls). E-mail: idd@tax.gov.ua. Personal account: Through the taxpayer’s electronic cabinet.

Working hours: Monday–Friday, from 08:00 to 18:00.

The only state web portal

The only state web portal The only state web portal

The only state web portal