New step towards each other.

From now on, in private part of the Electronic cabinet, the taxpayer can give consent to receive information about oneself by the counterparty.

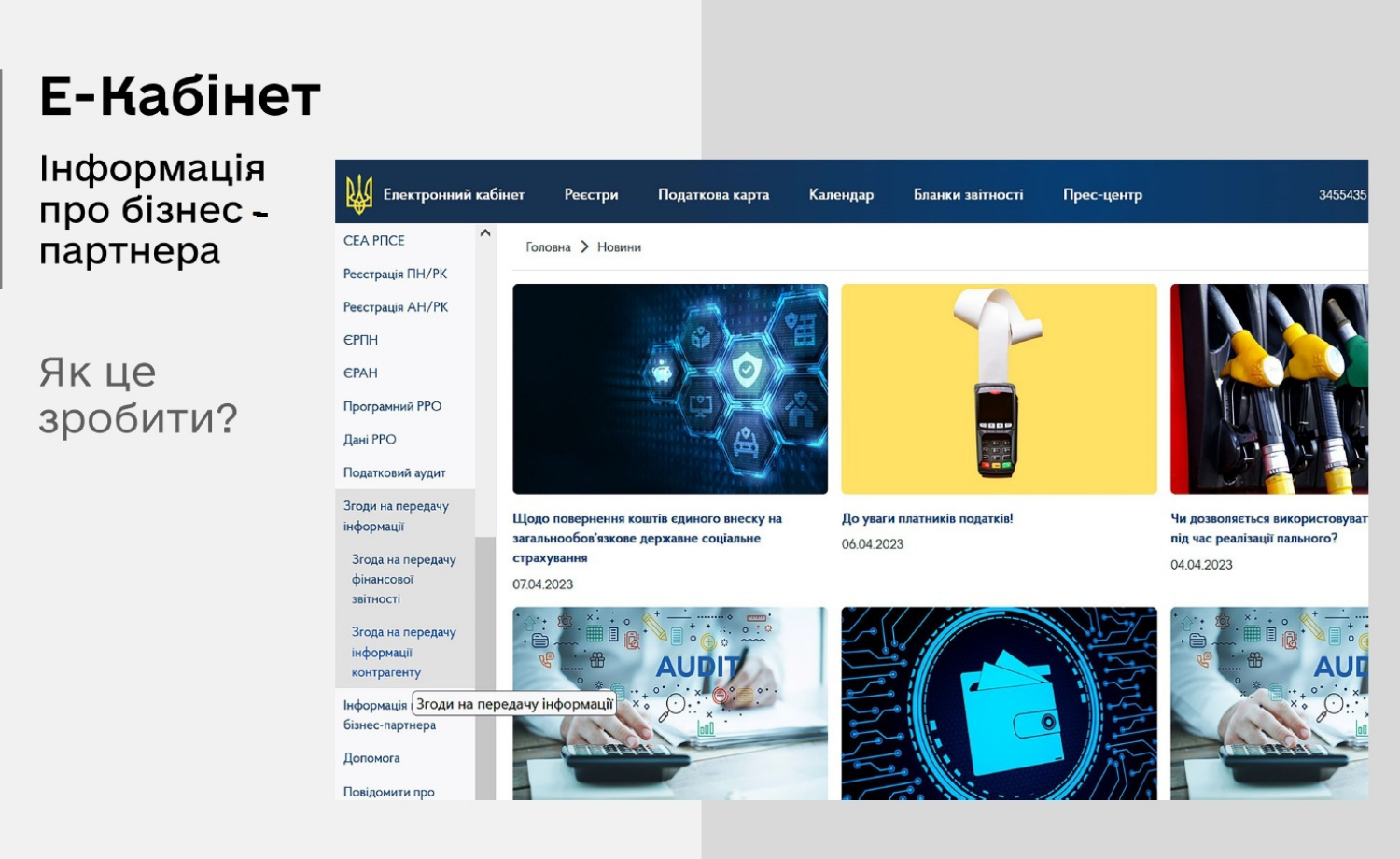

How to do it?

In the mode "Consent to transfer of information to the counterparty" of the "Consent to transfer information" menu to the taxpayer:

- specify the counterparty’s code;

- determine type of information*;

- give consent.

In the "Information business partner" menu of the counterparty:

- review information;

- form excerpt.

_____________________________

*List of information: debt (tax debt); accrued monetary liabilities; amounts of paid taxes, levies, payments; registration suspension of tax invoice/adjustment calculation; availability of taxation objects; availability of licenses; untimely registered tax invoice/adjustment calculation; list of products according to Ukrainian classification of products of the foreign economic activity; information on the inclusion in/exclusion from list of taxpayers who meet risk criteria; transfer pricing reporting; financial result before taxation; residual value of fixed and intangible assets; presence of export/import.

The only state web portal

The only state web portal The only state web portal

The only state web portal