-

State Tax Service

of Ukraine - Service

- Activity

- Legislation

- Public relations

- Press Center

- Contacts

- Home

- Press Center

- News

- Dubinsky “ethyl alcohol”

Dubinsky “ethyl alcohol”

Citizen Dubinsky again decided to mention the State Tax Service and its Head :)

After his lies were refuted about:

- the “billion scrolls” (https://tax.gov.ua/media-tsentr/novini/428173.html) which, incidentally, looked especially pointless on the background of growing VAT revenues in a shrinking economy;

- tax assistance to “scrolls” in Kyiv region (https://www.facebook.com/TaxUkraine/posts/335062441201657);

- coronavirus horror in the central apparatus of the STS (https://www.facebook.com/TaxUkraine/posts/367470664627501);

This Citizen tried to apply his “analytical” abilities in the ethyl alcohol turnover, obviously hoping that this is where he will finally be able to demonstrate the “shadowing of industry” :)

To substantiate his “shadow” fantasies, Citizen Dubinsky used fulfillment indicators of the excise tax revenues from ethyl alcohol.

“The epidemic is in a full swing, production of antiseptics has increased and we haven’t stopped drinking less” – said Dubinsky, but, according to him “white ethyl alcohol has disappeared somewhere”. And the evidences of it (disappearance of “white ethyl alcohol”), according to Dubinsky is “Execution of the excise tax on ethyl alcohol by months:

March 788%

April 538%

May 131%

June 62%

July 77%

August 79%

September 60%”

“Mr. Lyubchenko” – Citizen Dubinsky asks pathetically – “Answer, how did it happen that Your super-efficient Service drove the ethyl alcohol industry into the shadows in a few months?”

We inform Citizen Dubinsky that questions asked by him and the substantiation of his fantasies look especially ridiculous coming from the Deputy Chairman of the Verkhovna Rada Committee on Finance, Tax and Customs Policy and we inform that in April 2020 the Verkhovna Rada of Ukraine adopted amendments to the tax legislation, which applied a zero rate (0%) of the excise tax to ethyl alcohol used for production of disinfectants (by the way, Citizen Dubinsky also voted for these changes).

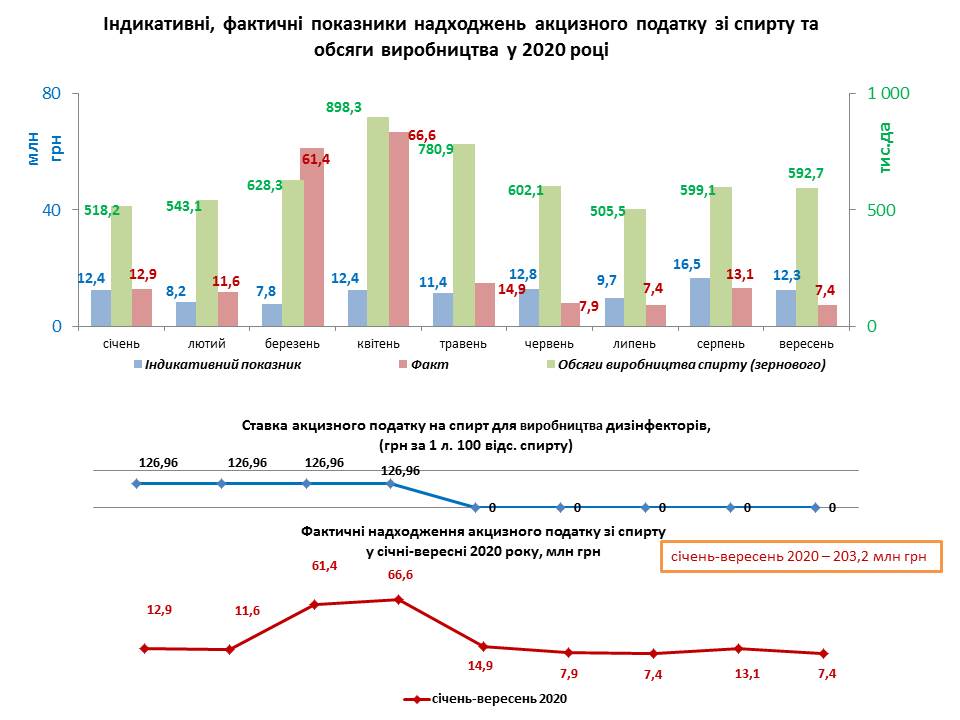

So, what Citizen Dubinsky was trying to pretend to be “shadowing”, in reality looked like this:

1. Budget received 12.85 million UAH or 104% of the expected figures in January 2020 with the excise duty on ethyl alcohol indicator of 12.3 million UAH. In February 2020, the situation was already changing –11.6 million UAH of revenues with an indicative of 8.18 million UAH, the fact was 145% of the predicted level. However, as we can see, no records of hundreds percent are observed.

2. In March 2020, the situation has changed radically – revenues have increased several times at once. It’s not hard to guess why this happened, is it? :)

Well, of course, the frantic demand for disinfectants, which arose in February 2020, was finally reflected in production – ethyl alcohol for antiseptics began to be produced at a very fast pace and the excise tax rate on it, for a moment, was 126 UAH per 1 (!) liter.

By the way, isn’t that a reason why in his publication Citizen Dubinsky so cautiously “forgot” to show the state of revenues over the first 2 months of 2020, because even the most ignorant of his supporters would understand why such an unprecedented revenues growth, and at the same time someone could ask why it took place only in March, and not in February when there were queues for antiseptics in pharmacies?

3. Сombination of the rapid production growth with a high rate was a factor that led to the over-fulfillment of indicative figures from the excise tax on ethyl alcohol by hundreds of percent. But after the tax rate was set at zero, revenues immediately decreased, because 0% of any volume of produced ethyl alcohol means 0 UAH of revenue

This is a real reason for current level of income which Citizen Dubinsky tried to pass off as evidence that the Tax service “in a matter of months drove the ethyl alcohol industry into the shadows”.

Does Citizen Dubinsky know about this? STS tends to think so, but, having driven himself into a dead end with his previous lies, he probably can no longer get out of this corner, so even the prospect of fooling around, after exposing his next lie, does not stop Citizen Dubinsky :)

So let’s reassure Citizen Dubinsky – ethyl alcohol has not gone anywhere, it is carefully accounted for and taxed according to current legislation, as the said Citizen can see by visiting any excise warehouse. In the same way, nowhere, except in his imagination, the VAT “scrolls” grow, which will once again be confirmed by the indicators of both revenues and full and timely reimbursement of this tax in October 2020.

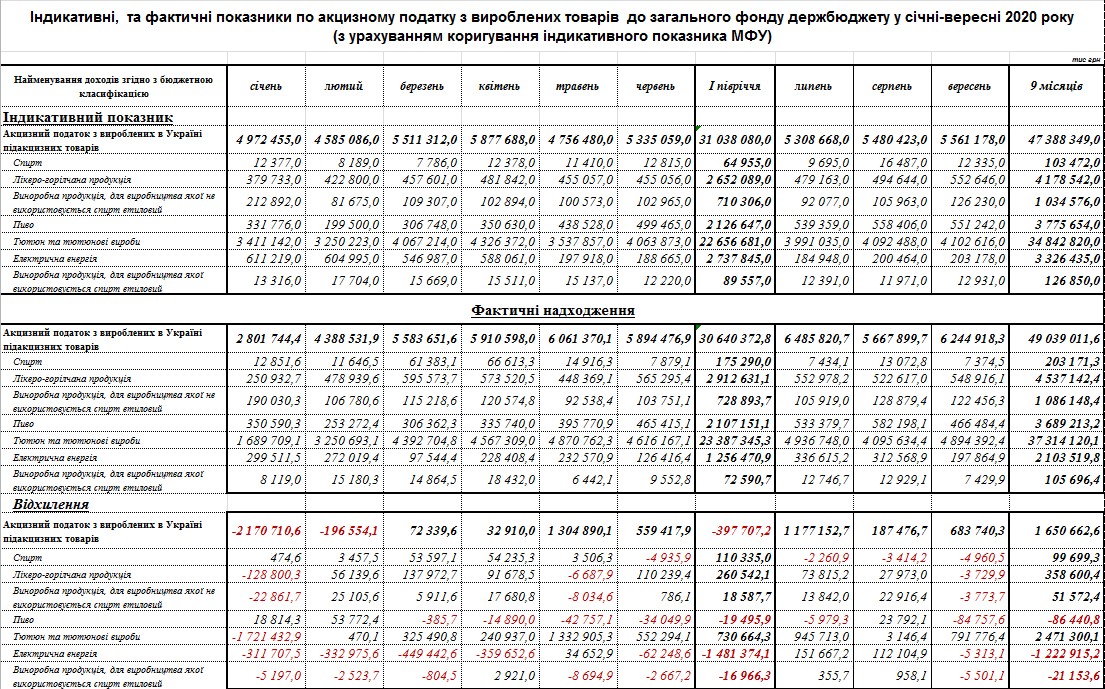

In addition, we are pleased to inform Citizen Dubinsky that in the un-shadowing the turnover of excisable products, the STS has made a significant progress over the past 5 months. This is also evident in the tax revenues indicators and not only allowed to exceed a target over the last 5 months but also to make up for the backlog of 2.3 billion UAH which arose during January – April 2020.

This is a convincing result of the work with conscientious taxpayers whom the STS protects from unfair competition from the same “shadow” with which Citizen Dubinsky allegedly fights so hard (at least he tries very hard to imitate this struggle;)).

But the fact is that at a time when the budget did not receive billions UAH from the system of shadow activities in the excisable product market, Citizen Dubinsky was not worried at all :)

It is enough to look only at the state of implementation of revenues indications from the excise tax on tobacco and alcohol beverages during the first 4 months of 2020 – the indicative lag was more than 1 billion UAH! That’s where was every reason to ask what’s going on :). But Citizen Dubinsky, trying to invent “shadowing of the market”, only six months ago did not want to see its real shadowing. As of today the STS and conscientious taxpayers will cope with this problem without you, Citizen Dubinsky, and this cooperation will be ongoing in the future.

For all those who are interested in the real situation with excise tax revenues, we publish relevant information.

P.s. Citizen Dubinsky, the STS paid attention to your ardent desire to receive a quick response to your publication, but we must disappoint you. Rebutting your next lie is certainly worth noting, but it is not a top priority for the Service. However, do not be upset – each of your lies will still be refuted in the end :).