Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portalParagraph 4 of Procedure for acceptance by the payment service providers of payment instructions for payment of salaries, approved by Order of the Ministry of Finance of Ukraine № 291 as of 16.09.2022 with changes and amendments (hereinafter – Procedure) specifies, in particular, that settlement certificate for payment of salaries is compiled by payer of single contribution to obligatory state social insurance (hereinafter – single contribution) in form according to Annex 1 to Procedure.

In order to prevent mistakes that may occur during preparation of settlement certificate, the State tax Service ensures clarification regarding its preparation, as well as examples of its filling in.

Field "Head of the controlling body (authorized person)" and ""___" ____________ 20__year" is filled in by the controlling body.

Payer of single contribution indicates date of its preparation in field "SETTLEMENT CERTIFICATE for _________ 20__year".

Field "Name / surname, patronymic (if available) of payer of single contribution" must indicate name (for legal entities) or surname, first name and patronymic (if available) (for individuals) of payer of single contribution. Compiling settlement certificate in the electronic form, the specified field is automatically filled in according to the payer’s registration data.

Field "Code according to the Unified State Register of Enterprises and Organizations of Ukraine, registration number of the taxpayer’s registration card or series (if available) and passport number of individual who, due to religious beliefs refused to accept registration number of the taxpayer’s registration card and officially notified relevant controlling body about it and has mark in a passport" must indicate code according to the Unified State Register of Enterprises and Organizations of Ukraine (for legal entities) or Registration number of the taxpayer’s registration card or series (if available) and passport number (for individuals), according to which payer of single contribution is registered in the controlling body. Compiling settlement certificate in the electronic form, the specified field is automatically filled in according to the payer’s registration data.

Payer of single contribution indicates own account in field "Settlement №" for performing payment operations in the IBAN format. Compiling settlement certificate in the electronic form, payer has opportunity to choose one of accounts registered for him / her according to such payer’s registration data.

Field "Title of the payment service provider" must indicate title (name) of the payment service provider that opened the corresponding account. Compiling settlement certificate in the electronic form, the specified requisites are automatically filled in according to the payer’s registration data and account chosen by him / her.

Line 1 "Salary specified in the payment instruction or cash check" indicates amount of salaries specified in payment instruction, that is, salary is reduced by the amount of tax deductions and other mandatory payments, which are payable through the service provider of payment services.

Line 1.1 "Salaries that exceed the maximum amount from which single contribution is accrued" indicates amount that exceeds the maximum amount of actual expenses for salaries of employees, financial support of military personnel, members of the rank-and-file and senior staff, taxable income (profit), total taxable income, which are equal to fifteen sizes of the minimum salary, established by the law, which is subject to single contribution (it is 100500.00 UAH in 2023), which is reduced by the amount of tax deductions and other mandatory payments. For example: reduced by 19.5%, i.e. by the amount of personal income tax and military levy.

Line 1.2 "Salaries of working disabled persons" indicates amount of salaries of persons with disabilities reduced by the amount of tax deductions and other mandatory payments.

Line 2 "22% x (line 1 - line 1.1 - line 1.2)" must contain calculation of 22% of the difference of lines 1, 1.1 and 1.2. Compiling settlement certificate in the electronic form, calculation of the indicated line is carried out automatically on the basis of data specified in lines 1, 1.1 and 1.2 with the possibility of making changes by payer of single contribution in case of disagreement with the automatic calculation.

Calculation of 8.41% of the amount specified in line 1.2 is carried out in line 3 "8.41% x line 1.2". Compiling settlement certificate in the electronic form, calculation of the indicated line is carried out automatically on the basis of data specified in line 1.2 with the possibility of making changes by payer of single contribution in case of disagreement with the automatic calculation.

Line 4 "Overpayment of single contribution" must reflect amount of the overpaid single contribution, i.e. minus advance payments made before the day of receipt of funds in institutions of the payment service provider for the current reporting period and in the current reporting period. For example: the overpayment amount does not include single contribution paid by 20.03.2023 from salary for February and March 2023.

Line 5 "Amount of single contribution, which is indicated in payment instructions and is subject to the transfer (line 2 + line 3 - line 4)" must contain calculation of single contribution that is subject to the transfer. Compiling settlement certificate in the electronic form, calculation of the indicated line is carried out automatically on the basis of data specified in lines 2, 3 and 4 with the possibility of making changes by payer of single contribution in case of disagreement with the automatic calculation.

The first field "Information for the payment service provider" must reflect salary specified in payment instruction. The second field must reflect date, number and amount of payment instruction for payment of single contribution, which cannot be less than amount of the indicator in line 5.

Field "Information for the payment service provider" is mandatory for payer of single contribution. Failure to fill in the specified field is a ground for refusal to approve settlement certificate by the controlling body according to Paragraph 4 of Procedure.

We also draw attention of payers of single contribution, who submit settlement certificate for approval through the Electronic cabinet, fact of receiving "positive" receipts № 1 and 2 means that document has been checked for compliance with the current form, electronic document standards and presence of mandatory requisites, and registered in the controlling body for the approval procedure. That is, receipt № 2 is not the final stage of approval, instead, completion result of the specified procedure is sending to payer of single contribution to the Electronic cabinet of the approved settlement certificate in the electronic form or refusal of approval with existing qualified electronic signature and qualified electronic seal.

Examples of filling in settlement certificate

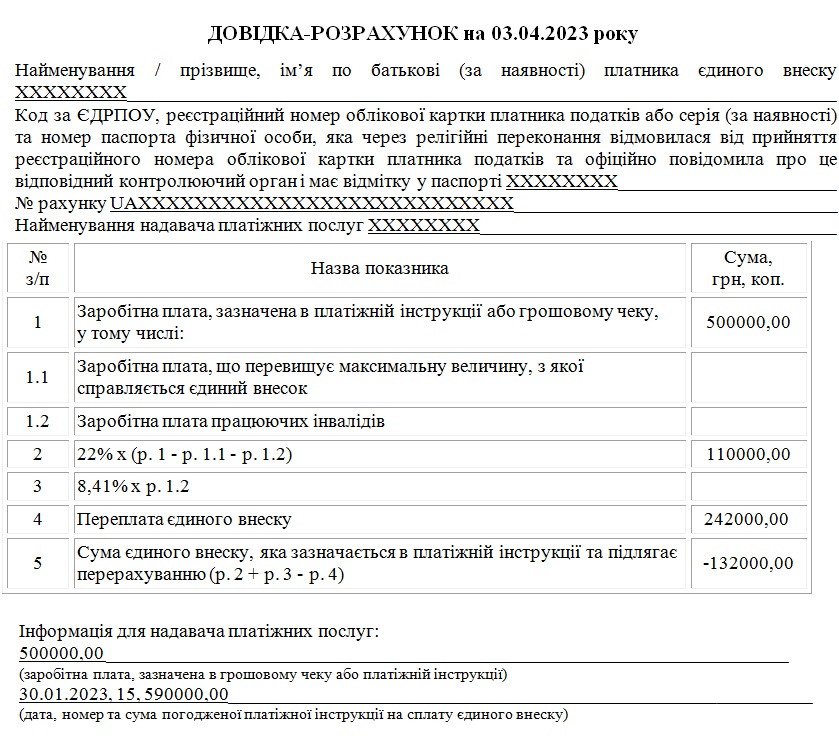

1. On 17.03.2023, the company's employees will get salaries for the first half of March 2023 in the amount of 500 000.00 UAH. Herewith, salaries of individual employees of the company exceed the maximum amount from which single contribution is accrued in the total amount of 50 000.00 UAH (the maximum amount of actual labor costs from which single contribution is accrued is determined for each insured person separately). Company also employs persons with disabilities, whose salaries amounted to 53 000.00 UAH.

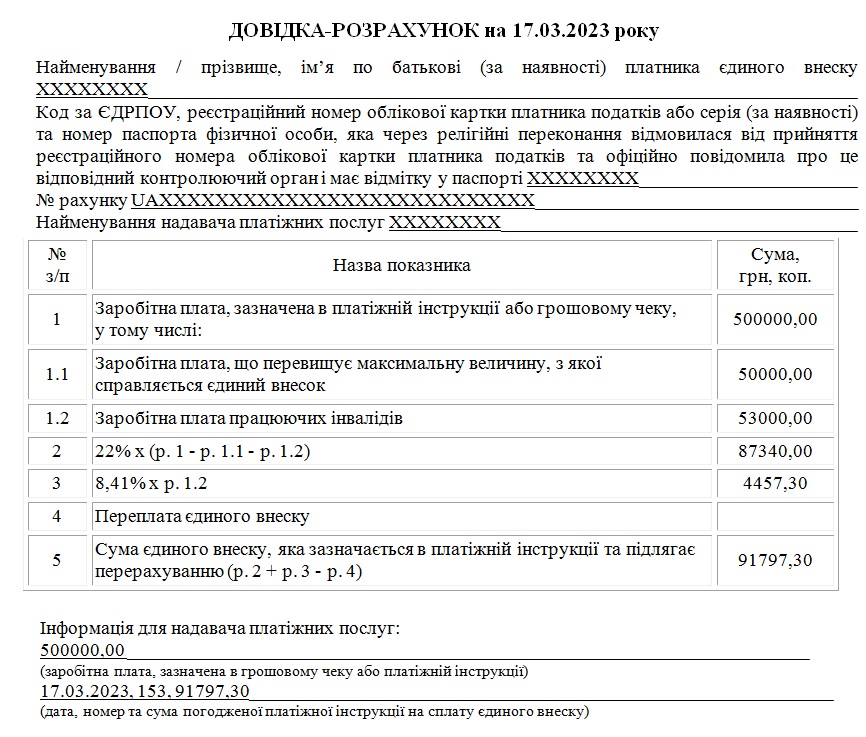

2. For March 2023, employees of the same company got salaries in the total amount of 1 200 000.00 UAH. Withholding was made from salaries in the amount of 234 000.00 UAH.

On 03.04.2023, payer of single contribution receives from the payment service provider funds for payment of salaries for March 2023 in the amount of 466 000.00 UAH (1 200 000.00 UAH – 234 000.00 UAH - 500 000.00 UAH (amount of salaries paid for the first half of March 2023)).

Total amount of salaries that exceed the maximum amount from which single contribution is accrued according to results of March 2023 (before tax deductions and other mandatory payments) amounted to 140 000.00 UAH.

Therefore, calculation of the indicator, which must be reflected in line 1.1 of settlement certificate, is carried out as follows:

140 000.00 UAH –50 000.00 UAH = 90 000.00 UAH – value of line 1.1 of the previous settlement certificate (for the first half of the month) is subtracted from the total amount of salaries that exceed the maximum value from which monthly single contribution is accrued;

90 000.00 UAH * 18% + 90 000.00 UAH * 1.5% = 17 550.00 UAH – in the absence of other mandatory payments, tax deductions (personal income tax and military levy) are calculated from amount of salaries that exceed the maximum amount from which single contribution is accrued, determined in the previous step;

90 000.00 UAH - 17 550.00 UAH = 72 450.00 UAH – amount of salaries that exceed the maximum amount from which single contribution is accrued, reduced by the amount of tax deductions and other mandatory payments, is calculated.

Total amount of salaries of persons with disabilities according to results of March 2023 (before tax deductions and other mandatory payments) amounted to 107 000.00 UAH.

Therefore, calculation of the indicator, which must be reflected in line 1.2 of settlement certificate, is carried out as follows:

107 000.00 UAH – 53 000.00 UAH = 54 000.00 UAH – value of line 1.2 of previous settlement certificate (for the first half of the month) is subtracted from the total monthly salary of persons with disabilities;

54 000.00 UAH * 18% + 54 000.00 UAH * 1.5% = 10 530.00 UAH – in the absence of other mandatory payments, tax deductions (personal income tax and military levy) are calculated from amount of salaries of persons with disabilities, determined in the previous step;

54 000.00 UAH – 10 530.00 UAH = 43 470.00 UAH – amount of salaries of persons with disabilities, reduced by the amount of tax deductions and other mandatory payments, is calculated.

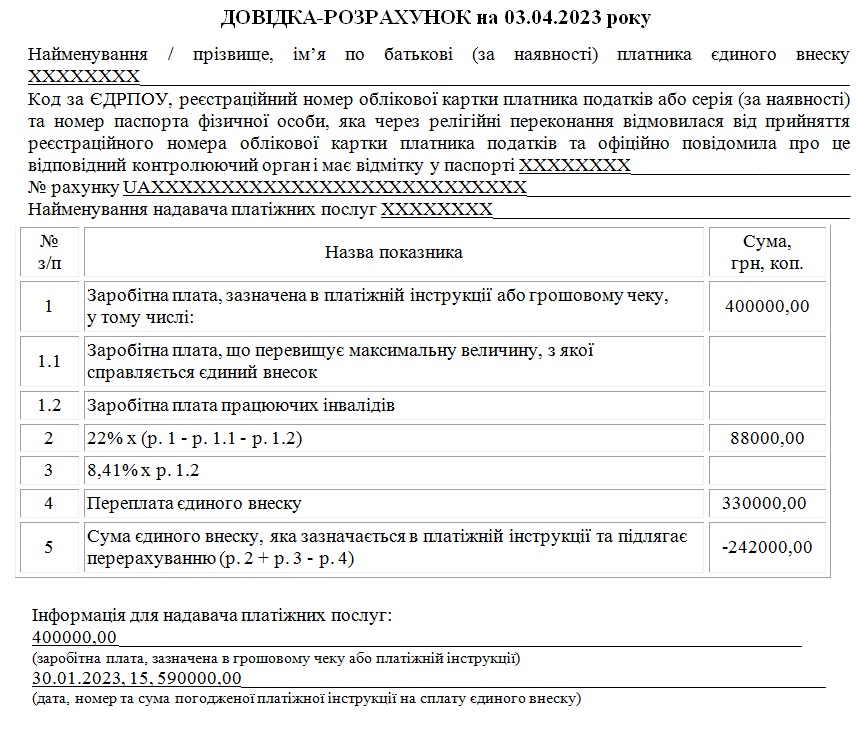

3. On 17.03.2023, the company's employees will get salaries for the first half of March 2023 in the amount of 400 000.00 UAH. At the same time, the company has an overpayment of single contribution in the amount of 330 000.00 UAH.

4. For March 2023, employees of the same company will get accrued salaries in the total amount of 1 118 012.42 UAH. Withholding was made from wages in the amount of 218 012.42 UAH.

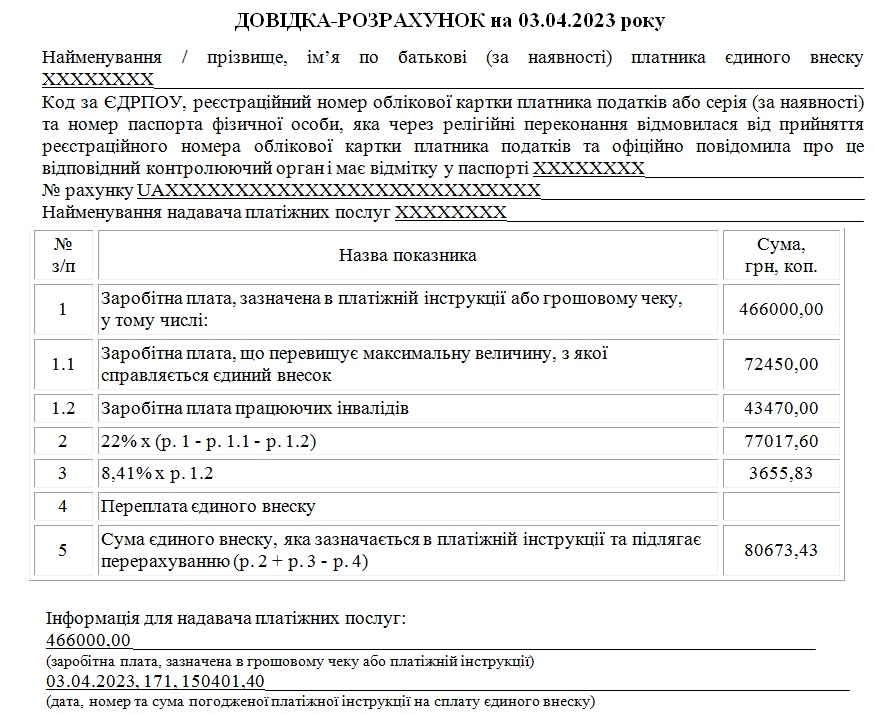

On 03.04.2023, payer of single contribution receives from the payment service provider funds for payment of salaries for March 2023 in the amount of 500 000.00 UAH.

The overpayment balance of single contribution after payment of salaries for the first half of March 2023 is 242 000.00 UAH.