Ministry of Finance of Ukraine, together with the State Tax Service, continues communication “Taxes protect” campaign. Our goal is to show with clear real-life examples how the tax system works and why every contribution matters.

It was previously explained how blogger Maria must pay taxes on her TikTok advertising income. This story helps explain how taxation works for self-employed individuals and digital content creators.

Today we offer second real-life situation – story of a salaried employee Vasyl, who earns income from a construction company. Using his example, we demonstrate how taxes are withheld from salaries, what payments employer transfers to the budget, and why these revenues are critically important for financing defense, social programs and the country’s recovery.

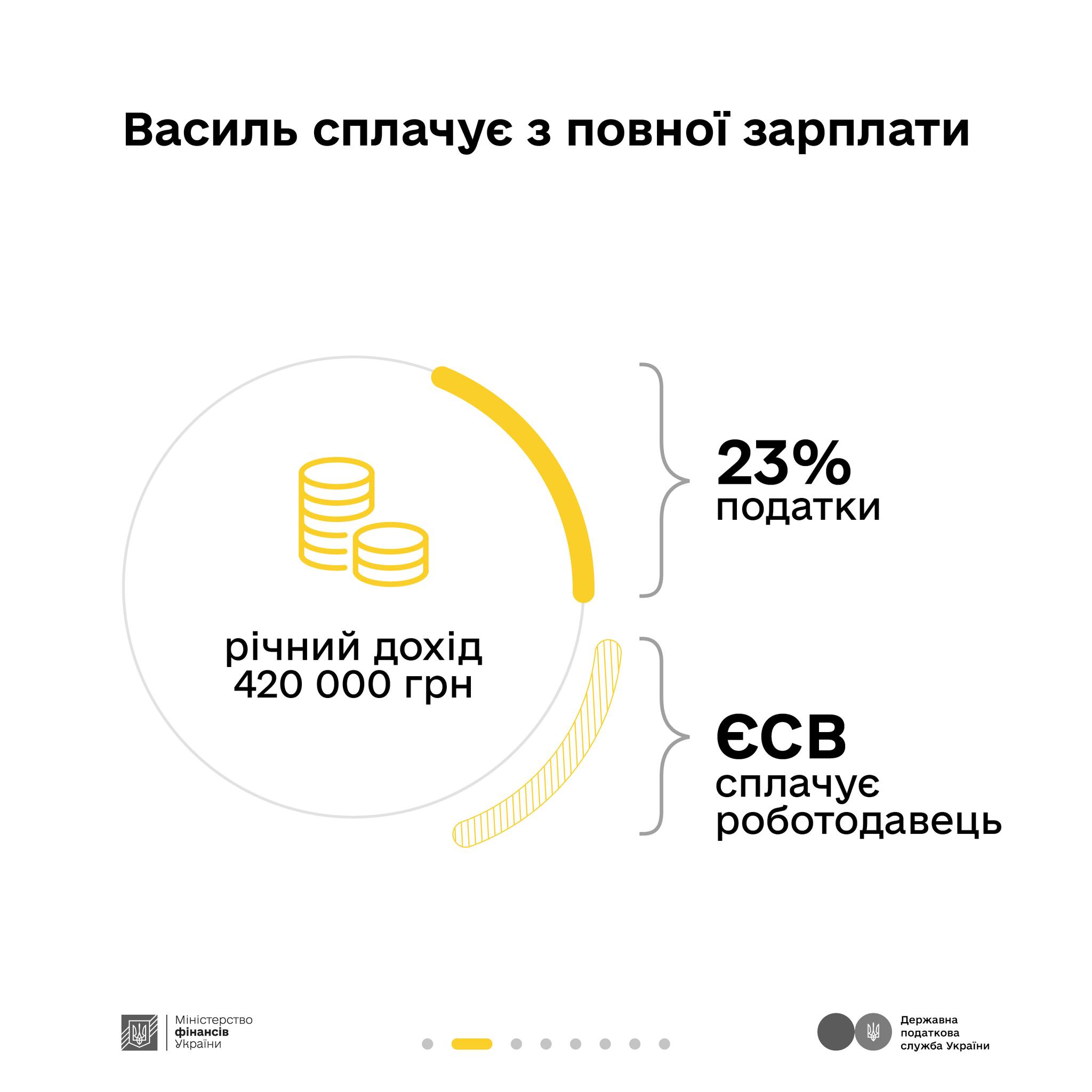

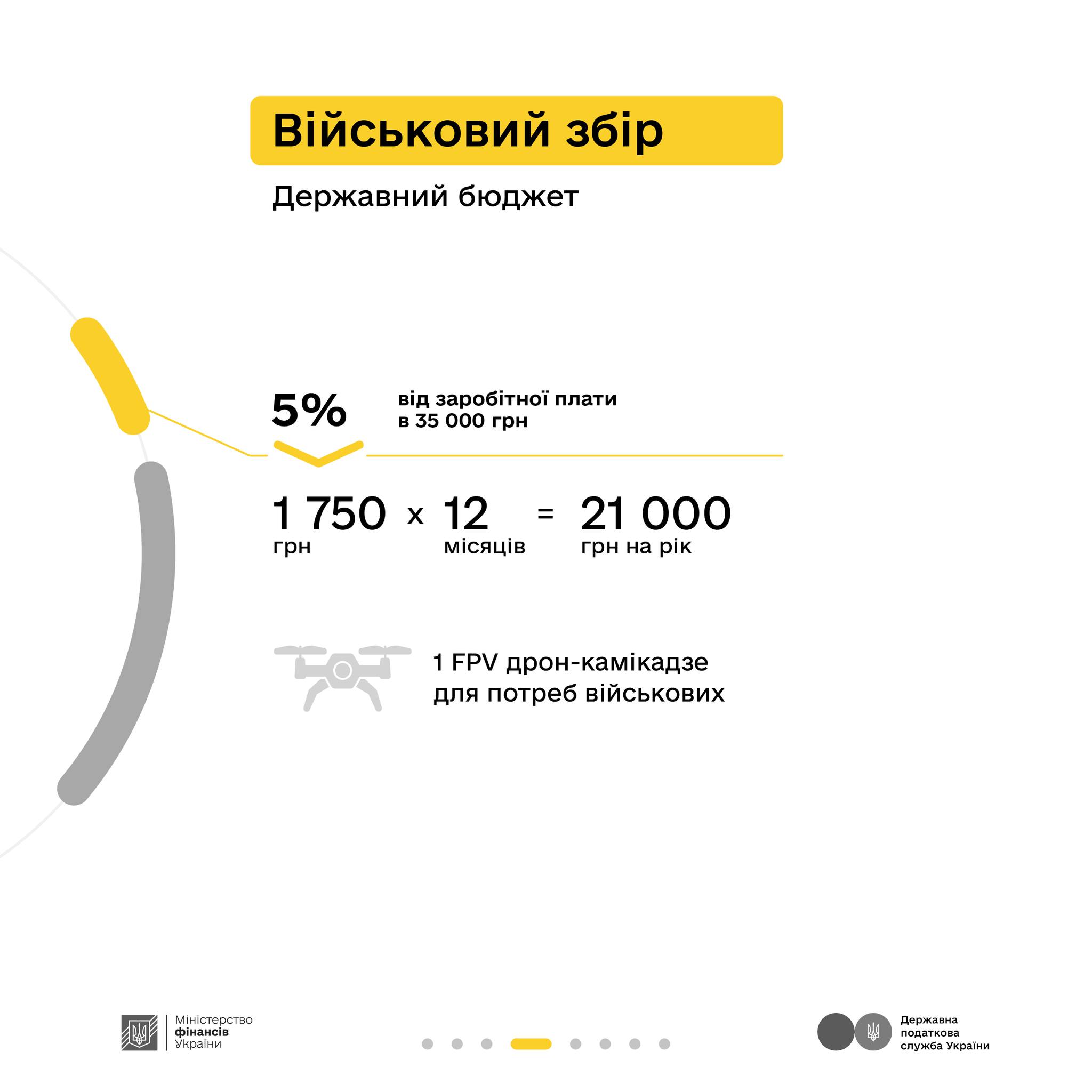

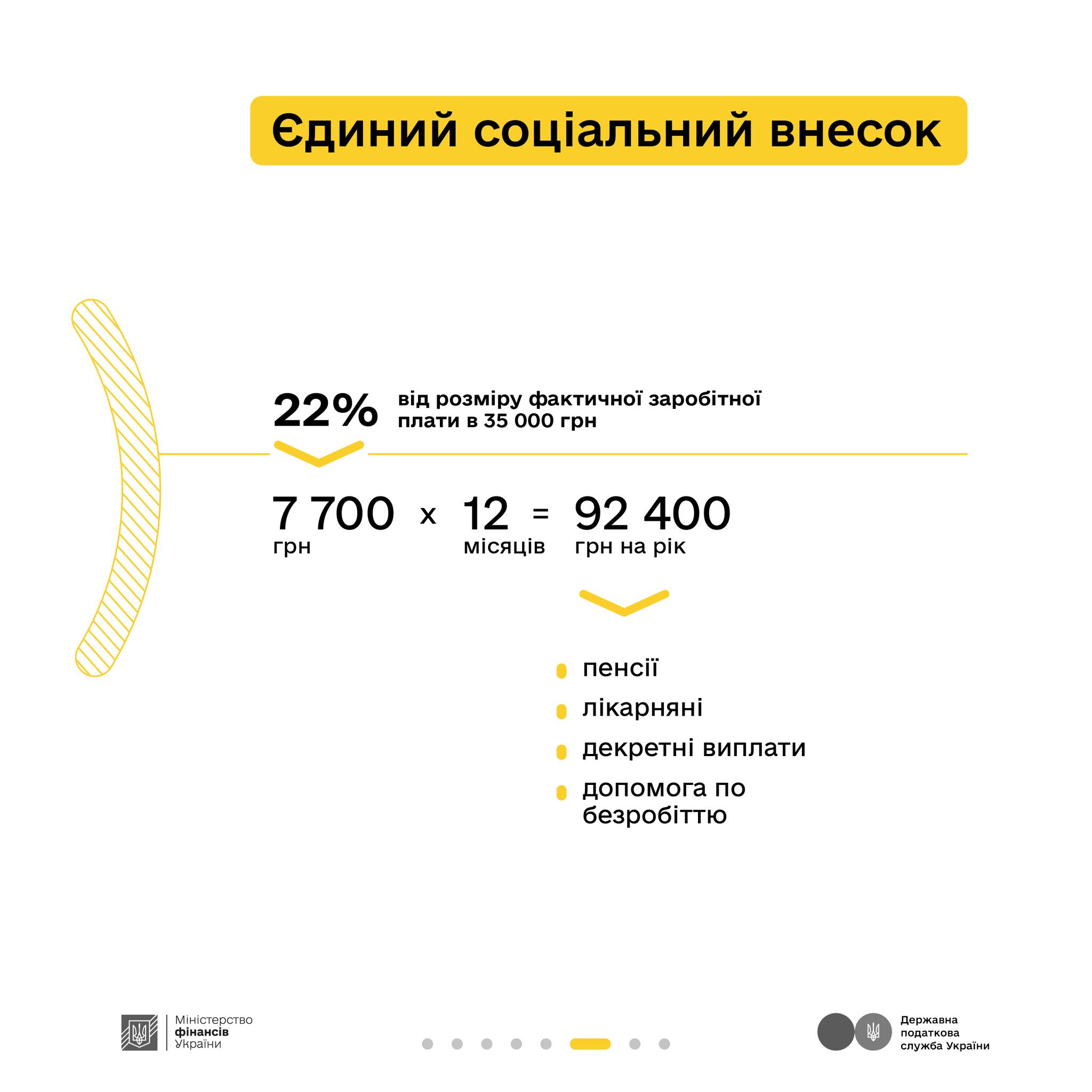

Vasyl, at the age of 48, works in a construction company as an architect. Vasyl is officially employed, under employment contract, and pays taxes on his full, “white” salary. His monthly income before taxes is 35 000 UAH (105 thousand UAH /quarter, 420 thousand UAH /year). After taxes, he receives 26 950 UAH in cash.

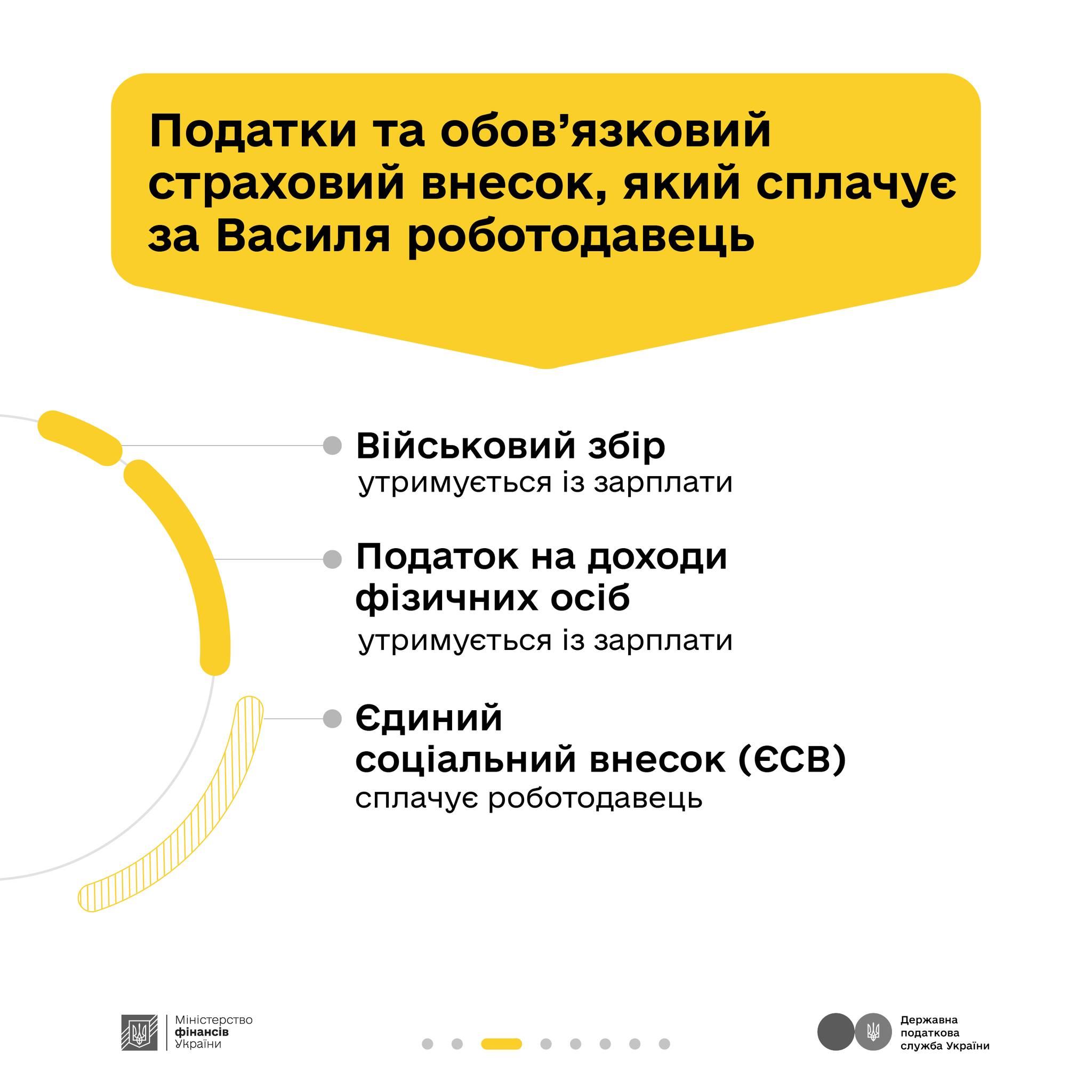

Taxes and obligatory insurance premiums for Vasyl are paid monthly by the employer.

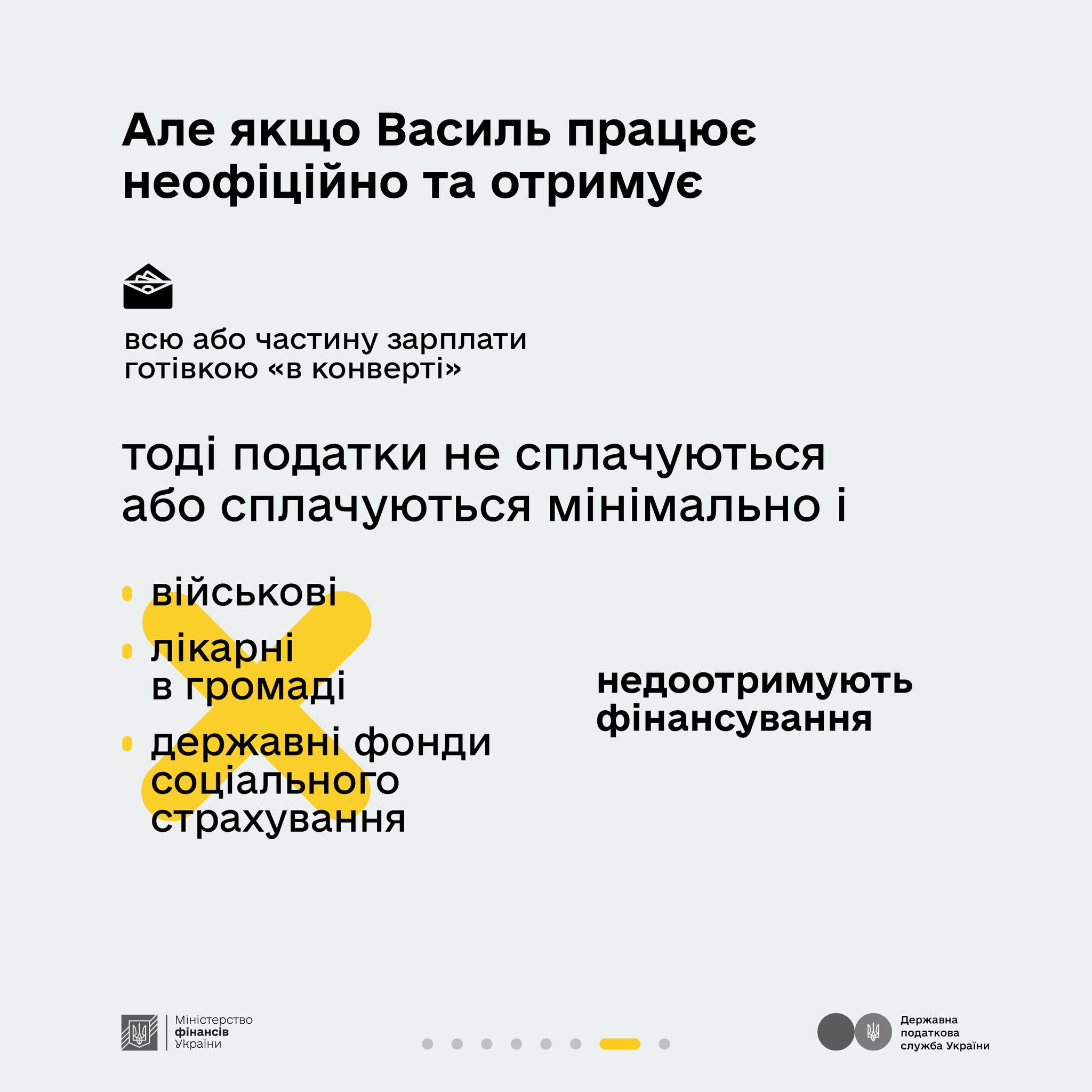

If Vasyl is employed without employment contract and receives all or part of his salary “in the envelope” in cash, then taxes will not be paid or will be paid minimally. Then:

- the military will not defend their positions without a kamikaze drone,

- there will be no possibility to monitor the patient’s condition in the intensive care unit,

- state social insurance funds will not be replenished, therefore, Vasyl will not receive social insurance and relevant payments if necessary.

Taxes protect. Help with your contribution!

Communication campaign is being implemented by the Ministry of Finance of Ukraine together with the State Tax Service with funding from the Great Britain’s Government through the Department of Foreign Affairs and International Development. Information presented in the campaign materials does not necessarily reflect views of the Great Britain’s Government.

The only state web portal

The only state web portal The only state web portal

The only state web portal