Ministry of Finance of Ukraine and State Tax Service continue the communication campaign "Taxes protect." In the previous materials, have already been told what taxes a TikTok blogger, hired employee and married couple who grow and sell vegetables pay.

Now let’s move on to another relevant situation. In focus is Yurii, who earns from buying and selling cryptocurrency. What taxes does he have to pay on the profit he receives? How to correctly reflect such income? Explain in detail.

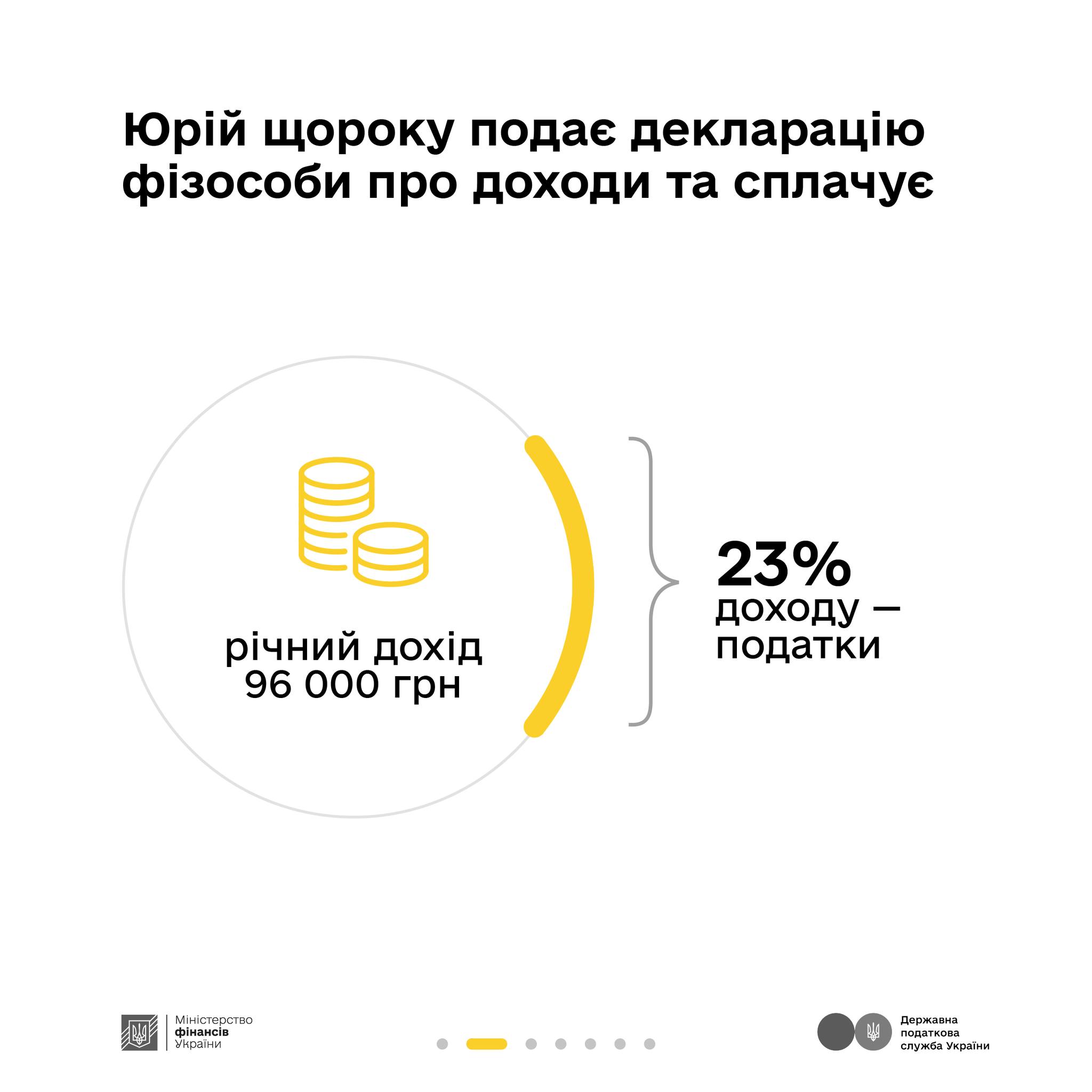

20-year-old Yurii has figured out cryptocurrency, registered on the exchange and monitors market fluctuations. Every month, he receives about 8 thousand UAH from crypto purchase and sale transactions (24 thousand UAH/quarter; 96 thousand UAH/year).

To legalize income, Yurii submits tax declaration of individual on income received in the previous year by May 1 each year through the taxpayer’s Electronic cabinet on the State Tax Service’s web portal and pays taxes.

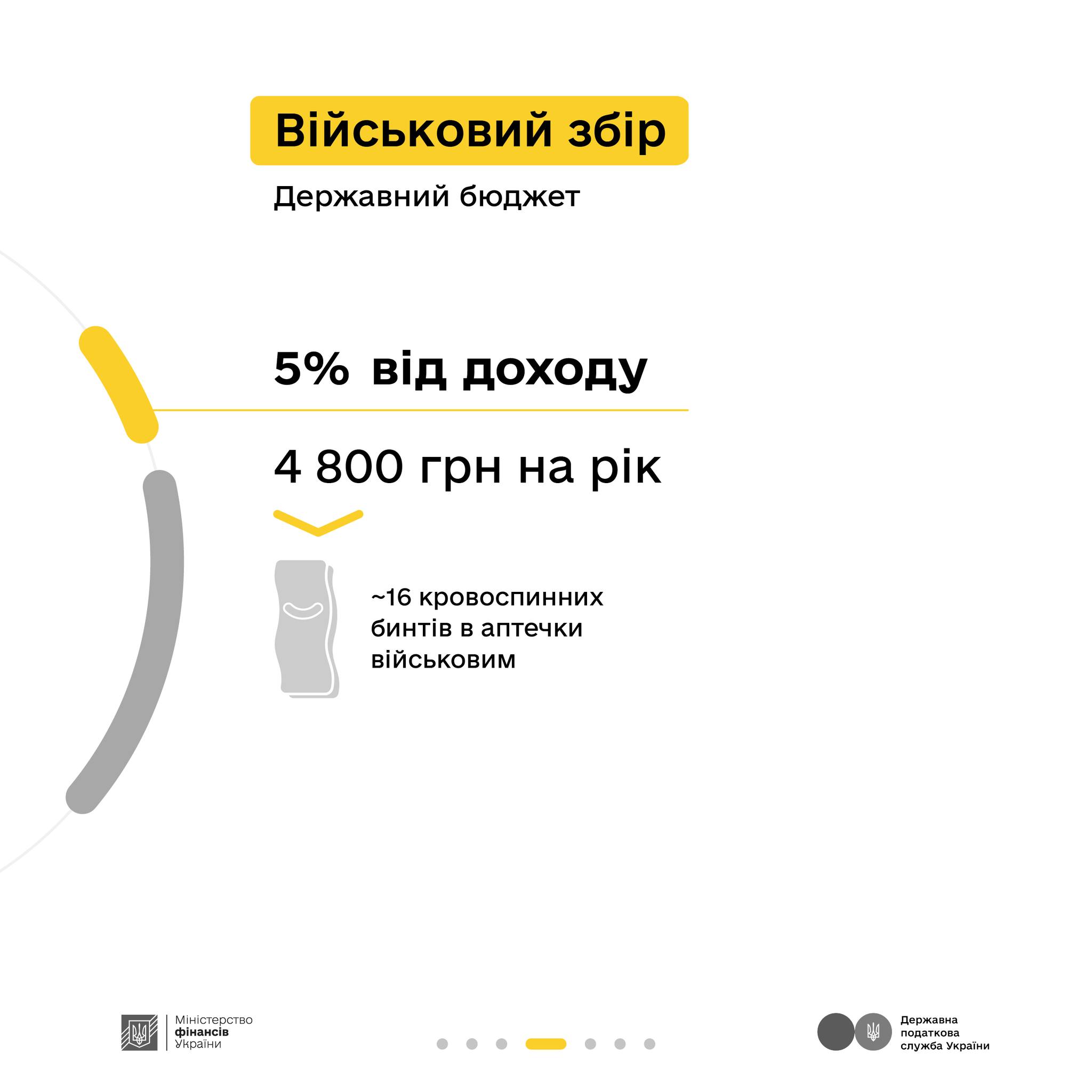

Result for the year looks like this:

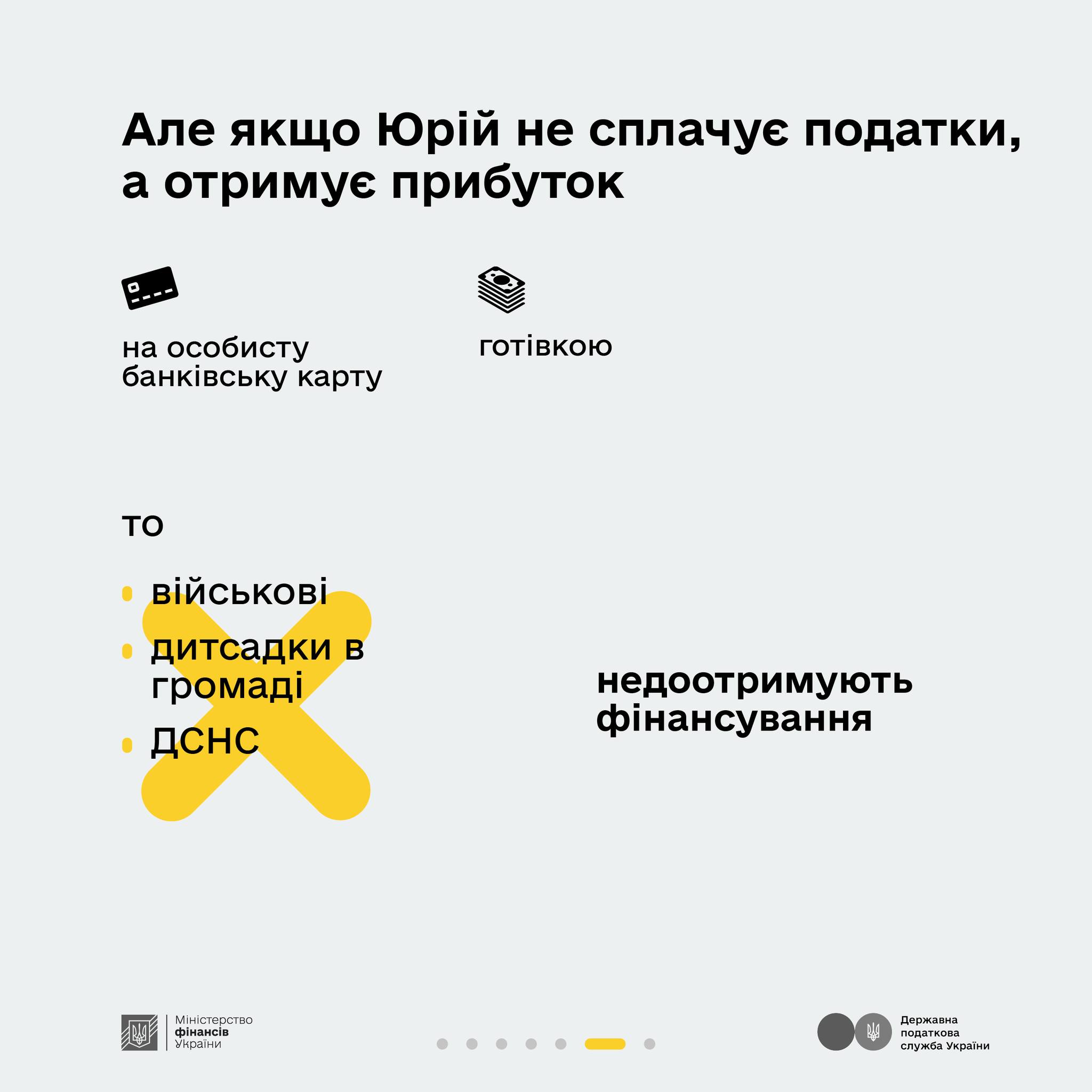

If Yurii does not declare income and trades cryptocurrency through the "gray" platforms and receives income in cash or as a P2P transfer to a bank card and does not pay taxes, then:

- militaries will not have a hemostatic bandage to stop the bleeding of a comrade and save life,

- State Emergency Service brigade will not be able to put out a fire after shelling;

- community kindergartens will be underfunded.

Taxes protect. Help with your contribution!

Communication campaign is being implemented by the Ministry of Finance of Ukraine together with the State Tax Service with funding from the Great Britain’s Government through the Department of Foreign Affairs and International Development. Information presented in the campaign materials does not necessarily reflect views of the Great Britain’s Government.

The only state web portal

The only state web portal The only state web portal

The only state web portal