Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portalStarting from 08.09.2021, the State Tax Service has introduced revised software for acceptance and processing of excise invoices, taking into account the need to comply with a set of requirements during their registration in the Unified register of tax invoices and correct reflection of fuel limit in the Electronic administration system of the sale of fuel and ethyl alcohol, namely:

availability of right to carry out activities with fuel on the basis of relevant license for individuals (sellers and buyers);

availability of sufficient volume of registered tanks – for receiving fuel at excise warehouse to which fuel is shipped.

I. Presence of right to carry out activity with fuel on the basis of relevant license for individuals (sellers and buyers).

Sale of fuel without a license is prohibited.

Sale of excisable goods (products) – any operations in the customs territory of Ukraine, involving shipment of excisable goods (products) under contracts of sale, mines, supplies and other economic, civil law agreements with the transfer of ownership or without such, for a fee (compensation) or without such, regardless of the terms of its provision, as well as free shipment of goods, including toll raw materials, sale of excisable goods by retail trade entities (Sub-paragraph 14.1.212 Paragraph 14.1 Article 14 of the Code).

Law of Ukraine as of 19.12.1995 № 481 “On state regulation of production and turnover of ethyl alcohol, cognac and fruit alcohol, alcoholic beverages, tobacco products and fuel” (hereinafter – Law 481) defines types of activities subject to licensing, in particular, but not exclusively:

fuel production – activity of refining oil, gas condensate, natural gas and their mixture, which results in fuel or other refined products;

fuel storage – fuel storage activity (own or received from other individuals) with or without change of its physical and chemical characteristics;

fuel wholesale – activity on the purchase and further sale of fuel with change or without change of its physical and chemical characteristics to business entities (including foreign business entities operating through their registered permanent establishments) of retail and / or wholesale and / or to other individuals;

place of fuel wholesale – is a place (territory) where facilities and / or equipment and / or tanks used for wholesale and / or storage of fuel on the ownership right or use are located;

retail sale of fuel – activity on the purchase or receipt and further sale or release of fuel with change or without change of its physical and chemical characteristics from gas station / gas filling station / gas filling point and other places of the retail sale through fuel distribution stations.

License for the fuel storage is not obtained at used fuel storage place (Article 15 of the Law 481):

enterprises, institutions and organizations that are fully maintained at the expense of state or local budget;

enterprises, institutions and organizations of the state reserve system;

business entities (including foreign business entities operating through their registered permanent establishments) for the fuel storage consumed for their own production and technological needs exclusively at oil and gas production sites, drilling platforms and which is not sold through the retail places.

Specified norm is provided for fuel storage without its further realization.

ІІ. Availability of sufficient volume of registered tanks – for receiving fuel at excise warehouse to which fuel is shipped (registration of the 2nd copy of excise invoice).

Presence of sufficient volume of registered tanks in excise warehouse requires consideration of indicators:

volume of tanks registered in the Unified state register of flow and level meters of fuel level in the tank (hereinafter – Register) at excise warehouse to which fuel is shipped,

fuel residues that are in such warehouse according to Electronic administration system of the sale of fuel and ethyl alcohol.

Presence of sufficient volume of registered tanks, which can accommodate excise warehouse, is reflected by the business entity in certificate of the excise fuel manager, excise fuel depots, fuel tanks, flow and level meters, approved by Order of the Ministry of Finance as of 27.11.2018 44 9 “On approval of data format, structure and forms of electronic documents for filling the Unified state register of flow and level meters – fuel level meters in the tank”.

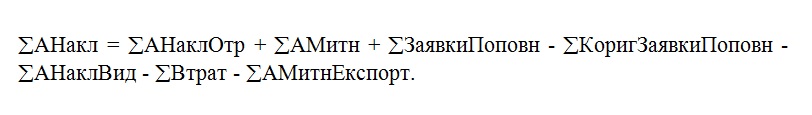

Fuel balance in Electronic administration system of the sale of fuel and ethyl alcohol is determined according to Paragraph 232.3 Article 232 for each product subcategory code according to Ukrainian classification of the FEA products (∑ANakl) calculated by the following formula:

Excise invoice is drawn up by taxpayer on the day of import of fuel or ethyl alcohol to the customs territory of Ukraine or on the day of sale of fuel or ethyl alcohol at each full or partial operation on sale of fuel or ethyl alcohol (Paragraph 231.3 Article 231 of the Code).

Excise invoice is drawn up by taxpayer on the day of import of fuel or ethyl alcohol to the customs territory of Ukraine or on the day of sale of fuel or ethyl alcohol at each full or partial operation on sale of fuel or ethyl alcohol (Paragraph 231.3 Article 231 of the Code).

In addition, the excise invoice may be drawn up, in particular, but not exclusively:

a) on a daily basis of operations (if excise invoices were not drawn up for these operations) for each commodity subcategory code according to Ukrainian classification of the FEA products in the case of fuel sale for cash to the final consumer (who is not a business entity), calculations for which are made through cashier / registrars of settlement operations or through banking institution or payment device (directly to the current account of the person – fuel seller).

b) consolidated excise invoices for each product subcategory code according to Ukrainian classification of the FEA products not later than the last day of such month for the entire volume of sold fuel during such month in case of continuous supply of fuel, the person – fuel seller may draw up for each recipient of fuel.

Consolidated excise invoice may also be drawn up for each commodity subcategory code according to Ukrainian classification of the FEA products and separately for each excise warehouse / mobile excise warehouse by the person – fuel seller, not later than the last day of reporting month for the total volume of fuel released in the fuel tank of vehicle or in the consumer’s container through fuel dispensing or oil dispensing columns from excise warehouse, which is a place of retail sale for which license is obtained, if excise invoices were not drawn up for these operations, used for own consumption or industrial processing during the reporting month, or lost within and / or above he established norms of losses, spoiled, destroyed, including as a result of accident, fire, flood, other force majeure circumstances or for other reasons related to the natural result, as well as due to evaporation in the process of production, processing, storage or transportation during the reporting month.

In the case of fuel sale through fuel dispensing or oil dispensing column in the fuel tank of vehicle or in the consumer’s container for cash to final consumer, for which payments are made through registrars of settlement operations, through banking institution or payment device, the payer has right to independently choose method of drawing up excise invoices for such operations (consolidated or on a daily basis).

Registration terms of excise invoices in the Unified register of tax invoices defined in Paragraph 231.6 Article 231 of the Code, in particular but not exclusively, the first copy of consolidated excise invoice and excise invoice drawn up for operations specified in Sub-paragraph 1 of Sub-paragraph 229.8.10 Paragraph 229.8 Article 229 of this Code – not later than 15 calendar days from the date of their compilation.

As follows, the consolidated excise invoice can be registered on any day from the date of its preparation, but not later than 15 days; the taxpayer independently chooses method of drawing up excise invoices (consolidated or on a daily basis) with unlimited number of consolidated excise invoices per month, which can be compiled (for a week, for a decade, etc.).

It should be noted that according to Paragraph 233.1 Article 233 of the Tax Code of Ukraine, there is automatic comparison of indicators, in particular volumes of turnover and fuel residues in order to verify the completeness of declaration and payment of excise tax by taxpayers from the volume of imported fuel or ethyl alcohol to the customs territory of Ukraine, produced and sold in the customs territory of Ukraine.

Comparison compares indicators from the Electronic administration system of fuel and ethyl alcohol with indicators of Register on the volume of turnover and fuel residues in terms of codes according to Ukrainian classification of the FEA products (except for liquefied gas (propane or a mixture of propane and butane), other gases, butane, isobutane at which the same rates of excise tax are set, for which volumes of turnover and fuel residues are summed up and compared with the total), excise warehouses and managers of excise warehouses (Paragraph 233.3 Article 233 of the Code).

In case of discrepancy of the business entity’ data, it is necessary to draw up and register 1 copy of excise invoices for sold volumes of fuel and / or 2 copies – for receipt.

Therefore, business entities need to control compliance of registered volumes of tanks and residues in such tanks with fuel residues with data from Electronic administration system of fuel and ethyl alcohol.