As a part of the communication campaign “Taxes protect”, which the Ministry of Finance of Ukraine implements jointly with the State Tax Service, we continue to tell what tax obligations citizens face in different life situations and what benefits conscientious tax payment provides to the society.

The fifth story of the campaign concerns Hanna, who rents out two apartments.

We explain:

- what taxes are paid for renting out an apartment,

- what tax rates and payment terms are there;

- where do the funds go and how are they used by the state and communities.

Read the publication and learn how rental taxes work to strengthen defense, develop local infrastructure and provide important public needs.

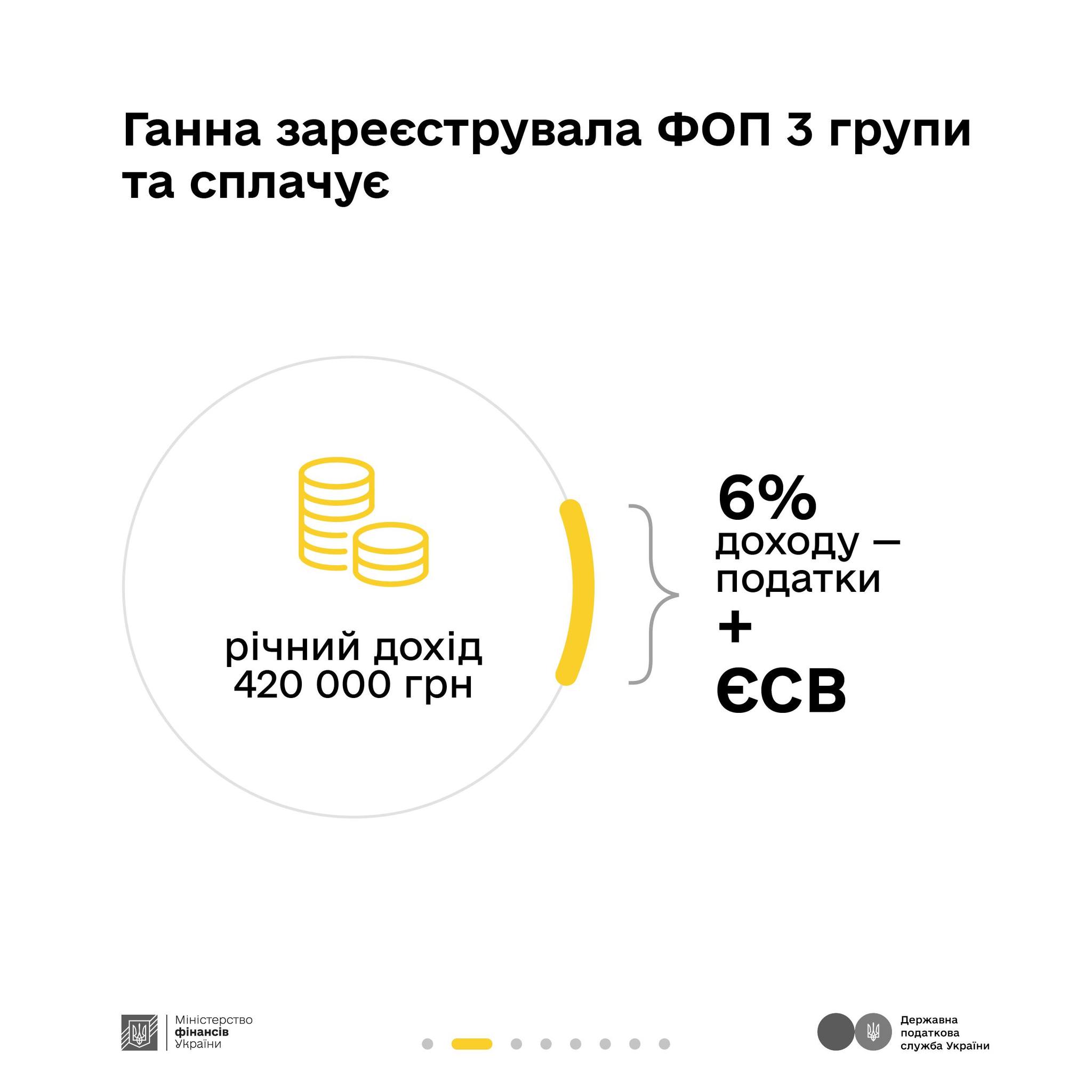

40-year-old Hanna has several one-room apartments, two of which she rents out. She receives 20 thousand UAH per month for an apartment in the capital, and 15 thousand UAH for an apartment in Uzhhorod (a total of 105 thousand UAH/quarter; 420 thousand UAH/year). In order to receive official income, Hanna registered her activities as an individual-entrepreneur of the single tax Group III. This allows her to officially provide rental services to citizens of Ukraine and foreigners.

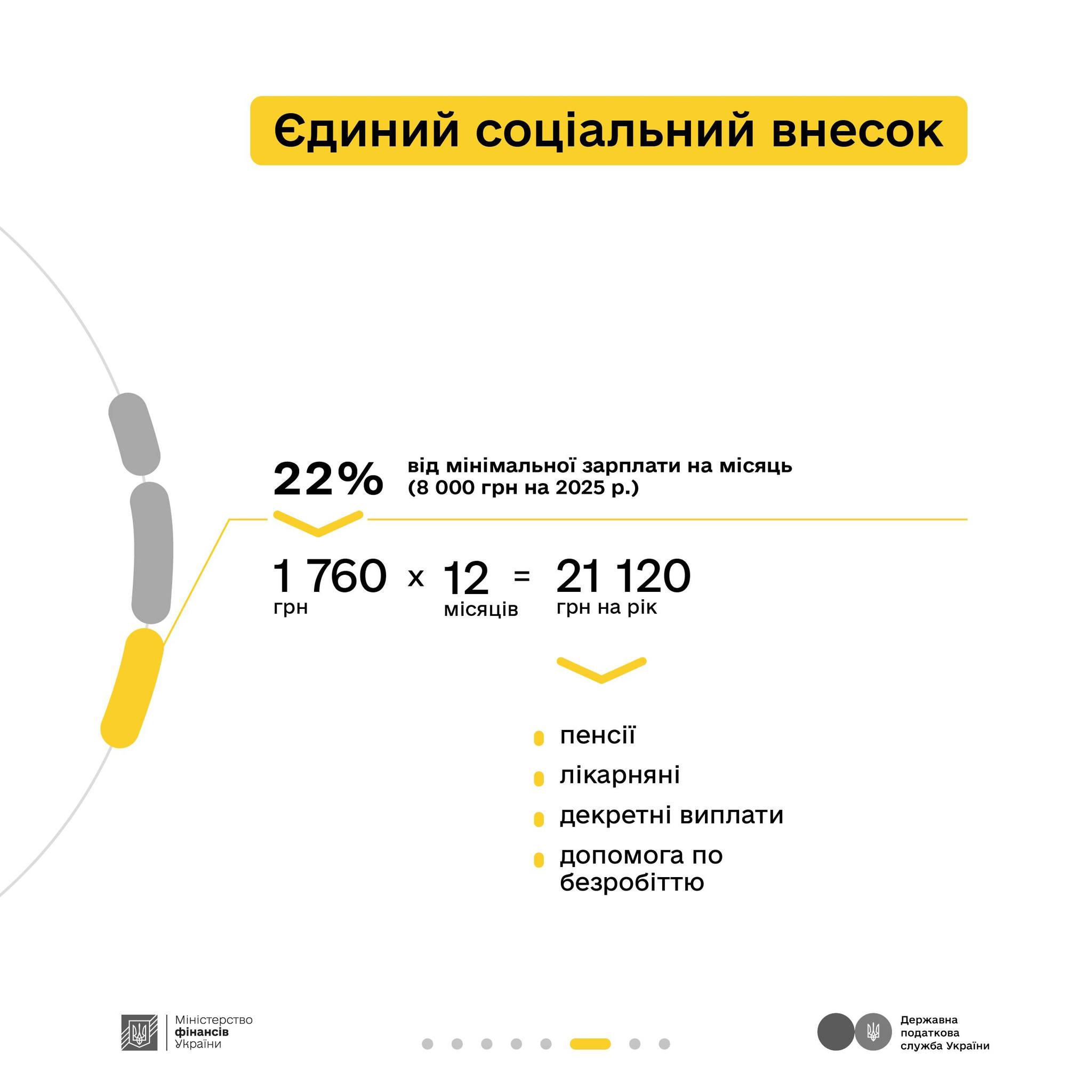

Every quarter, Hanna submits tax declaration through the taxpayer’s Electronic cabinet on the State Tax Service’s web portal and pays taxes and obligatory insurance contribution.

Result for the year looks like this:

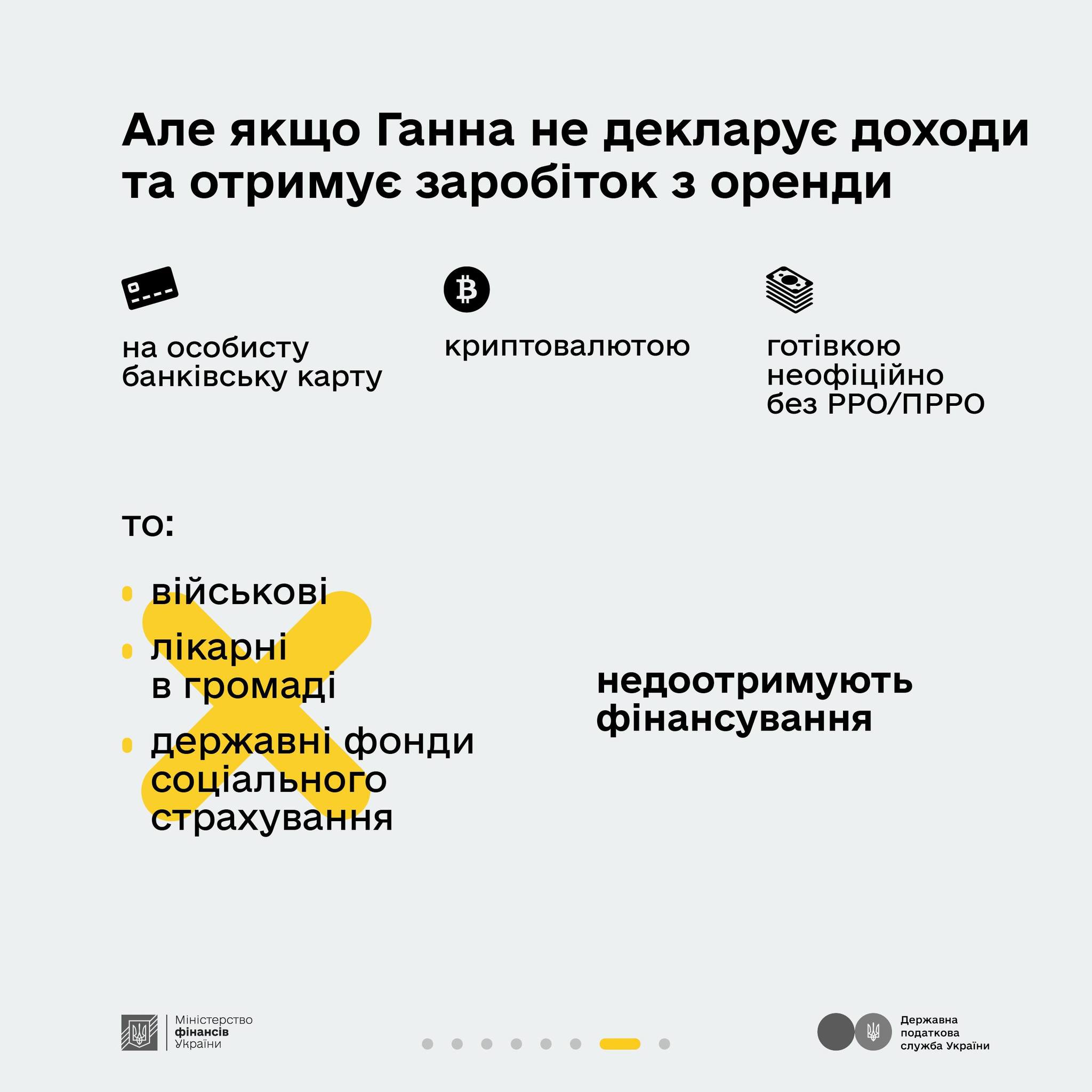

If Hanna receives rent on a personal bank card, in cryptocurrency or in cash without using RRO/PRRO and does not declare these funds, it turns out that she does not pay income taxes. Then:

- militaries does not have high-quality equipment for personal protection on the battlefield,

- patients are freezing in the hospital’s therapeutic department,

- state social insurance funds are not replenished, therefore, Hanna will not receive social insurance and relevant payments if necessary.

Taxes protect. Help with your contribution!

Communication campaign is being implemented by the Ministry of Finance of Ukraine together with the State Tax Service with funding from the Great Britain’s Government through the Department of Foreign Affairs and International Development. Information presented in the campaign materials does not necessarily reflect views of the Great Britain’s Government.

The only state web portal

The only state web portal The only state web portal

The only state web portal