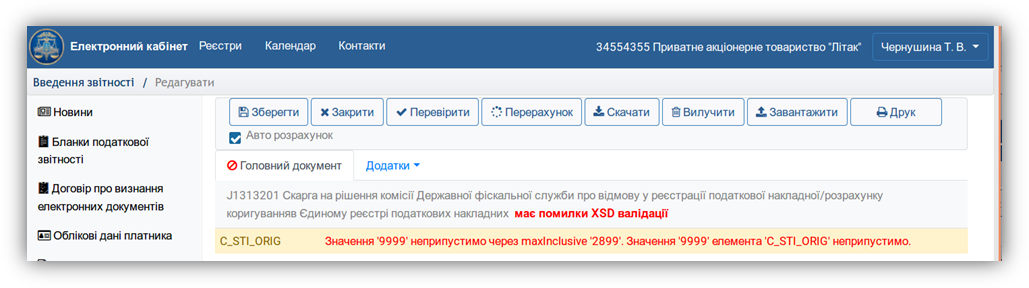

Question №1: XSD Validation Error appears attempting to check or save document J1313201 Complaint against the refusal STS commission decision regarding registration of tax invoice / calculation adjustment in the Unified register of tax invoices:

Validation error

Answer: This error appears due to the established code of the STI body 99 UKRAINE 99 STATE TAX SERVICE during creation of document

| Important! Creating a complaint, leave the STI code suggested by the system. |

Question №2: Question about declaration – how to add rows in the section “INFORMATION ABOUT PERSONAL IMMOVABLE (MOVABLE) PROPERTY”?

Answer: Tables in declarations which can contain any number of rows – have only have one line during creation of the new document. Adding a new row to the table is done by right-clicking when you hover over any field in an existing row of that table. Table row editing toolbar should appear:

use the right mouse button to add / delete rows

Question №3: What to do if during signing the report is not sent instead and appears a column with the following content: “Instructions for preparation and submission of tax documents were violated. Agreement on the recognition of electronic reporting may be terminated”?

Answer: You need to enter section “Reporting”, select reporting group F13, create and submit form F1392001 – “Application for joining the agreement on recognition of electronic documents”, wait for the incoming receipt within one working day and submit reports.

| Important! Taxpayers who until 01.01.2018 did not have agreements on recognition of electronic reporting with the STS bodies and taxpayers who after 01.01.2018 has expired manager key certificate due to which the previously concluded contract was automatically terminated in order to submit reporting electronically or through the e-mail or any other software, must sign and submit application for joining the agreement on recognition of electronic documents (form F1392001 for legal entities and reporting group F13 – Applications for individuals). |

Question №4: After re-generation of the qualified electronic signature it is impossible to enter the private part of the Electronic cabinet with the keys from Accredited key certification center Privat Bank. Key is processed but clicking on the “Login” there is notification that I do not have the right to sign.

Answer: Keys issued by the Accredited key certification center Privat Bank (jks. files) may contain two keys in one file – the official key and the print key. By default, the key is often the first to select a print key that cannot be logged into the private part of the Electronic Cabinet. To solve this situation entering the private part in the login window please Select key with jks, try selecting the second key from the drop-down list.

Question №5: Cannot sign my counterparty adjustment in the private part of the Electronic Cabinet. I have to sign and send it for registration. Signing function is not active.

Answer: In the menu “Received tax invoices / calculation adjustments” there are available to view and sign all the counterparty’s negative tax invoice adjustments provided by Your counterparties, regardless of the software they were created and sent to the STS.

Question №6: What symbol in the F3050211 form should be used to fill in the non-reporting fields (rows with months before the state registration of the individual-entrepreneur): “dash”, omission or otherwise?

Answer: You do not need to fill in the fields in the non-reporting rows of declaration, the system will issue a warning when checking, after clicking the Edit button this document can be signed and sent to the STS (more details are in the section “Reporting” of the E-cabinet).