Головна сторінка Державної податкової служби України

The only state web portal

The only state web portalof electronic services

The only state web portal

The only state web portalPeculiarities of calculating rent tax liabilities for the subsoil use for extraction of minerals in case of subjecting volumes of mined minerals for which tax obligations have been fulfilled, to other types of operations of primary processing of mineral raw materials in the next tax (reporting) period

Rent payers for the subsoil use for extraction of minerals (hereinafter – Rent) are business entities that have acquired right to use the subsoil object (plot) on the basis of received special permits for the subsoil use (hereinafter – special permit) within the limits of specific subsoil sections for carrying out economic activities for extraction of minerals, including during geological research (or geological research with subsequent research and industrial development) within the limits of the subsoil objects (sections) indicated in such special permits (Sub-paragraph 252.1.1 Paragraph 252.1 Article 252 of the Tax Code of Ukraine (hereinafter – Code)).

Paragraph 252.3 Article 252 of the Code stipulates that rent’s taxation object for each subsoil area provided for use, which is defined in the corresponding special permit, is volume of commercial products of mining enterprise (hereinafter – Commodity products), which is a result of economic activity for extraction of minerals in the tax (reporting) period, types of which are established by the conditions for mineral raw materials of the subsoil area to which it belongs, including volume of mineral raw materials formed as a result of primary processing, which is carried out by entities other than the rent payer, under the terms of economic contracts for services with raw materials.

Economic activity of the mining enterprise for extraction of minerals for purposes of Section IX of the Code is activity of the mining enterprise, which includes processes of extraction and primary processing of minerals (Sub-paragraph 14.1.37 Paragraph 14.1 Article 14 of the Code), where extraction of minerals is defined as a set of technological extraction operations, in particular from deposits of the bottom of reservoirs, and moving, including temporary storage, to the surface of the subsoil’s part (rocks, ore raw materials, etc.) that contains minerals, and special types of mining work, which includes underground gasification and smelting, chemical and bacterial leaching, dredging and hydraulic development of placer deposits, hydraulic transport of mining rocks of reservoir bottom deposits (Sub-paragraph 14.1.51 Paragraph 14.1 Article 14 of the Code).

Primary processing (enrichment) of mineral raw materials according to Sub-paragrap.1.150 Paragraph 14.1 Article 14 of the Code is a component of the mining enterprise’s economic activity, which includes a set of operations: collecting, crushing or grinding, drying, sorting according to any physical properties of crushed or ground rocks or mineral formations with use of any technological sorting processes that ensure obtaining commercial products by the mining enterprise, types of which are established by the approved conditions for mineral raw materials of the surface’s sub-object (site).

Execution of technological extraction operations and technological operations of primary processing can be performed by the rent payer in more than one tax (reporting) period and, accordingly, tax obligations from the Rent payment can arise (specify) as after execution of technological extraction operations (if mined mineral raw materials meet requirements of standards for Commodity products suitable for use by industries other than mining), and after technological operations for primary processing of mined mineral substance.

In case that volumes of Commodity products taken into account after mining operations (if mined mineral raw materials meet requirements of standards for Commodity products suitable for use by industries other than mining) with payment of relevant tax obligations, in the following tax ( reporting) periods, based on the rent payer’s decision, primary processing operations are carried out, result of which are new types of commodity products, for this Paragraph 252.14 Article 252 of the Code provides for the possibility of specifying (without application of sanctions) tax obligations from the Rent payment, taking into account previously fulfilled tax obligations that arose from previous operations with this type of mineral.

Rent tax obligations for each tax (reporting) period corresponding to a calendar quarter are declared in Annex 1 to the Rent tax declaration, form of which is approved by Order № 719 of the Ministry of Finance of Ukraine as of 17.08.2015, registered in the Ministry of Justice of Ukraine on 03.09.2015 under № 1051/27496 (hereinafter – Declaration, Annex 1).

In case of taking into account in the reporting (tax) period one or more new types of Commodity products based on results of operations on the initial processing of previously declared mined Commodity products, a separate calculation is made for each such type, identified by lines of Section 8 Annex 1 to the Declaration (Annex 1 to the Declaration).

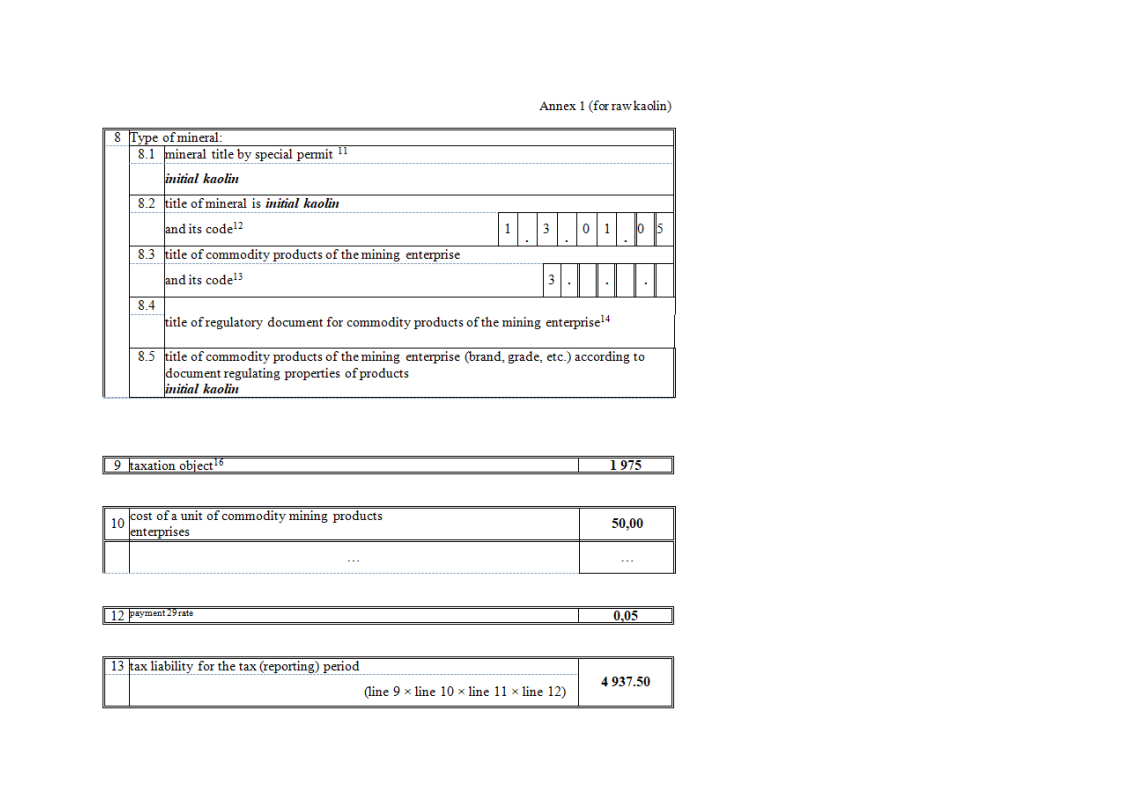

Section 8 "Type of mineral" of Annex 1 to the Declaration reflects information on types of mineral, including Commodity products, in particular:

"title of mineral under a special permit" (line 8.1 of Annex 1 to the Declaration);

"title of mineral and its code" is indicated according to Annex 13 to the Declaration (line 8.2 of Annex 1 to the Declaration);

"title of commodity products of the mining enterprise and its code" is indicated according to Annex 14 to the Declaration (line 8.3 of Annex 1 to the Declaration);

"title of regulatory document for commodity products of the mining enterprise" (line 8.4 of Annex 1 to the Declaration);

"title of commercial products of the mining enterprise (brand, grade, etc.) according to document regulating properties of products" (line 8.5 of Annex 1 to the Declaration).

List of minerals of national and local importance was approved by Resolution № 827 of the Cabinet of Ministers of Ukraine as of 12.12.1994 (hereinafter – List). At the same time, in case of mineral use in several directions according to the List, usage direction of mineral deposit is determined by decision of the State Commission on Mineral Reserves.

At the same time, instructions of the State Commission on Mineral Reserves on the Application of Classification of Mineral Reserves and Resources of the State Subsoil Fund, approved by Resolution of the Cabinet of Ministers of Ukraine № 432 as of 05.05.1997 (hereinafter – Classification), stipulate that to the deposits of certain types of minerals, distribution of mineral reserves according to the cost of their extraction and processing into Commodity products is also envisaged, according to the approved conditions for mineral raw materials as a set of requirements for quality and quantity of minerals, mining-geological and other conditions for the subsoil area’s use (hereinafter - Conditions) with expert selection of that variant of technical and economic calculations, which ensures rational subsoil use, mainly based on the maximization of economic benefit (rental income) received by the subsoil’s owner in order to use estimates of technical, economic and financial indicators of economic activity for purposes of investment planning and taxation (Clause 7 of Paragraph 2 of Regulations on the procedure for conducting state examination and assessment of mineral reserves, approved by Resolution of the Cabinet of Ministers of Ukraine № 865as of 22.12.1994)). Conditions particularly in effectiveness terms of economic activity of the mining enterprise, are based on compliance by these enterprises with such obligatory requirement for implementation of economic activity of the mining enterprise as exceeding profitability of activity of the mining enterprise from production of commodity products, which meets established standards, refinancing rates of the National Bank (Paragraphs 2-3 of Classification).

Example

Let's consider calculation procedure of the rent tax liabilities on the conditional example of subjecting volumes of mined raw kaolin to primary processing (enrichment) operations.

Mining enterprise (hereinafter – Enterprise) mined 2 000 tons of kaolin in the 1st quarter of 2023 and recognized 1975 tons of raw kaolin taken into account as the rent taxation object in the Declaration (25 tons of raw kaolin were lost in the subsoil).

Commodity products of mined raw kaolin in the 1st quarter of 2023 were sold in the amount of 975 tons at a price of 50 UAH/t, with an estimated cost of raw kaolin of 43 UAH/t, the higher of which – 50 UAH/t is used as the Rent tax base in the Declaration for the 1st quarter of 2023. The rest formed stocks of the Enterprise's commodity products.

Enterprise put into operation kaolin enrichment cycle in April 2023, where operations were performed to enrich 1000 tons of raw kaolin reserves in April – May 2023, with the following types and quantities of commodity products:

- enriched kaolin – 825 tons;

- quartz sand – 175 tons.

Manufactured products were sold in full on June 10, 2023 at the actual price (excluding VAT), namely:

- 4000 UAH/ton of enriched kaolin;

- 200 UAH /ton of quartz sand.

Actual sale price of each type of commodity product exceeded their estimated value:

- kaolin – 150 UAH/t;

- quartz sand – 100 UAH/t.

Since as a result of beneficiation operations, Commodity product type has changed, there is a need to clarify tax obligations from the Rent payment for such types of Commodity products, which are sold after enrichment of raw kaolin.

Let's consider procedure for the Enterprise’s calculation of its Rent tax liabilities, which will not violate requirements of tax legislation.

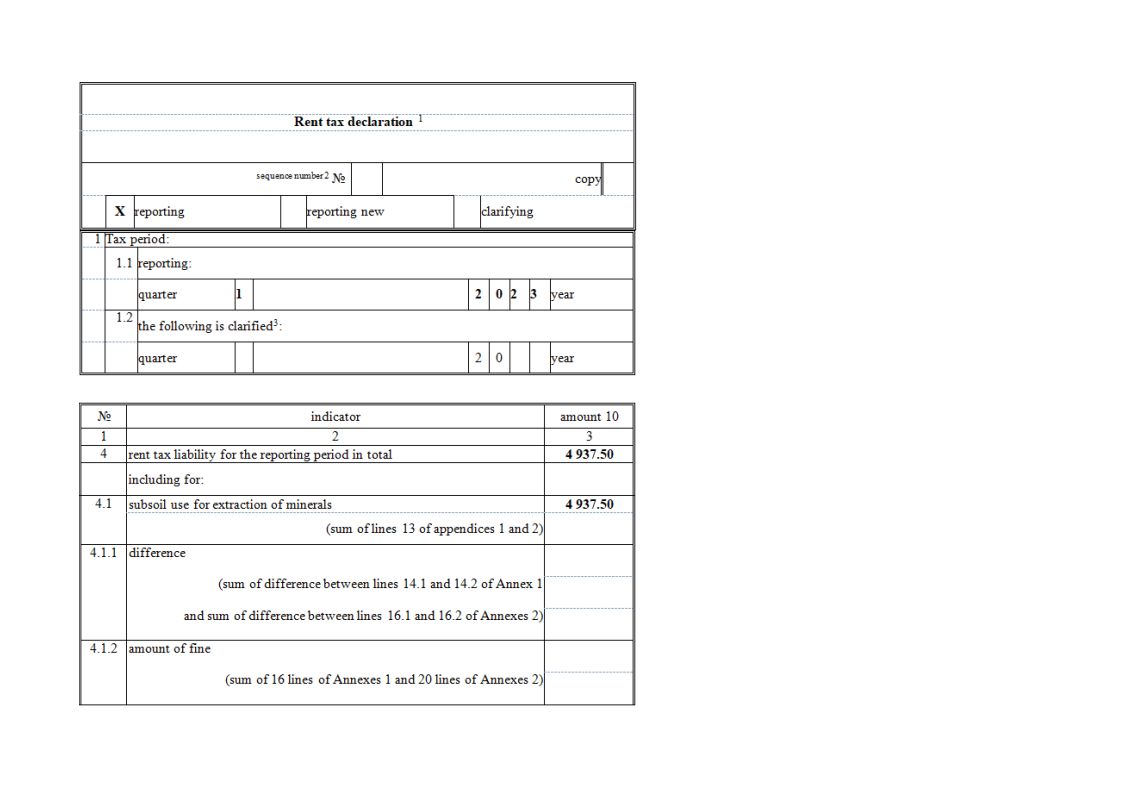

Enterprise declared the Rent tax liabilities for the 1st quarter of 2023 for 1975 tons of raw kaolin in the amount of 4 937.50 UAH at the 5 percent rent rate:

1 975 tons × 50 UAH × 5% = 4 937.50 UAH.

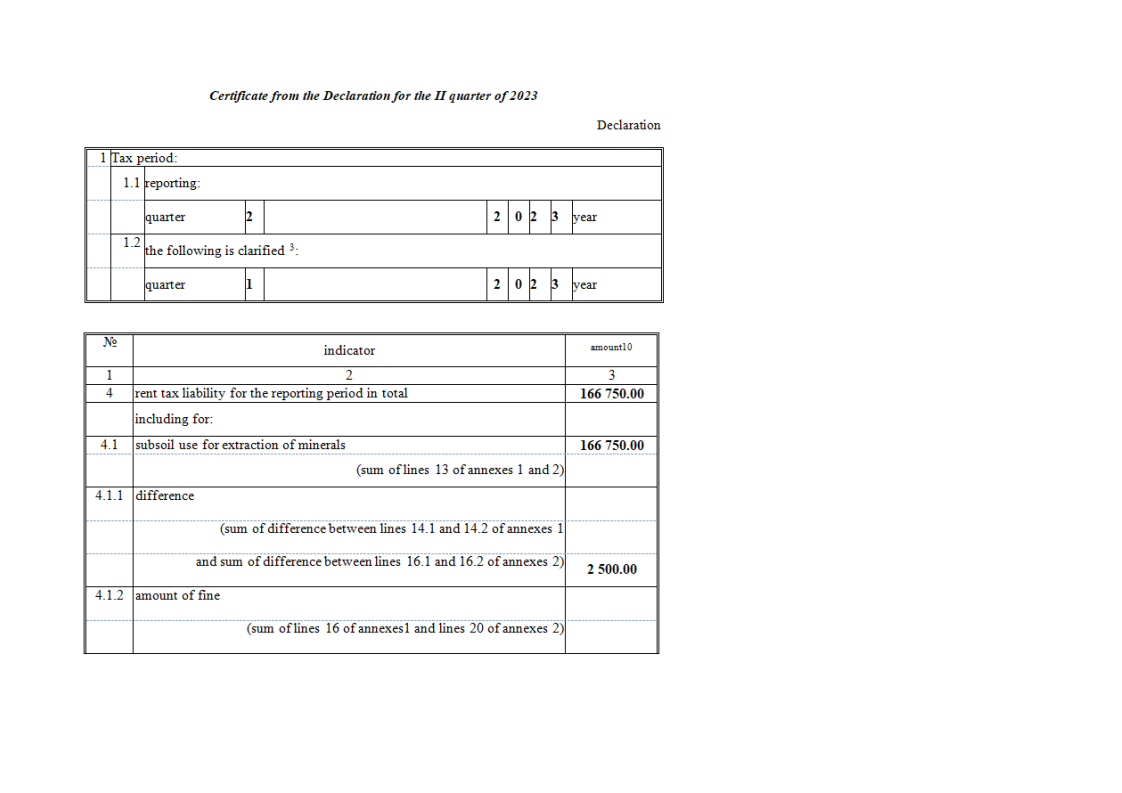

Certificate from the reporting Declaration and Annex 1 to it for the 1st quarter of 2023

Declaration

As a result of the Enterprise’s exposure of 1000 tons of mined raw kaolin to enrichment operations in April – May 2023, for which the Rent tax liabilities in the amount of 2500 UAH were paid in the 1st quarter of 2023, the following was received:

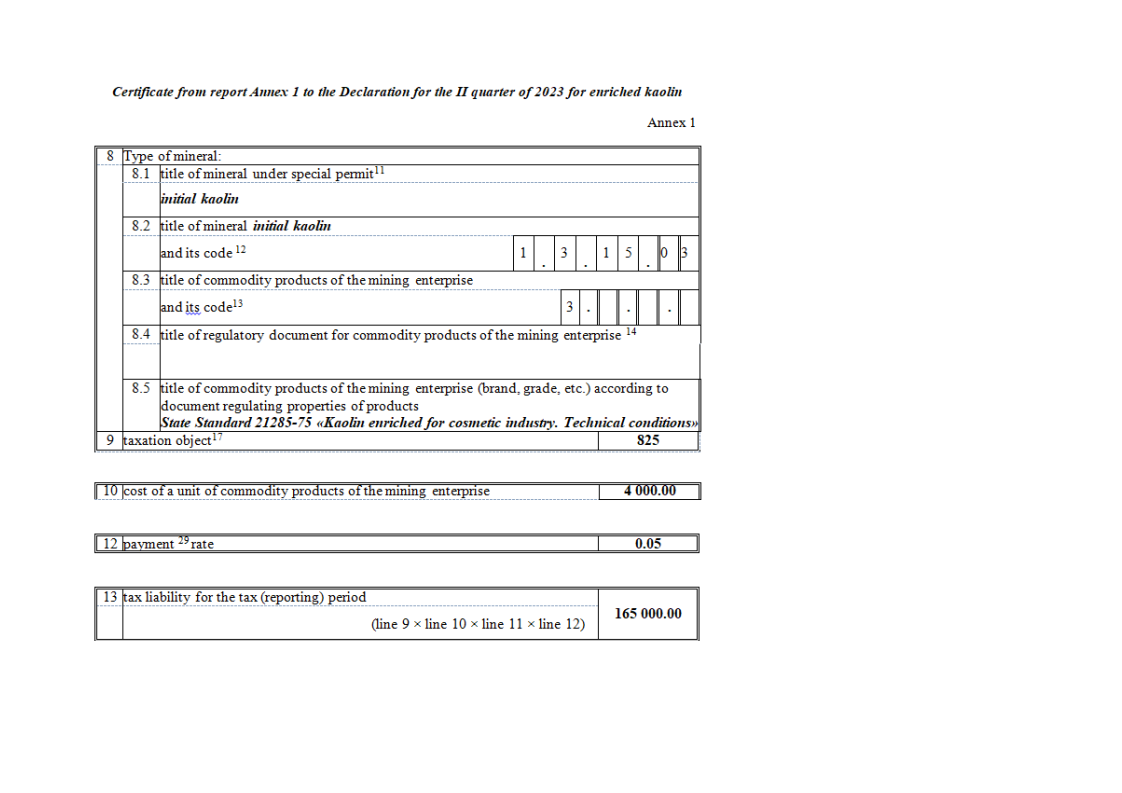

825 tons of enriched kaolin, quality characteristics of which correspond to Technical conditions 21-533-2001 "Kaolin prosyanivskyi";

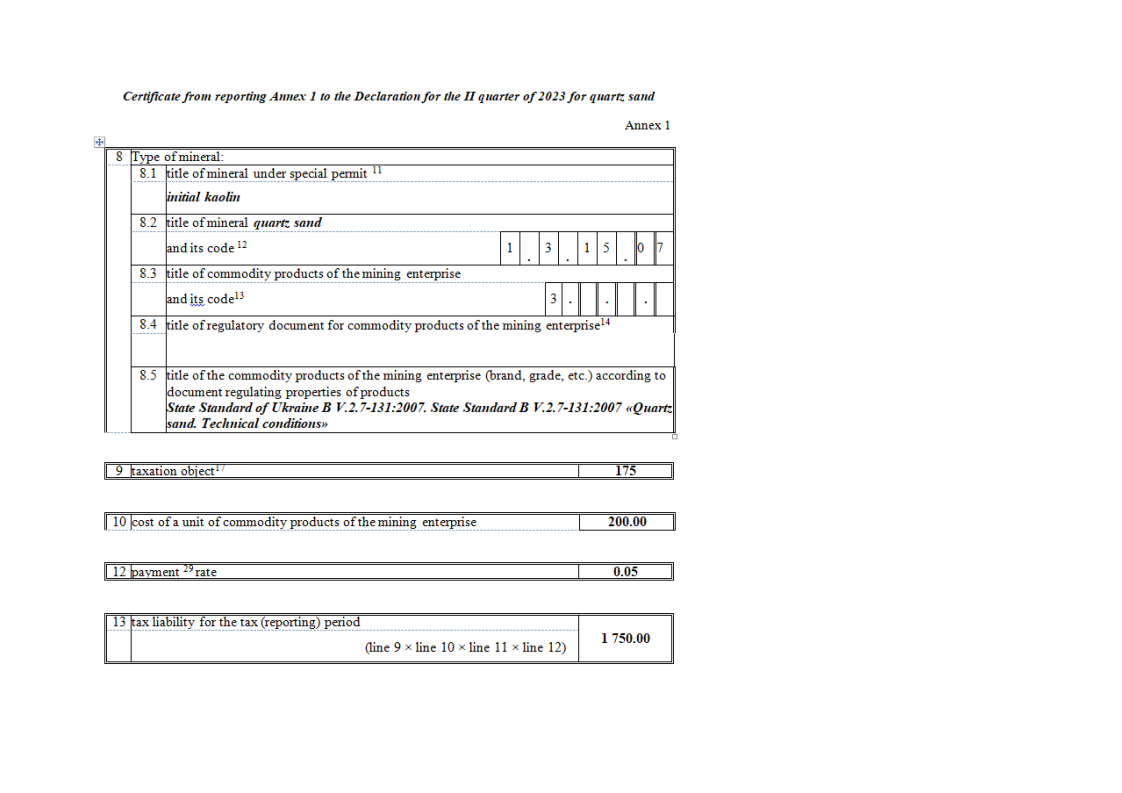

175 tons of quartz sand, quality characteristics of which correspond to State Standard of Ukraine B V. (Constructions of buildings and structures. Steel construction structures. Load test methods) 2.7-131:2007. Standard of Ukraine B V. 2.7-131:2007.

Rent tax liabilities are calculated in the amount of 165 000.00 and 1 750.00 UAH for enriched kaolin and quartz sand, respectively:

825 tons × 4000 UAH × 5% = 165 000.00 UAH,

175 tons × 200 UAH × 5% = 1 750.00 UAH.

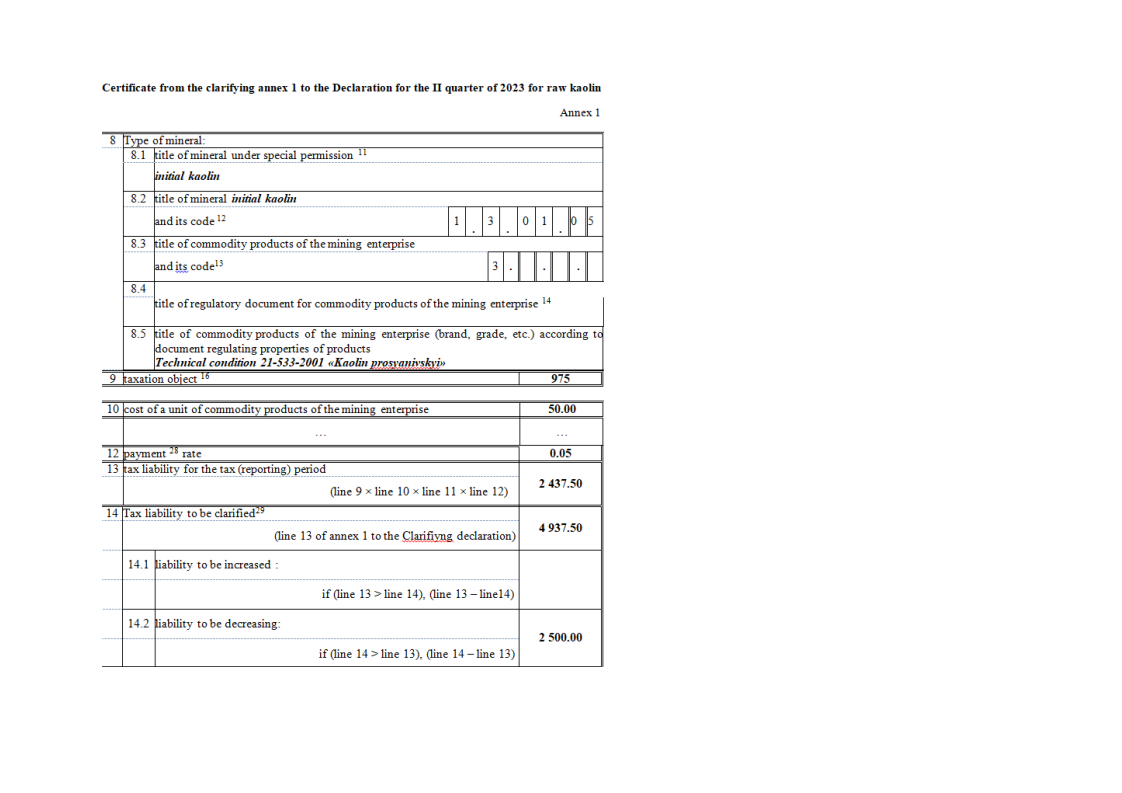

Such Enterprise’s rent tax obligations for volumes of commodity products types obtained as a result of application of primary processing operations are declared in the reporting Declaration for the 2nd quarter of 2023 in separate annexes 1 to it (excerpt from reporting annexes 1 and reporting Declaration for the 2nd quarter 2023).

Herewith, the Enterprise’s rent tax obligations for 975 tons of crude kaolin sold in the 1st quarter of 2023 actually amounted to 2 375.00 UAH:

975 tons × 50 UAH × 5% = 2 437.00 UAH;

Therefore, Rent tax obligations for the 1st quarter of 2023 for 1975 tons of raw kaolin in the amount of 4 937.50 UAH were declared and paid by the Enterprise, of which 975 tons were sold in the 1st quarter of 2023, and 1000 tons in the 2nd quarter 2023 subjected to enrichment operations, must be reduced by the amount of 2 500.00 UAH, which is reflected in Paragraph 14.2 of the clarifying annex 1 to the Declaration for the II quarter of 2023 (excerpt from the Declaration and clarifying annex 1 to it for the II quarter of 2023):

4 937.50 – 2 375.00 = 2 500.00 UAH.

As follows, the Enterprise, in compliance with norms of Paragraph 252.14 Article 252 of the Code, has fulfilled the Rent tax obligations for volumes of Commodity products obtained as a result of primary processing of raw kaolin – enriched kaolin and quartz sand.