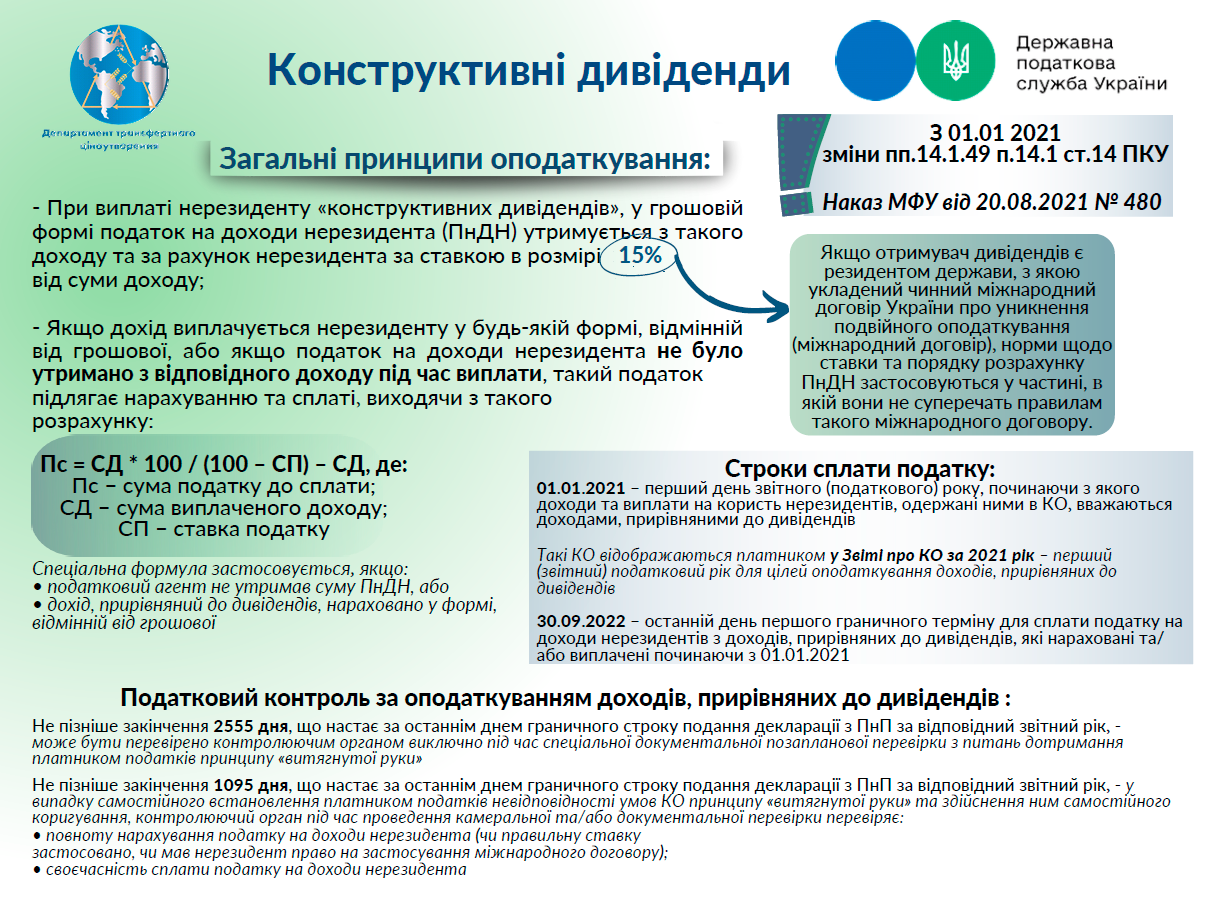

Amendments to the Tax Code of Ukraine (hereinafter – TCU) regarding constructive dividends entered into force on 01.01.2021 (according to provisions of Paragraph 608Sub-section 10 Section XX "Transitional provisions" of the TCU).

List of operations, which for taxation purposes are equated to dividends, is given in Sub-paragraph 14.1.49 Paragraph 14.1 Article 14 of the TCU.

Sub-paragraph 141.4.2 Paragraph 141.4 Article 141 of the TCU determines requirement for taxation of non-resident income tax on payments, which are equated to dividends due to inconsistency of pricing in such operations of the "arm's length" principle.

That is, in case of non-observance of the "arm's length" principle, detected deviations are equated to dividends from the following operations:

- amount of income in the form of payments for securities (corporate rights) paid in favor of non-resident specified in Sub-paragraphs "a", "c", "d" of Sub-paragraph 39.2.1.1 of Sub-paragraph 39.2.1 Paragraph 39.2 Article 39 of the TCU, in controlled operations over amount that corresponds to the "arm's length" principle;

- cost of goods (works, services), except for securities and derivatives, purchased from non-resident, specified in Sub-paragraphs "a", "c", "d" of Sub-paragraph 39.2.1.1 of Sub-paragraph 39.2.1 Paragraph 39.2 Article 39 of the TCU, in controlled operations over amount that corresponds to the "arm's length" principle;

- underestimation amount of the cost of goods (works, services) sold to non-resident specified in in Sub-paragraphs "a", "c", "d" of Sub-paragraph 39.2.1.1 of Sub-paragraph 39.2.1 Paragraph 39.2 Article 39 of the TCU, in controlled operations compared to amount that corresponds to the "arm's length" principle.

Therefore, please note that from 01.01.2021, the specified income is taxed at the 15% rate, unless otherwise is provided by international agreements or according to formula specified in Sub-paragraph 141.4.2 Paragraph 141.4 Article 141 of the TCU.

Mechanism of application of relevant international agreements is disclosed in detail in the general tax consultation of the Ministry of Finance of Ukraine № 480 as of 20.08.2021 on taxation of non-residents’ income, which are equated to dividends.

In addition, 01.01.2021 is the first day of reporting period, starting from which income and payments in favor of non-residents in controlled operations, in which such income is detected, must be reflected by the taxpayer in report on controlled operations.

It should also be noted that in case of payment of income tax of non-residents by 30.09.2022, namely the last day of the first deadline for payment of income tax of non-residents on incomes equated to dividends, fines and interest will not be charged.

Transfer pricing adjustments in the amount of 3.1 billion UAH were made in 2022, which are equivalent to "constructive dividends" but only 405 million UAH was declared in annex to tax invoice to the Income tax declaration and 49 million UAH was paid in repatriation tax.

Currently, declaration campaign "constructive dividends" continues due to the fact that liabilities are reflected in the Income tax declaration of the reporting period in which they were paid to the budget.

As follows, please pay attention to the need to declare such payments by submitting annex to tax invoice to the corporate income tax declaration for 2022 and to pay fines in case of non-payment of tax on such non-residents’ income after the deadline for payment.

The only state web portal

The only state web portal The only state web portal

The only state web portal